Local News

A detailed look at the awful predicament in which JNF Canada now finds itself since the CRA revoked its charitable status on August 10

By BERNIE BELLAN (September 6, 2024) For several weeks we’ve been writing on this website about the quandary in which JNF Canada now finds itself as a result of the CRA’s announcement on August 10 that it was revoking JNF Canada’s charitable status. What follows is a detailed review of what’s happened since the CRA made that announcement. As a result of that decision JNF Canada has not been able to issue tax receipts for donations – and, in the worst case scenario, could be hit with a penalty amounting to 100% of its assets (which are over $32 million).

Here’s what’s happened: On August 10, the Canada Revenue Agency dropped a bombshell with an announcement in the Canada Gazette that JNF Canada’s charitable status had been revoked.

Not only did the announcement catch JNF Canada by surprise, it came on a Saturday – which JNF Canada regarded as especially hurtful considering it was Shabbat.

What the CRA has done has enormous ramifications, not only for an organization that has had a storied history in the development of Israel, but for many Canadians – Jews and non-Jews alike, when it comes to charitable giving, no organization has had a higher priority than the Jewish National Fund Canada.

As such, prior to publication, we did contact the Canada Revenue Agency to try to get a better idea why it had revoked JNF Canada’s charitable status, asking in an email dated August 29: “What I’ve been trying to understand is whether there is any one key issue that has led to the CRA’s revoking JNF-Canada’s charitable status or is it as a result of many issues?”

Email sent to jewishpostandnews.ca by CRA

The CRA did respond, writing “We can confirm that the charitable status of the Jewish National Fund of Canada Inc. / Fonds National Juif du Canada Inc. (the Organization) is revoked effective August 10, 2024, in accordance with the Income Tax Act (the Act).

“As the charitable sector is supported by all Canadian taxpayers, the Canada Revenue Agency (CRA) is committed to increasing the transparency and accountability of charitable organizations by providing relevant information about them to the public, in accordance with the disclosure provisions of the Income Tax Act (the Act).

“For more information, please visit Canada Gazette, Part I, Volume 158, Number 32 and the CRA’s List of charities and certain other qualified donees. Furthermore, under the Act, the CRA can release a copy of the letter(s) it sent to the charity outlining the reasons for its revocation. Please find here a copy of the letters the CRA has sent to the Organization about the reasons for revocation. Any redactions found in the documents are intended to protect confidential taxpayer information as required by the Act.”

JNF CEO Lance Davis questions the CRA’s stance

Also, prior to publication, we invited JNF Canada to respond to the CRA’s decision. On September 5, we received a response from Lance Davis, CEO, JNF Canada (It should be explained that Davis refers extensively to the term “charitable object.” Later in this article there will be a detailed explanation of what that term means and why the CRA maintains JNF Canada deviated from its charitable object.) Here is what Lance Davis wrote:

“The CRA’s confirmation of revocation letter, focusing on JNF Canada’s work in 2011-12 is fundamentally about our founding charitable object, meaning the key purpose of the charity. If the charitable purpose is not charitable then all of our subsequent work would be problematic. We disagree and have argued to the CRA that our work for the past five decades is indeed charitable.

“Secondly, if after more than fifty years, CRA changes its opinion about an object that it accepted in 1967, then a simple solution would have been to work with JNF to identify a new charitable object and ensure its compliance. JNF Canada submitted ten potential charitable objects to the CRA and they ignored these suggestions. We called upon the CRA more than 10 times to help us resolve this dispute and these requests were not answered. Interestingly, representatives of the CRA did accept meetings with organizations calling for the revocation of our charitable status, but not JNF.

“The CRA did address two recent projects, meaning they were realized long after the time frame of the audit. They identified two rather small administrative issues. We do our work in Hebrew and submitted some documentation in Hebrew which is not illegal. However, we should have translated it before we shared it. We are involved with two psychiatric hospitals in Jerusalem and there was an error in the documentation provided, which we acknowledge. It was human error. It could have been solved with a simple phone call or email asking for clarification. If this is an issue worthy of inclusion in the letter of revocation, it certainly is a draconian response. The projects in question were built properly. The receipts for the work were submitted. We have professionals on the ground checking the work. One simply has to look at the photos of the before and after to see that that we realized important charitable social service projects assisting Israel’s most vulnerable populations: those suffering from the most severe mental illnesses and special needs children.”

In order to understand the significance of the CRA decision one need only consider some aspects of how much JNF Canada has contributed to Israel since its inception in 1968 (when it was created as a wholly separate entity from the Keren Kayemet Le’Yisrael (Jewish National Fund).

In the years since its creation JNF has funded over $200 million for more than 180 projects in Israel and has planted over 2 million trees. As of 2022 JNF Canada had almost $32 million in assets in Canada.

Now, with the decision to revoke its charitable status, while JNF has assured its supporters that it will carry on even if it is no longer able to issue charitable receipts, the danger is that it will be forced to pay a penalty amounting to 100% of all its assets in a year’s time from the date of revocation.

In the days that followed the decision to revoke JNF Canada’s charitable status – and ever since, for that matter, there has been much confusion as to what led the CRA to take such drastic action.

The CRA cited a number of reasons for the decision to revoke, including that JNF Canada failed “to be constituted for exclusively charitable purposes;” was engaged in activities that are not in furtherance of charitable purposes;” was not exercising “direction and control over the activities undertaken in Israel and thus not devoting its resources to its own charitable activities;” provided “funds to non-qualified donees;” and failed to have “insufficient documentation to substantiate the activities undertaken in Israel and its failure to keep information in such form that would enable the Minister to determine whether there are grounds for the revocation of its registration.”

On August 14, we reported on the JNF’s response to the CRA’s shocking announcement by running a story on jewishpostandnews.ca that was first published on a website known as Algemeiner. That story noted JNF Canada’s response to the CRA’s decision to revoke its charitable status: The “CRA usually takes certain measures, like negotiating compliance agreements or invoking sanctions, before drastically revoking an organization’s charitable status,’ JNF Canada said. ” But, in its dealing with JNF Canada, the CRA ‘not only skipped steps 1-3, it also refused to enter into a dialogue with us and to entertain our suggestions of new objects for our charity or to discuss a compliance agreement,’ the Jewish group said. ‘We maintain that the CRA erred both in fact and in law and that the process was flawed and unfair, which is why we have ended up in court.’

The story went on to say that “JNF Canada also maintains that it has addressed CRA’s concerns about its work with KKL by taking steps such as reducing the number of its projects with the group and engaging in a compliant agreement with the Israeli charity.

“ ‘KKL works for JNF Canada, just like any other agent that we utilize. JNF Canada selects the projects we wish to support and we always have direction and control over all of the funds as we reimburse expenses upon receipt of valid expense reports. In short, we have addressed the CRA’s concerns.’ ”

The CJN criticizes JNF Canada

Also on August 14 the Canadian Jewish News released a podcast with well-known journalist Ellin Bessner in which Bessner examined in great detail the charges laid by the CRA that had led to its revoking JNF Canada’s charitable status. For part of the podcast Bessner also interviewed lawyer Mark Blumberg, who specializes in charity law. (We have been in touch with Blumberg several times since, asking him about the CRA’s decision. At the end of this story you can read a very interesting comment by Blumberg about the suggestion that politicians should intervene in this situation to reverse CRA’s decision.)

During her podcast Bessner was critical of JNF Canada and, in an article subsequently published by the CJN many of those criticisms were repeated in print, including:

“Canada Revenue Agency (CRA) warned JNF Canada in 2019 it planned to take away its charitable status and then warned them again in 2023 and in 2024, due to ‘repeated and serious non-compliance’ with the Income tax Act rules governing charities, particularly covering JNF Canada’s work in Israel.

The article went on to say that “Documents recently released to The CJN by the CRA show the venerable Canadian Jewish charity–that has helped reforest and build infrastructure in Israel since the late 1960s—had been warned repeatedly to clean up its act between 2016 and 2023, and even earlier.

“ ‘The CRA letter dated Aug. 21, 1989, raised concerns about the [JNF Canada’s] direction and control, and maintenance of books and records,’ according to the CRA documents. ‘The major concerns about the Organization’s activities overseas have been present since the first audit.’

To clarify, the CRA began auditing JNF Canada in 2011 and sent letters to JNF Canada in 2016 and 2018. The CRA began issuing warnings to JNF Canada beginning in 2019 that JNF Canada’s charitable status could be revoked.

The CRA released 358 pages of documents to Bessner and we were able ourselves to see those documents. In fairness to JNF Canada, many of the documents are simply repetitions of other documents. The gist of the CRA’s complaint with JNF Canada is that it had not been in compliance with regulations in the Income Tax Act that govern the behaviour of charities, nor had it taken proper steps to correct its behaviour even though it has been given repeated warnings for many years.

JNF Canada’s “charitable object” comes in for close scrutiny

One particularly interesting aspect of the CRA’s criticisms of JNF Canada had to do with what is known as JNF Canada’s “charitable object.” Every charity, in order to be allowed to issue tax receipts, has to have a “charitable object” that would have to have some sort of humanitarian purpose.

Now, in order to understand something about the JNF’s charitable object you have to go back to the inception of JNF Canada in 1968. Until that point there was no such thing as JNF Canada. There was only what was known as “Keren Kayemeth Le’Yisrael,” which is how many of us knew of the organization. When JNF Canada was created in 1968, it declared that its “charitable object” – you may be surprised to learn, was “the relief of poverty” – by employing “indigent workers” to plant trees and prepare parks.

It may be a digression, but in looking at the 358 pages of documents that CRA had sent to JNF Canada, I was surprised to see the extent to which CRA examined in minute detail how much those “indigent workers” were paid. CRA concluded that, based on Israel’s minimum wage for the periods which were examined, workers were overpaid quite a bit for the work they did. (We cite that only to show how far CRA went in examining JNF Canada records.)

In other instances, CRA complained that there was an insufficient paper trail for projects undertaken by JNF Canada in Israel or, as was noted in one particular instance, receipts and invoices were submitted to CRA in Hebrew. As well, CRA noted JNF provided documentation for the wrong project when it was asked to provide documentation for a particular project.

JNF Canada responded strongly – both to the reasons CRA cited in revoking JNF Canada’s charitable status, and the manner in which Ellin Bessner reported on the CRA decision – claiming that Bessner had not gone to JNF Canada for a response to CRA’s criticisms before publishing a piece that cited CRA criticisms of JNF Canada.

JNF Canada responds to the CJN story

JNF Canada published a response to the CJN story on its website, saying in part:

“Although JNF was in regular contact with the CJN reporting team prior to the publication of the article on the history of our relationship with the CRA, we were never asked for our views on critical issues raised in the article. Furthermore, the behaviour of the CRA or their findings, are never questioned or criticized. Rather, it assumes that the CRA is righteous and just, and JNF is the guilty party.

“Not surprisingly, this leaves the readers with a one-sided and unbalanced impression.

“A few issues raised

“Due to human error, we provided the CRA with documentation on the wrong psychiatric hospital project. We annually oversee funding for multiple projects and at the time, we were supporting two psychiatric facilities in Jerusalem. A phone call would have quickly resolved the matter.

“Hebrew is the language of work in Israel, the language in which we receive 100s of documents, and a language our leadership can read and work in. While there is no law that requires documentation to be submitted to CRA in English or French, we should have translated certain documents to make it easier for the CRA to review. Again, a phone call would have resolved the matter quickly.

“And still, these are periphery issues in the matter of our revocation. The CRA revoked our charitable status without a fair process even though we have addressed their principal concerns. Fundamentally, CRA is questioning our charitable objects and therefore our charitable activities in support of the people of Israel.” (emphasis mine)

Added to the entire issue is the concern which many supporters of JNF have expressed that CRA has acted in response to demands from vehemently anti-Israel groups, such as Independent Jewish Voices, to cancel JNF Canada’s charitable status. Those anti-Israel groups had long voiced criticisms that JNF Canada was providing support for projects operating over the “green line,”i.e., in the “occupied territories,” and on Israel Defence Forces bases.

JNF Canada claims that it fully responded to those allegations but that it never heard back from CRA with regard to its responses.

Finally, in the same post on its website in which it provides a vigorous defence against the criticism levelled against it by CRA, JNF Canada now notes that it is appealing the CRA decision before the Federal Court of Canada (in two separate cases).

JNF Canada also says “that we are calling on our elected representatives to take responsibility. To date, Liberal MPs have situated the actions of CRA as a bureaucratic response to JNF ‘s charitable objects because of audits undertaken in 2014. If elected officials are arguing that unelected bureaucrats have been delegated the authority to make a decision of this magnitude, that was a mistake. The Government should take responsibility. The Minister of National Revenue and the Government of Canada should put the revocation of our charitable status on hold until the courts have ruled, as is customary in situations like ours (based on our lawyer’s review of over 200 cases).”

Can the government intervene?

We have been in touch with various elected representatives to gage their reaction to what has happened. As one might well understand, this is an extremely sensitive matter. The entire aspect of political involvement in as consequential a bureaucratic matter as the CRA’s decision to revoke the charitable status of as important a charity as JNF Canada has huge ramifications.

But, as lawyer Mark Blumberg advised us in an email, with reference to the Minister of Revenue’s intervening in a decision taken by CRA, “This is from the CRA’s website with my underlining:

“The Minister of National Revenue

“The Minister is responsible to Parliament for all CRA activities and exercises powers relating to regulation-making and providing reports to Parliament or the Governor in Council (Cabinet). It is a longstanding practice that the Minister does not direct officials how to interpret the law in individual cases. This practice preserves the Minister’s right to be informed while at the same time protecting the Minister from allegations of political interference in taxpayers’ affairs.”

Local News

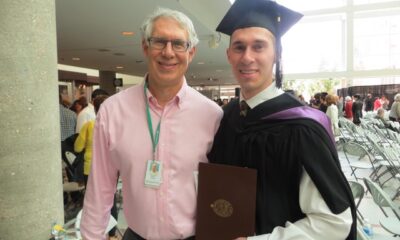

Eyal Kraut: continuing the family medical tradition

By GERRY POSNER When you talk medicine and family connections to medicine, one of the families you have to think of almost immediately is the Berbrayer- Kraut family. There are three generations of doctors now in this family, starting with Dr. Peter Berbrayer, of blessed memory, an orthopaedic surgeon (and father of Karla); Dr. Allan Kraut (husband of Karla Berbrayer, an internal medicine and occupational health physician; and Allan and Karla’s son, Dr. Eyal Kraut, an endocrinologist, who now lives in Toronto. Not to be overlooked as part of the Berbrayer-Kraut family medical team is Dr. David Berbrayer, son of Peter, and a medical director in rehabilitation redicine in Toronto. Each of these men has made contributions in his respective field and I expect many readers are well aware of that. Perhaps, because he is still young, Eyal, one of four children of Allan and Karla, is less known – although, because of his participation in the community, I am betting younger readers will know him.

Eyal Kraut was born and raised in Winnipeg. He is a product of the then Ramah Hebrew School and later the Gray Academy. It is fair to say that Eyal was exposed to the Jewish world right from the start in many aspects, not the least of which was by way of his mother Karla’s having run the Music and Mavens Programme at the Campus for many years, as well as being a musical impresario of great renown. In his high school years, Kraut was active in multiple leadership positions, including student council and the Jewish Federation’s P2K committee ( now P2G).

And, he was not just limited to school activities as he was what might be called a “player” at the Herzlia Synagogue, where he often led services, not to mention his talent as a shofar blower ( no small skill; I know that from trying for a week without making a sound). Moreover, Kraut taught Bar/ Bat Mitzvah lessons, was on staff at the Rady JCC during his school days, also staff at Camp Massad. In short, Kraut was the full package coming out of high school. He attended the University of Manitoba and graduated with a Bachelor of Science degree. While at the university, he served as president of Hillel. Subsequently, he entered the University of Manitoba Medical School.

In 2014, Eyal Kraut graduated with his MD degree. During his time as a medical student he participated in the Manitoba Medical Students Association and also sat on numerous committees. Upon graduation, Kraut was off to Queen’s University for his residency in internal medicine. It was in Kingston that he met his future wife, Zoey Katz, who was from Toronto. The couple returned to Winnipeg for Eyal’s clinical fellowship in endocrinology, which is the specialty focussing on diabetes and hormones. While he was busy with becoming a doctor, his wife Zoey was a nurse at Children’s Hospital. Now that is taking togetherness to a new level. Even then, Eyal and Zoey helped to lead services at the Simkin Centre.

In 2019, the couple made the decision to move to Toronto. Currently, Eyal works at a clinic in downtown Toronto, while at the same time he also has a weekly clinic at Mount Sinai Hospital. Yet, even with the move to Toronto, Eyal retained his medical license in Manitoba and for several years, he returned to Winnipeg for several days every two months to run a small endocrinology clinic in Winnipeg, located at Confusion Corner, called Cardio 1 Lifesmart. That is what I call staying connected to your roots. Even then, Eyal used his spare time to head to the Rady JCC, as JCC memberships are honoured everywhere there is a JCC. The routine of trips to Winnipeg ultimately concluded just recently – at the end of October. Eyal and Zoey now have a two-year-old son, Asher, with another baby on the way, so the trips to Winnipeg are no longer as feasible as they were. Still, Eyal is clear that he intends to make regular visits (to see family of course,) also to show his kids what life is like in Winnipeg. This is one guy who appreciates from whence he came.

Even with his impressive background, what really makes Eyal stand out is a talent that no one likely knows about and that is Eyal’s ability to recognize people. It was at Beth Tzedec Synagogue in Toronto not long ago – at Yom Kippur services, and with a full sanctuary, when out of the blue, a guy whom I did not know tapped me on the shoulder and asked if I was Gerry Posner. He just picked me out from my photo in the Jewish Post. That photo has me with a baseball cap on my head, but at synagogue I had a kippah on. Now, that is a rare talent. (Ed. note: Oh come on Gerry – you’ve written before how Winnipeggers, including the equally famous Rabbi Matthew Leibl – before he became a rabbi, have spotted you in baseball stadiums across North America and come up to you . You’re world famous for sure!)

Local News

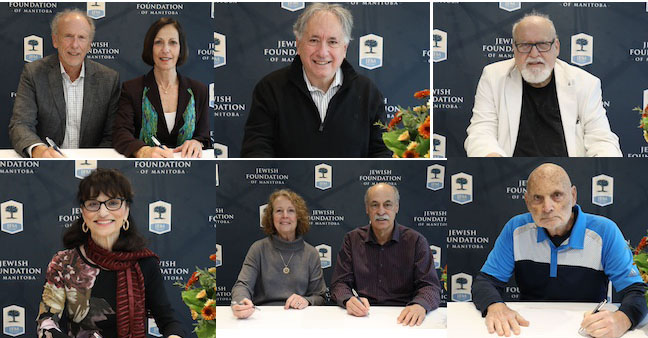

Latest Jewish Foundation Endowment Book of Life signings took place November 3rd

By MYRON LOVE Almost everyone has a story to tell. And, for the past 25-plus years, the Jewish Foundation of Manitoba – through its ongoing Endowment Book of Life program – has been assembling stories of current and former members of our Jewish community.

As explained on the Foundation website, “the Endowment Book of Life program is a planned program that offers participants an opportunity to leave both a financial and historical legacy to the community.”

Donors promise to leave a bequest to the Foundation, in return for which their family stories are inscribed in the Book of Life.

The annual official unveiling of new stories this year was held on Sunday, November 3, at the Shaarey Zedek Synagogue and included brunch, some musical entertainment featuring a talented quartet of singers – including Josh Bellan, Alyssa Crockett, Julia Kroft and Hailey Witt (who have seemingly been the young go-to performers at Jewish community functions over the past year or two) – as well as a poetry reading by members of the StudioWorks Players – and comments by Rabbi Alan Finkel as to why he chose to add his and his family’s stories to the Endowment Book of Life.

In his remarks, Finkel, the recently retired rabbi of Temple Shalom, spoke of his family’s stories – in this case, his family’s stories of the Holocaust. “My family has always shared their stories,” he noted. ”Their stories are part of the Shoah Foundation’s collection of stories. And both my mother (Carmela Finkel – who passed away three years ago) and my Aunt Betty (Kirshner) have shared their stories with hundreds of students at the Holocaust Education Centre. Later, my mother was honoured to have her story included as part of the video displays at the Canadian museum of human Rights.

“But, even as I embraced the power of those survivors’ stories,” he continued, “I could see that the list of story tellers was getting ever shorter. I wondered how those stories would continue to be told once there was no one left to tell them.”

Shortly after his mother’s passing, he said, the family came together to discuss how to continue their mother’s legacy. Their response was to create the Carmela Shragge Finkel Holocaust Education Endowment Fund at the Jewish Foundation of Manitoba – with proceeds directed toward the Jewish Heritage Centre of Western Canada.

“My page in the Endowment Book of Life is more about my personal life journey that led me to become a rabbi at 65,” he said, “but really, behind it all there are a lot of different threads and stories of Jewish community that intertwine and bind us to each other and to our Jewish community. This, to me, is the real gift of the Endowment Book of Life project – allowing each of us to here to tell our own stories in our own ways, to find our own unique paths of building our Jewish community here in Manitoba – and to celebrate how we are all part of klal Yisrael.”

Signatories to the Book of Life this year included: Dr. Sharon Goszer Tritt and Dr. Stephen Tritt; Brenda Honigman – in memory of her late father Sam, and late brother Archie; Ellie Kives – in memory of her husband Philip; David Wilder; Alisa Abrams; Marlene Reiss and Perry Rose; and Moshe Selchen, in memory

of the late Saul Feldman, a friend of the Selchen family. Feldman was a little-known member of our Jewish community who passed away a couple of years ago and left $2.6 million in his will to the Jewish Foundation.

In his introductory remarks, John Diamond, the Jewish Foundation of Manitoba’s CEO, described the Endowment Book of Life program, as “one of our most successful. We last hosted this event in 2022,” he noted, “and, I’m proud to say, I was a signer that year.”

Diamond explained why he and his wife, Heather, chose to commit to our community’s future. “In 2022,” he recalled, “we were beginning to glimpse what the world would look like post-pandemic. That prolonged period of uncertainty gave us the opportunity to think about our community’s future. If the generations before us had not been forward-thinking, prioritizing the next wave of Jewish Winnipeggers, where would we have been during the pandemic? How would our community have looked?

“Simply put, we were and are very fortunate. Thanks to that forethought, we were able to navigate that uncertainty. We need to continue putting future generations in a similar position to what we find ourselves in now.”

In her closing remarks, Dafna Shore, the JFM’s vice chair (who was filling in for chair Dan Blankstein, who was unable to attend), reported that the Endowment Book of Life currently contains over 800 stories.

“Each story is deeply personal and uniquely individual,” she pointed out. “What makes this program so special – and why it resonates with so many people – is the change to immortalize stories that otherwise might go untold.

“Every family has stories, some hidden away about what makes them exceptional. Very few are known beyond those who lived them. Sharing these stories in the Endowment Book of Life celebrates the lives lived in our community. They are an encyclopedia of what makes our community so rich in history, compassion and generosity.”

Shore thanked this most recent group of story tellers for sharing their stories and for committing to making a legacy gift. “Your gesture,” she said, “will serve to inspire the next generation to do the same. As long as our community has individuals who choose to put their community’s longevity at the top of their priorities, our community will continue to thrive.”

Local News

2024 Yom Tov attendance meets expectations

By MYRON LOVE Congregational leaders in our community are, for the most part, quite pleased with Tom Tov attendance this past Yom Tov.

“We sold out our seats,” reports Dr. Rena Secter Elbaze , the Shaarey Zedek’s executive director.

The remodeled and expanded Shaarey Zedek, our community’s oldest and largest congregation, has a capacity of about 900 in the main sanctuary – with an additional 250 for the separate Family Service downstairs.

Once again, this year, the popular Rabbi Emeritus Alan Green – who was the Shaarey Zedek’s senior rabbi for 18 years – returned to lead Rosh Hashanah and Yom Kippur services in the main sanctuary with Cantor Leslie Emery, the Quartet, and the Ruach Volunteer Choir. Rabbi Anibal Mass led the popular family service with Noah Trachtenberg, a Youth Band and the Dor Chadash Youth Choir.

Shaarey Zedek has, over the past few years, built a substantial following for its Shabbat and Yom Tov services online. Elbaze notes though that the number of people participating in Rosh Hashonah and Yom Kippur servicers online this year was considerably lower. That was because, she says, many of those congregants were eager to come back to the shul – which just re-opened a couple of months ago after being closed for three years due to construction – and daven in person.

“We were essentially sold out for Yom Tov by early September,” reports Jonathan Buchwald, Congregation. Etz Chayim’s executive director. “Our members were really excited about our first Yom Tov in our new building.”

By necessity – in reflecting the congregation’s slowly declining membership numbers – the new Etz Chayim – at 1155 Wilkes Avenue – is considerably smaller than its predecessor. To accommodate the demand for Yom Kippur seating in particular, Buchwald had earlier reported, the Kol Nidre service was to be held at the Holiday Inn Express at the airport – and there were two services for Yom Kippur day.

Buchwald notes that 335 were in attendance for the first services on Rosh Hashonah and Yom Kippur service and 120 for the second service on Rosh Hashanah – with 450 for Kol Nidre at the hotel. There were 250 for Neilah and 50 for the Young Family services. About 150 followed online.

As usual, Rabbi Kliel Rose and Cantor Tracy Kasner led Etz Chayim’s High Holiday services – with a separate family service geared toward families with young children as well as a Junior Congregation.

Over at Temple Shalom, our community’s 60-year Reform congregation,Past President Ruth Livingston says that there was “good enthusiasm” for Yom Tov and that the congregation members were very happy with the services led by cantorial soloist Janet Pelletier Goetz as well as long time Temple Shalom member Myriam Saitman – who is set to begin training in September toward her rabbinical ordination – and, for the first time, choir leader Erica Tallis –a 2020 graduate of the Desautels Faculty of Music at the University of Manitoba.

For the second year in a row, South end Winnipeg further offered a fourth liberal Jewish option in the form of Rabbi Matthew Leibl’s “Services on the River: A Modern High Holidays.”

The former Shaarey Zedek – and now independent – rabbi’s services were held once again at The Gates on Roblin – which can accommodate up to 300. Last year, Leibl reported in an earlier interview, about 250 people attended his service. He was expecting to have similar number this year.”

“Services on the River: A modern High Holidays” services were scheduled for the second day of Rosh Hashanah, Erev Yom Kippur and Yom Kippur morning. The services also featured the husband and wife cantorial team of Justin Odwak and Sarah Sommer.

All services were 90 minutes.

Still with the South End, Jack Craven president of Orthodox congregation Adas Yeshurun Herzlia says that people are happy that things are back to normal. “We had a good crowd for Yom Tov,” he says.

The congregation – led by Rabbi Yossi Benarroch – has a membership of about 100 and can accommodate up to 250.

“We were filled up for Rosh Hashonah and Yom kippur,” notes Rabbi Avroham Altein, Winnipeg’s senior Chabad-Lubavitch Rabbi of the south end Lubavitch Centre. “We also had a full house for Erev Simchas Torah.”

The Lubavitch Centre has a capacity of between 200 and 300.

The Simkin Centre also held Yom Tov services – on all three days – that were open to the general public. The services were led by Steven Hyman with the Simkin Centre Choir under the direction of Bonnie Antel.

In the North End, the Conservative egalitarian Chevra Mishnayes congregation – the largest congregation in that part of the city with the relocation of Etz Chayim south – saw a bit of a bump in attendance.

“We had 20 new people this year,” reports Chevta Mishnayes President Rob Waldman. “This is the first time that we have seen an uptake in attendance for Yom Tov since before the Covid lockdowns.”

Last year, just under100 came to the Garden city shul for Yom Tov.

This year’s service were once again led by Al Benarroch.

About 18 months ago, a new North End Orthodox congregation came into being as a result of the merger of the struggling Chavurat Tefila and Talmud Torah Beth Jacob members. The renamed Chavurat Tefila Talmud Torah Congregation – located at on the corner of Hartford and McGregor in West Kildonan – attracted between 40 and 50 daveners for its first Yom Tov services last year last year and about the same number this year.

Services at the shul this year were led by Cantor Menachem Frenkel from Silver Spring, MD.

“Cantor Frenkel was recommended by a friend and member of the shul,” says Cary Rubenfeld, the shul’s treasurer and spokesperson. “He was quite well received by the congregation. He is a multi-talented ba’al tefilah. He brought with him an extensive range of traditional and contemporary melodies which the congregants enjoyed.”

The venerable House of Ashkenazie, the last of our community’s old-style Orthodox congregations, was once again the only shul to report a bit of a decline in attendance from last year – with attendance for Yom Tov hovering around 30. Shul President Gary Minuk avers though that the Ashkenazie – which still holds services throughout the year on Thursday mornings – will continue to carry on “as long as we can still make minyans.”

Our community’s most northerly High Holiday services were held at Camp Massad. After a two year absence due to the Covid lockdowns, Camp Massad resumed its innovative Rosh Hashanah service last year. In pre-Covid times, Massad executive director Danial Sprintz noted last year, Rosh Hashanah at Massad had attracted as many as 150 participants. In 2023, 90 attended. This year’s attendance, he reports, was slightly higher.

“Our people were excited to come together,” he says. “We always offer a creative and interactive service that combines some traditional prayers with contemporary readings, folk music and our usual Camp Massad shtick.”