Features

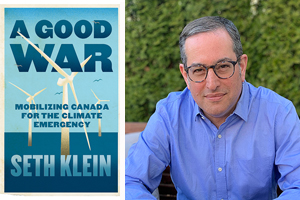

A Good War: Mobilizing Canada for the Climate Emergency

Review/Interview by MARTIN ZEILIG

There are parallels between our wartime experience and the climate current crisis, maintains author Seth Klein in his optimistic new book.

“I ultimately decided to structure the entire book around lessons from Canada’s Second World War experience,” he writes.

Klein served for 22 years as the founding director of the British Columbia office of the Canadian Centre for Policy Alternatives (CCPA), Canada’s foremost social justice think tank, says an online biography. He is now a freelance policy consultant, speaker, researcher and writer, and author of A Good War: Mobilizing Canada for the Climate Emergency. Seth is an adjunct professor with Simon Fraser University’s Urban Studies program, and remains a research associate with the CCPA’s BC Office.

The book explores what wartime-scale climate mobilization could actually mean.

“Each chapter jumps back and forth in time between stories of what Canada did during the war and what we now face,” Klein writes.

Among the many questions it answers are: How was public opinion rallied to support mobilization during the war, and how might it be galvanized again?

What were the roles of governments, news media, and arts and culture? And critically, what sort of political leadership do we require to see us through challenges like this? How was social solidarity secured across class, race and gender, and how can we do so again?

Mr. Klein consented to an email interview with The Jewish Post & News.

JP&N: Why did you decide to write this book now?

SK: Like many people, I think, as I read the latest scientific warnings, I’m afraid. In particular, I feel deep anxiety about the state of the world we are leaving to our kids and those who will live throughout most of this century and beyond. And so this book project began with a desire to address this harrowing gap between what the science says we must do and what our politics seems prepared to entertain. I wanted to explore if and how we can align our politics and economy in Canada with what the science says we must urgently do to address the climate emergency. And it is that. I had always planned to include a chapter on lessons from the Second World War for rapid transformation as a reminder that we have done this before. We have mobilized in common cause across society to confront an existential threat. And in doing so, we have retooled our entire economy – twice, in fact, once to wrap up wartime production and again to reconvert back to a peace-time economy – all in the space of six short years.

JP&N: What are the most essential/realistic policies that Canada should implement to deal with the climate crisis?

SK: To execute a successful battle, we need a plan. Here, then, are seven key strategic lessons that emerge from my study of our WWII mobilization:

1. Adopt an emergency mindset. As we’ve all witnessed in recent months, something powerful happens when we approach a crisis by naming the emergency and the need for wartime-scale action. It creates a new sense of shared purpose, a renewed unity across Canada’s confederation, and liberates a level of political action that seemed previously impossible. Economic ideas deemed off-limits become newly considered. And we become collectively willing to see our governments adopt mandatory policies, replacing voluntary measures that merely incentivize and encourage change with clear timelines and regulatory fiat in order to drive change.

2. Rally the public at every turn. Many assume that at the outbreak of the Second World War everyone understood the threat and were ready to rally. But that was not so. It took leadership to mobilize the public. In frequency and tone, in words and in action, the climate mobilization needs to look and sound and feel like an emergency. If our governments are not behaving as if the situation is an emergency – or they send contradictory messages by approving new fossil fuel infrastructure – then they are effectively communicating to the public that it is not.

3. Inequality is toxic to social solidarity and mass mobilization. A successful mobilization requires that people make common cause across class, race and gender, and that the public have confidence that sacrifices are being made by the rich as well as middle-class and modest-income people. During the First World War, inequality undermined such efforts. Consequently, at the outset of the Second World War, the government took bold steps to lessen inequality and limit excess profits. Such measures are needed again today. Moreover, polling clearly shows that when ambitious climate action is linked to tackling inequality, support does not go down – rather, it goes dramatically up.

4. Embrace economic planning and create the economic institutions needed to get the job done. During WWII, starting from a base of virtually nothing, the Canadian economy and its labour force pumped out planes, military vehicles, ships and armaments at a speed and scale that is simply mind-blowing. Remarkably, the Canadian government (under the leadership of C.D. Howe) established 28 crown corporations to meet the supply and munitions requirements of the war effort. The private sector had a key role to play in that economic transition, but vitally, it was not allowed to determine the allocation of scarce resources. In a time of emergency, we don’t leave such decisions to the market. Howe’s department undertook detailed economic planning to ensure wartime production was prioritized, conducting a national inventory of wartime supply needs and production capacity and coordinating the supply chains of all core war production inputs (machine tools, rubber, metals, timber, coal, oil and more). The climate emergency demands a similar approach. We must again conduct an inventory of conversion needs, determining how many heat pumps, solar arrays, wind farms, electric buses, etc., we will need to electrify virtually everything and end our reliance on fossil fuels. And we will need a new generation of crown corporations to then ensure those items are manufactured and deployed at the requisite scale.

5. Spend what it takes to win. A benefit of an emergency mentality is that it forces governments out of an austerity mindset. This year, in response to the COVID emergency, Canada’s debt-to-GDP ratio will rise to about 50%. At the end of WWII, it was 108%. In order to finance the war effort, the government issued new public Victory Bonds and new forms of progressive taxation were instituted. Yet these new taxes, and, what remains to this day historic levels of public debt, did not produce economic disaster. On the contrary, they heralded an era of record economic performance. As we confront the climate emergency, financing the transformation before us requires that we employ similar tools.

6. Indigenous leadership, title and rights are central to winning. Indigenous people played an important role in the Second World War. Today, their role in successfully confronting the climate crisis is pivotal. As our mainstream politics dithers on meaningful and coherent climate action, the assertion of Indigenous title and rights is buying us time, slowing and blocking new fossil fuel projects until our larger politics come into compliance with the climate science. Some of Canada’s most inspiring renewable energy projects are also happening under First Nations’ leadership. It is imperative to both honour and support such efforts.

7. Leave no one behind. The Second World War saw over one million Canadians enlist in military service and even more employed in munitions production (far more than are employed in the fossil fuel industry today). After the war, all those people had to be reintegrated into a peacetime economy. That too required careful planning, and the development of new programs for returning soldiers, from income support to housing to post-secondary training. The ambition of these initiatives provides a model for what a just transition can look like today for all workers whose economic and employment security is currently tied to the fossil fuel economy, with a special focus on those provinces and regions most reliant on oil and gas production.

JP&N: Is there anything else you’d like to share with our readers?

SK: The book is an invitation to our political leaders, to reflect on the leaders who saw us through the Second World War and to consider who they want to be, and how they wish to be remembered, as we undertake this defining task of our lives. My hope is that this book might embolden them to be more politically daring than we have seen to date, because that is what this moment demands.

And much like the trials that tested the character of past generations, the book is also an invitation to all of us to reflect on who we want to be as we together confront this crisis.

A Good War: Mobilizing Canada for the Climate Emergency

By Seth Klein

(ECW Press 464 pg. $24.95)

Available on Amazon.ca in both paperback and Kindle format

Features

ClarityCheck: Securing Communication for Authors and Digital Publishers

In the world of digital publishing, communication is the lifeblood of creation. Authors connect with editors, contributors, and collaborators via email and phone calls. Publishers manage submissions, coordinate with freelance teams, and negotiate contracts online.

However, the same digital channels that enable efficient publishing also carry risk. Unknown contacts, fraudulent inquiries, and impersonation attempts can disrupt projects, delay timelines, or compromise sensitive intellectual property.

This is where ClarityCheck becomes a vital tool for authors and digital publishers. By allowing users to verify phone numbers and email addresses, ClarityCheck enhances trust, supports safer collaboration, and minimizes operational risks.

Why Verification Matters in Digital Publishing

Digital publishing involves multiple types of external communication:

- Manuscript submissions

- Editing and proofreading coordination

- Author-publisher negotiations

- Marketing and promotional campaigns

- Collaboration with illustrators and designers

In these workflows, unverified contacts can lead to:

- Scams or fraudulent project offers

- Intellectual property theft

- Miscommunication causing delays

- Financial loss due to fraudulent payments

- Unauthorized sharing of sensitive drafts

Platforms like Reddit feature discussions from authors and freelancers about using verification tools to safeguard their work. This highlights the growing awareness of digital safety in creative industries.

What Is ClarityCheck?

ClarityCheck is an online service that enables users to search for publicly available information associated with phone numbers and email addresses. Its primary goal is to provide additional context about a contact before initiating or continuing communication.

Rather than relying purely on intuition, authors and publishers can access structured information to assess credibility. This proactive approach supports safer project management and protects intellectual property.

You can explore community feedback and discussions about the service here: ClarityCheck

Key Benefits for Authors and Digital Publishers

1. Protecting Manuscript Submissions

Authors often submit manuscripts to multiple editors or publishers. Before sharing full drafts:

- Verify the contact’s legitimacy

- Ensure the communication aligns with known publishing entities

- Reduce risk of unauthorized distribution

A quick lookup can prevent time-consuming disputes and protect original content.

2. Safeguarding Collaborative Projects

Digital publishing frequently involves external contributors such as:

- Illustrators

- Designers

- Editors

- Ghostwriters

Verification ensures all collaborators are trustworthy, minimizing the chance of intellectual property theft or miscommunication.

3. Enhancing Marketing and PR Outreach

Promoting a book or digital publication often involves connecting with:

- Bloggers

- Reviewers

- Book influencers

- Digital media outlets

Before sharing press kits or marketing materials, verifying email addresses or phone contacts adds confidence and prevents potential misuse.

How ClarityCheck Works

While the internal system is proprietary, the user workflow is straightforward and efficient:

| Step | Action | Outcome |

| 1 | Enter phone number or email | Search initiated |

| 2 | Aggregation of publicly available data | Digital footprint analyzed |

| 3 | Report generated | Structured overview presented |

| 4 | Review by user | Informed decision before engagement |

The platform’s simplicity makes it suitable for authors and publishing teams, even those with limited technical expertise.

Integrating ClarityCheck Into Publishing Workflows

Manuscript Submission Process

- Receive submission request

- Verify contact via ClarityCheck

- Confirm identity of editor or publisher

- Share draft or proceed with collaboration

Collaboration with Freelancers

- Initiate project with external contributors

- Run ClarityCheck to verify email or phone number

- Establish project agreement

- Begin content creation safely

Marketing Outreach

- Contact media or reviewers

- Verify digital identity

- Share promotional materials with confidence

Ethical and Privacy Considerations

While ClarityCheck provides useful context, it operates exclusively using publicly accessible information. Authors and publishers should always:

- Respect privacy and data protection regulations

- Use results responsibly

- Combine verification with personal judgment

- Avoid sharing sensitive data with unverified contacts

Responsible use ensures the platform supports security without compromising ethical standards.

Real-World Use Cases in Digital Publishing

Scenario 1: Verifying a New Editor

An author is contacted by an editor claiming to represent a small publishing house. Running a ClarityCheck report confirms the email domain aligns with publicly available information about the company, reducing risk before signing an agreement.

Scenario 2: Screening Freelance Illustrators

A digital publisher seeks an illustrator for a children’s book. Before sharing project details or compensation terms, ClarityCheck verifies contact information, ensuring the artist is legitimate.

Scenario 3: Marketing Outreach Safety

A self-publishing author plans a social media and email campaign. Verifying influencer or reviewer contacts helps prevent marketing materials from reaching fraudulent accounts.

Why Verification Strengthens Publishing Operations

In digital publishing, speed and creativity are essential, but they must be balanced with security:

- Protect intellectual property

- Maintain trust with collaborators

- Ensure financial transactions are secure

- Prevent delays due to miscommunication

Verification tools like ClarityCheck integrate seamlessly, allowing authors and publishing teams to focus on creation rather than risk management.

Final Thoughts

In a world where publishing is increasingly digital and collaborative, verifying contacts is not just prudent — it’s necessary.

ClarityCheck empowers authors, editors, and digital publishing professionals to confidently assess phone numbers and email addresses, protect their intellectual property, and streamline communication.

Whether managing manuscript submissions, coordinating external contributors, or launching marketing campaigns, integrating ClarityCheck into your workflow ensures clarity, safety, and professionalism.

In digital publishing, trust is as important as creativity — and ClarityCheck helps safeguard both.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.