Features

Winnipeg-born and raised Michael Lang is at the forefront of a technological innovation that can help to change the way neurosurgery is performed and how brain diseases such as Alzheimer’s Disease are treated

By BERNIE BELLAN We’ve often heard that one of the main reasons Manitoba lags behind other provinces when it comes to economic development is because there is both a lack of entrepreneurial capital in this province and innovative individuals who are willing to base their operations here.

Thus, it was refreshing to hear of one young man who not only grew up in Winnipeg, but who has also decided to stay here and work to help turn a company which he co-founded into a successful start-up.

That young man’s name is Michael Lang, 37. I first met Michael when he was in a bar mitzvah class at Temple Shalom with my daughter, Shira. Having grown up in River Heights, the son of Ida and Sherman Lang, Michael attended, in order, Ecole Robert H. Smith, River Heights Middle School, and Kelvin High School.

Michael notes that, as a young boy, he and several other students, including Ben Carr, would go to Hebrew teacher Ethel Amihude’s home for Hebrew lessons. As a side note I should mention that the same day I interviewed Michael for this story, I also received a phone call from Ben Carr, who is now the Member of Parliament for Winnipeg South Centre. When I mentioned to Ben that I had just got off the phone with his former classmate Michael Lang, Ben said to me that, during the rally held in support of Israel on October 10, at which Ben spoke, he was approached by a woman who said, “I’ll bet you don’t remember me. I taught you Hebrew in my home.” Of course, it was Ethel Amihude – and yes, Ben did recognize her immediately.

Returning to Michael Lang – upon graduating from Kelvin High School, Michael enrolled at the University of Winnipeg to study science, with a particular interest in Physics, which is something he’s always loved, he says. Michael went on to complete his Masters and Ph.D. in Physics at the University of Manitoba, he notes, although his he did much of his research at the University of Winnipeg – “a great experience,” he observes.

I asked him how the Physics Department at the University of Winnipeg would compare with other Physics departments in Canada and the US and, although Michael acknowledges that “it’s a small faculty” – maybe 10 professors in total, they definitely “punch above their weight.”

Now, in order to keep this article at a level that would be understandable to most readers (and to this writer as well), I wanted to avoid asking Michael to go into any great detail about what his area of specialty in Physics was, but – just to give you a taste of what it was that he concentrated upon in his studies, here’s a brief excerpt from his bio on the company website (known as tauMEDIS) that he’s helped to found: “Michael received his Ph.D. in Physics from the University of Manitoba with work on hyperpolarized 129Xe gas production for high-precision co-magnetometry.”

The key word in that sentence is “magnetometry,” because it helps to explain how Michael’s research in that field eventually led him into the field of magnetic resonance imaging – or, as the acronym of that term is much more familiar to most of us: “MRI.”

By now, getting an MRI performed for a host of medical issues is something a lot of us expect to have done – and not with undue delays – and when we must wait for an MRI to be performed, which was something greatly exacerbated as a result of Covid disruptions to our medical system, it can be excruciatingly trying.

In the spring of 2020 – shortly after the start of the pandemic, Michael was working as a lab technician at the University of Winnipeg, where he maintained that university’s small animal MRI facility. It was then that the Principal Investigator of the lab, Dr. Melanie Martin, introduced Michael to members of a group working on a novel intraoperative MRI system. Michael would soon after join the group as a post-doctoral fellow, helping to lay the groundwork for what became tauMEDIS.

What is tauMEDIS? According to information available on its website, “Originally formed in 2018, and officially founded in 2023 by a group of Canadian scientists and engineers who are passionate about medical imaging, the name TauMEDIS is an acronym for tau Medical Imaging Solutions…” (tau is a letter in the Greek alphabet that “has significance in both magnetic resonance imaging as well as a variety of neurodegenerative diseases.”)

Although there are a host of other companies active in producing MRI systems, tauMEDIS has developed a particular type of technology in a specialized area of magnetic resonance imaging known as iMRI: “Intraoperative magnetic resonance imaging” or “iMRI,” for short. iMRI is a “method to acquire updated images of the brain throughout a neurosurgical procedure. Neurosurgeons rely on iMRI technology to obtain accurate images of the brain that guide them in removing brain tumors and treating other conditions such as epilepsy.”

Where tauMEDIS is unique in this highly specialized field though, is in its having developed a method to mobilize a full-sized MRI machine that, not only does not require the patient to be moved from the operating table into another room to have an MRI performed, it optimizes the installation process, allowing for retrofitting in existing operating rooms. (There is another company that makes moving magnet iMRI machines, known as IMRIS, that also allows the patient to remain on the operating table during surgery without having to be moved, but incorporating those particular systems into hospitals usually involves making major changes to the infrastructure of existing operating rooms.) The tauMEDIS system, Michael explains, minimizes renovations, and drastically reduces installation time in existing operating facilities.

“We developed a method to mobilize the MRI on a floor-moving track-based vehicle,” he says. “Essentially it’s a high-precision tank-like device that brings the MRI system to the patient undergoing neurosurgery,” providing the surgical team with updated images of the brain throughout the procedure.

tauMEDIS was just recently incorporated in Manitoba (six months ago). In March of this year its prototype machine received approval from the Food and Drug Administration in the US.

Now, in addition to his role as the company’s Chief Technology Officer, Michael, along with the other principals in the company, have found themselves in the position of having to seek out investment funds for tauMEDIS to commercialize the iMRI system they have developed. The funding would support development of a Winnipeg facility that would begin producing actual systems for sale.

“We just recently had our first showing at the Congress of Neurological Surgeons,” Michael says, “and now we’re in the fund-raising phase.”

I asked him how much money they’re seeking, and he says, “$200,000 to start.” I said to him that doesn’t seem like a lot to ask for and that I wondered whether having this article appear in this paper might not be just what it would take to elicit a positive response from some would-be investors.

Further, Michael notes that the goal of tauMEDIS “is to set up a local facility, combining manufacturing and R&D of tauMEDIS products, all located right here in Manitoba. We hope to attract and develop talent, growing the Winnipeg medical device sector.” (I should also mention that years ago, when I was writing about the Crocus Investment Fund, I noted that one of the first investee companies for Crocus was that very same IMRIS, to which I previously referred. I asked Michael if he knew whatever became of IMRIS back then since, according to Michael, it has now become very successful. As I recall, the Crocus Fund lost its entire investment in IMRIS. According to Michael, the company is now based in Minnesota. What happened after the Crocus debacle I’m not sure – just another example of a company that had a great idea but, for whatever reason, couldn’t succeed in Manitoba – although it did take off when it relocated elsewhere.)

Not only is tauMEDIS seeking capital to begin producing its iMRI systems, it also has other technological innovations in the works – all in the area of medical imaging. As Michael Lang says, his “goal as Chief Technology Officer is to work with physicians around the world to make advances in medical imaging technology and develop novel solutions” that would dramatically improve patient health outcomes.

If you would like to find out more about tauMEDIS, email info@taumedis.com or go to its website: taumedis.ca.

Features

ClarityCheck: Securing Communication for Authors and Digital Publishers

In the world of digital publishing, communication is the lifeblood of creation. Authors connect with editors, contributors, and collaborators via email and phone calls. Publishers manage submissions, coordinate with freelance teams, and negotiate contracts online.

However, the same digital channels that enable efficient publishing also carry risk. Unknown contacts, fraudulent inquiries, and impersonation attempts can disrupt projects, delay timelines, or compromise sensitive intellectual property.

This is where ClarityCheck becomes a vital tool for authors and digital publishers. By allowing users to verify phone numbers and email addresses, ClarityCheck enhances trust, supports safer collaboration, and minimizes operational risks.

Why Verification Matters in Digital Publishing

Digital publishing involves multiple types of external communication:

- Manuscript submissions

- Editing and proofreading coordination

- Author-publisher negotiations

- Marketing and promotional campaigns

- Collaboration with illustrators and designers

In these workflows, unverified contacts can lead to:

- Scams or fraudulent project offers

- Intellectual property theft

- Miscommunication causing delays

- Financial loss due to fraudulent payments

- Unauthorized sharing of sensitive drafts

Platforms like Reddit feature discussions from authors and freelancers about using verification tools to safeguard their work. This highlights the growing awareness of digital safety in creative industries.

What Is ClarityCheck?

ClarityCheck is an online service that enables users to search for publicly available information associated with phone numbers and email addresses. Its primary goal is to provide additional context about a contact before initiating or continuing communication.

Rather than relying purely on intuition, authors and publishers can access structured information to assess credibility. This proactive approach supports safer project management and protects intellectual property.

You can explore community feedback and discussions about the service here: ClarityCheck

Key Benefits for Authors and Digital Publishers

1. Protecting Manuscript Submissions

Authors often submit manuscripts to multiple editors or publishers. Before sharing full drafts:

- Verify the contact’s legitimacy

- Ensure the communication aligns with known publishing entities

- Reduce risk of unauthorized distribution

A quick lookup can prevent time-consuming disputes and protect original content.

2. Safeguarding Collaborative Projects

Digital publishing frequently involves external contributors such as:

- Illustrators

- Designers

- Editors

- Ghostwriters

Verification ensures all collaborators are trustworthy, minimizing the chance of intellectual property theft or miscommunication.

3. Enhancing Marketing and PR Outreach

Promoting a book or digital publication often involves connecting with:

- Bloggers

- Reviewers

- Book influencers

- Digital media outlets

Before sharing press kits or marketing materials, verifying email addresses or phone contacts adds confidence and prevents potential misuse.

How ClarityCheck Works

While the internal system is proprietary, the user workflow is straightforward and efficient:

| Step | Action | Outcome |

| 1 | Enter phone number or email | Search initiated |

| 2 | Aggregation of publicly available data | Digital footprint analyzed |

| 3 | Report generated | Structured overview presented |

| 4 | Review by user | Informed decision before engagement |

The platform’s simplicity makes it suitable for authors and publishing teams, even those with limited technical expertise.

Integrating ClarityCheck Into Publishing Workflows

Manuscript Submission Process

- Receive submission request

- Verify contact via ClarityCheck

- Confirm identity of editor or publisher

- Share draft or proceed with collaboration

Collaboration with Freelancers

- Initiate project with external contributors

- Run ClarityCheck to verify email or phone number

- Establish project agreement

- Begin content creation safely

Marketing Outreach

- Contact media or reviewers

- Verify digital identity

- Share promotional materials with confidence

Ethical and Privacy Considerations

While ClarityCheck provides useful context, it operates exclusively using publicly accessible information. Authors and publishers should always:

- Respect privacy and data protection regulations

- Use results responsibly

- Combine verification with personal judgment

- Avoid sharing sensitive data with unverified contacts

Responsible use ensures the platform supports security without compromising ethical standards.

Real-World Use Cases in Digital Publishing

Scenario 1: Verifying a New Editor

An author is contacted by an editor claiming to represent a small publishing house. Running a ClarityCheck report confirms the email domain aligns with publicly available information about the company, reducing risk before signing an agreement.

Scenario 2: Screening Freelance Illustrators

A digital publisher seeks an illustrator for a children’s book. Before sharing project details or compensation terms, ClarityCheck verifies contact information, ensuring the artist is legitimate.

Scenario 3: Marketing Outreach Safety

A self-publishing author plans a social media and email campaign. Verifying influencer or reviewer contacts helps prevent marketing materials from reaching fraudulent accounts.

Why Verification Strengthens Publishing Operations

In digital publishing, speed and creativity are essential, but they must be balanced with security:

- Protect intellectual property

- Maintain trust with collaborators

- Ensure financial transactions are secure

- Prevent delays due to miscommunication

Verification tools like ClarityCheck integrate seamlessly, allowing authors and publishing teams to focus on creation rather than risk management.

Final Thoughts

In a world where publishing is increasingly digital and collaborative, verifying contacts is not just prudent — it’s necessary.

ClarityCheck empowers authors, editors, and digital publishing professionals to confidently assess phone numbers and email addresses, protect their intellectual property, and streamline communication.

Whether managing manuscript submissions, coordinating external contributors, or launching marketing campaigns, integrating ClarityCheck into your workflow ensures clarity, safety, and professionalism.

In digital publishing, trust is as important as creativity — and ClarityCheck helps safeguard both.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

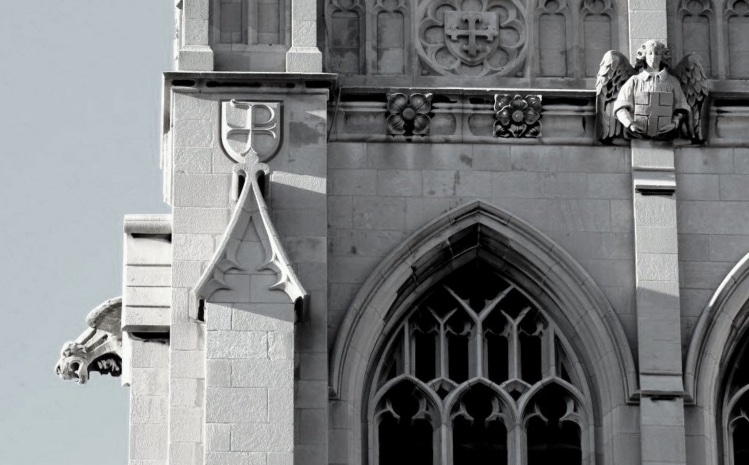

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.