Local News

Despite JNF Canada losing its latest appeal in the Federal Court of Canada to have its charitable status restored, it will continue the appeal process all the way to the Supreme Court of Canada, if necessary

By BERNIE BELLAN (June 17, 2025) Readers may recall that last August, in what was a shocking decision by the Canada Revenue Agency, JNF Canada lost its charitable status, which meant that it could no longer issue tax receipts for charitable donations. Further, JNF Canada was facing the prospect of having to wind down its operations and disburse all its assets by November 13, 2024, or face a 100% tax.

At the time, Canadian Jewish News reporter Ellin Bessner wrote a detailed examination of what had happened and why it happened.

Bessner noted the following reasons that the CRA had revoked JNF Canada’s charitable status:

“The agency’s findings in the audit ranged from where the charity’s books and records had been kept in 2011 and 2012 (mostly in Israel, which was a no-no), to what language the paperwork and receipts were kept in (mostly in Hebrew, which is not illegal but makes work difficult for auditors), to the conclusion that JNF Canada’s founding charitable purposes of relieving poverty in Israel by paying the salaries of indigent labourers, were not being met.”

Why would the CRA not enter into negotiations with JNF Canada over a new compliance agreement?

In an email received from Lance Davis, CEO of JNF Canada, on June 6, 2025, however, Davis addressed the particular concern to which Bessner referred in her August 2024 article – that JNF Canada was not meeting its “charitable object.”

Davis wrote: “The revocation is based on the CRA’s belief that our current charitable objective is no longer an acceptable charitable objective (after being acceptable for almost 60 years). It is not that the objective isn’t being met. It should be noted that we offered 10 new charitable objectives, which were previously approved for other charities, but the CRA never acknowledged these new objectives and continued to reject our requests for a compliance agreement. “

The CJN article offers more reasons for the CRA decision to revoke

Bessner’s article continued: “Another major issue was that because of missing paperwork and superficial oversight on the ground in Israel, it was felt the Montreal-based JNF Canada hadn’t been in control of or directing its own operations overseas. CRA believed the charity was acting merely as a funnel of money to the Jerusalem-based agency, the Jewish National Fund/Keren Kayemeth LeIsrael, which ran the projects.

“A further red flag for auditors were several projects in 2011 and 2012 that benefited the Israel Defence Forces, such as construction of buildings and green areas on IDF military bases. Registered charities are not permitted to support a foreign military financially, under Canadian laws. Some other projects were located in the West Bank and on other disputed land, the CRA found, something which Canada’s foreign policy frowns on.

Bessner further noted that “JNF Canada disagreed with the CRA’s view of that last category—and still does. But in 2019, the charity assured the public that it had stopped funding both kinds of projects after 2016, in order to comply with CRA requirements in good faith.”

A 2019 internal CRA memo says JNF Canada’s charitable status would not be revoked until the appeals process was exhausted

Immediately upon learning that the CRA had revoked JNF Canada’s charitable status, representatives of JNF Canada launched a series of legal appeals to have that decision reversed.

What is even more perplexing, however, notwithstanding the various reasons the CRA may have given for revoking JNF Canada’s charitable status, is why the CRA took that step when apparently, in August 2019, senior administrators within CRA had decided not to revoke JNF Canada’s charitable status until such time as JNF Canada had exhausted all its appeals including going so far as appealing to the Supreme Court of Canada.

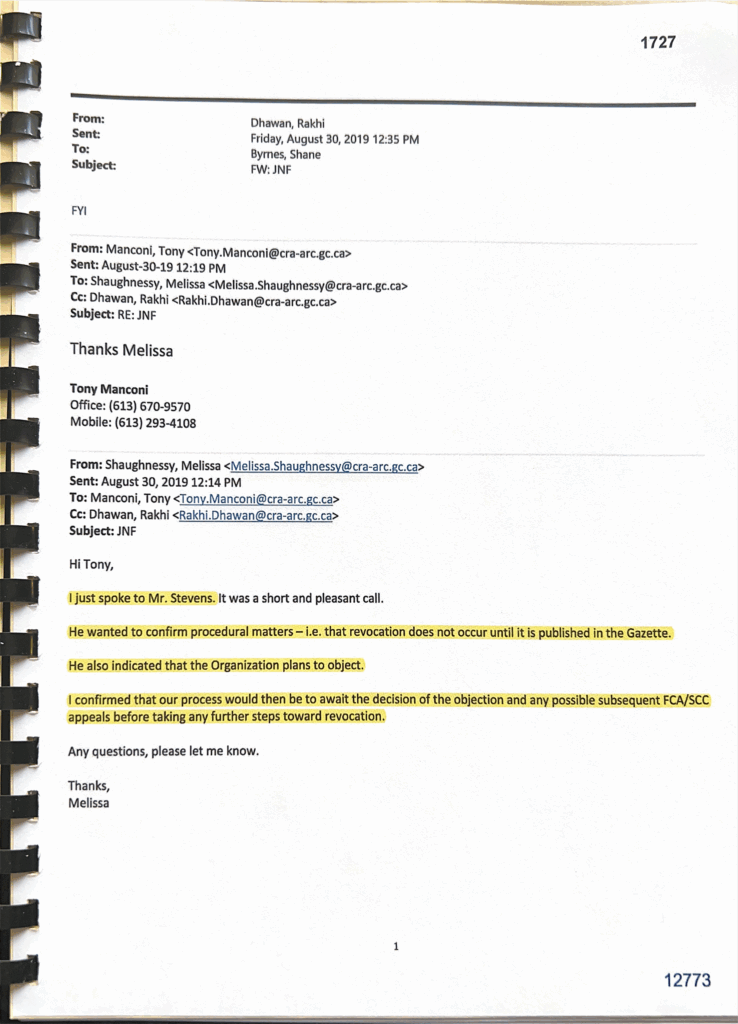

In an internal email circulated among three CRA employees in August 2019 (shown here), and which was written by Melissa Shaughnessy, who is currently listed as the “Acting /Manager, Charities Directorate, Compliance Division | Canada Revenue Agency,” Ms. Shaughnessy wrote: “I confirmed that our process would then be to await the decision of the objection and any possible subsequent FCA (Federal Court of Canada)/SCC (Supreme Court of Canada) appeals before taking any further steps toward revocation.” (emphasis ours)

As Lance Davis noted in an email sent to me on June 6, JNF Canada had already begun an appeal process to avoid having its charitable status revoked by the CRA. When the August 2024 decision to revoke its status was suddenly issued, notwithstanding the decision among CRA administrators, evident in the memo seen here, to await the results of the entire appeals process to which JNF Canada was entitled before revoking its charitable status, JNF Canada was blindsided.

Davis noted, with reference to what was written in that August 2019 CRA memo: “This approach was consistent with past practice of the CRA as reflected in its policies, publications and internal communications, and we relied on this assurance in our decision-making. Nonetheless, in 2024, the CRA published our revocation despite our Appeal 1 being active. …Appeal 2 is the appeal that we’ve now had two hearings on, both of which ruled on jurisdiction but not yet on the merits of revoking our status. We are currently determining with our leadership if we will proceed with another hearing to rule on the merits of our case, which we still believe are strong.”

We asked the CRA why that August 2019 memo which said revocation would not take place until JNF Canada’s appeals process in the courts was exhausted was reversed?

We contacted the CRA media department on June 10 to ask why, if the August 2019 memo gave clear indication that the CRA was not going to revoke JNF Canada’s charitable status until such time as all appeals by JNF Canada in the courts had been exhausted, the CRA had gone ahead in August 2024 and revoked JNF Canada’s charitable status? (We attached a screenshot of that August 2019 memo in case the CRA would take the position that there had never been any decision to await the results of JNF Canada’s appeals process.)

It took six full days for a media representative of the CRA to respond. In a typically Kafakaesque manner the CRA media representative simply entirely avoided dealing with the question about the memo, writing instead:

“The confidentiality provisions of the Act prevent the CRA from commenting on specific cases; however, we can provide you with the following general information.

“As mentioned in our response of August 30, 2024, we can confirm that the charitable status of the Jewish National Fund of Canada Inc. / Fonds National Juif du Canada Inc. (the Organization) was revoked effective August 10, 2024, in accordance with the Act.

“The CRA’s decision to revoke an organization’s charitable status is not taken lightly. Every organization facing revocation has the right to seek recourse.

“For more information about revocations, please visit: Revoking registered status – Canada.ca.

“The courts provide Canadians with an independent review of disputed issues, and court decisions serve to clarify the law or resolve disputes between the CRA and taxpayers. The CRA does not comment on the specific details of court cases to respect the confidentiality provisions of the Acts we administer. Publicly available information on this case may be obtained from the courts.”

However, as we noted in a previous article on our website, the CRA did release 358 pages of documents to us pertaining to its decision to revoke JNF Canada’s charitable status, following its decision to revoke. As Jonathan Rothman, writing on the CJN website, noted: “The communications branch of the CRA recently provided 358 pages of its correspondence with JNF Canada. Officials said that due to confidentiality restrictions in the Income Tax Act, the CRA can release this material only after revoking a charity’s status. ”

So, it is somewhat specious for the media spokesperson to claim that “The CRA does not comment on the specific details of court cases to respect the confidentiality provisions of the Acts we administer” when, in fact, the CRA was quite willing to release 358 pages of documents explaining why it had suddenly revoked JNF Canada’s charitable status in August 2024. The question remains: What changed from the time that memo was circulated in August 2019 among CRA administrators and August 2024, when JNF Canada’s charitable status was revoked, without any prior notice given to JNF Canada that was about to happen?

The appeals process continues to take its course

It is somewhat confusing to follow the appeals process which JNF Canada undertook. One was an appeal through the Federal Court and another was an appeal through the Federal Court of Canada.

As Ellin Bessner explained in a November 10, 2024 article which appeared on the CJN website,

in November 2024 the Federal Court turned down JNF Canada’s request that the CRA’s decision to revoke its charitable status be reversed. Bessner wrote that “Jewish National Fund of Canada has lost its first major legal battle to stop the tax department’s revocation of its charitable status, which came into effect three months ago.

“Late in the afternoon of Friday, Nov. 8, a Federal Court judge dismissed JNF Canada’s application for a judicial review—and the judge also dismissed a request for an injunction to force the Canada Revenue Agency (CRA) to remove the official revocation notice that was printed in the Canada Gazette on Aug. 10.”

But, as Lance Davis noted in his June 6 email to me, “the November decision was not on the merits of our case. It was simply that the Federal Court was not the correct court to rule on our case and so the motion was dismissed and we were advised to take our case to the Federal Court of Appeal.”

However, early in June, JNF Canada lost its appeal to the Federal Court of Canada to have its charitable status restored.

Again though, as Davis explained to me, “This recent ruling was again only on jurisdiction. We appealed the Federal Court’s first decision that it did not have jurisdiction. The reason our lawyers chose this route was we truly believed the Federal Court was the correct place to start our judicial review. Time is of the essence as we do not want to operate as a non-profit indefinitely. Both CRA and JNF agreed that since the FCA was hearing our case, they should rule on the merits and not on whether or not the FC had jurisdiction. They declined to rule on the merits and instead, simply upheld the FC ruling that the FCA is the correct court to hear our case.”

Letter sent to JNF Canada supporters on June 4 about the most recent court decision

However, with that most recent court decision going against JNF Canada, a letter was sent to JNF Canada supporters on June 4 by Lance Davis, and Nathan Disenhouse, President, JNF Canada. That letter noted that “This week, the Federal Court of Appeal dismissed our appeal, concluding that the Federal Court did not have jurisdiction over our claim that the Canada Revenue Agency’s (CRA) actions deprived JNF Canada of procedural fairness.

“The merits of our case – our arguments as to why the process afforded to us lacked procedural fairness – have still not been ruled on.

“While we are, of course, disappointed by this result, and while it is not the result we had expected, we always knew it was a possibility. For this reason, we have been actively planning next steps.

“When the revocation of our charitable status was published in the Canada Gazette on August 10, 2024, we indicated that we had been blindsided. This is because in 2019 the CRA clearly and explicitly assured JNF Canada that the CRA ‘would not proceed with a revocation until JNF had exhausted their appeals process in Federal Court of Appeal or Supreme Court of Canada.’ (emphasis ours) This approach was consistent with past practice of the CRA as reflected in its policies, publications and internal communications and we relied on this assurance in our decision-making.

“It is also important to emphasize that over the past decade JNF Canada has attempted to engage without success with the CRA in the hope of finding a mutually acceptable path forward. Approximately two weeks ago, JNF Canada made a settlement offer in advance of this hearing, which was rejected without a counteroffer or any type of dialogue. We urge the CRA, under the leadership of the newly appointed Honourable Wayne Long Secretary of State, Canada Revenue Agency and Financial Institutions, to engage with us in the hope of our arriving at a mutually satisfactory agreement.

“In looking ahead, JNF Canada will continue to challenge the CRA’s revocation of JNF’s charitable status and its decision to publish notice of the revocation when it did in 2024. We have a multi-pronged strategy in place which will ensure that all reasonable legal processes are engaged to protect JNF Canada’s rights.

“While the court ruling was surprising and disappointing, please rest assured that we remain committed to helping address the needs of Israelis during these troubling times and to pursuing justice through the judicial process.”

Davis added this, in his June 6 email to me:

“While we are disappointed with the outcome of our appeal, it is important to clarify that our main/underlying appeal is still in the court system at the Federal Court of Appeal. While we do not have a set date yet, we are expecting our case to be heard in late 2025 or early 2026.”

What has the impact of the CRA decision been on JNF Canada the past 10 months?

So, how have JNF Canada’s operations been affected since that August 2024 decision by the CRA to revoke its charitable status?

Davis wrote, in his email to

“JNF Canada has certainly experienced difficulties since we were revoked on August 10, 2024. It is evident that our revenue has diminished. For example, major gifts from charitable foundations cannot be donated to JNF Canada as these gifts can only be sent to a registered charity. However, we are pleased to share that thousands of Canadians from coast to coast have made contributions to JNF Canada without a charitable receipt. They believe in our mission and mandate so much that they forgo the benefits of a charitable receipt. To us, this demonstrates strong support from our community, and we are as motivated as ever to find a resolution.

“In the meantime, JNF is continuing to proudly operate as a non-profit and support the projects and programs we know are of deep importance to our community here in Canada. Thankfully, we have collaborated with like-minded charities. We are pleased to support three critical projects right now: the rehabilitation of Canada Park’s forests, the Ashdod Rehabilitation & Therapy Centre and the Sderot Resilience Centre. “

Manitoba/Saskatchewan division of JNF Canada carrying on

We also contacted David Greaves, Executive Director, JNF Canada, Manitoba/Saskatchewan, to ask him what impact the CRA August 2024 ruling has had on the Winnipeg office?

Greaves was upbeat in his response. He noted, for instance, that rather than laying off employees in the Winnipeg office, the number of positions there had increased from 3 1/2 to 4.

As well, Greaves observed that the Manitoba/Saskatchewan division was coming off a very successful Negev Gala – despite not being able to issue tax receipts for attendees at the Gala or donors who did not attend the Gala but still wanted to support JNF Canada, and that the office here was already planning next year’s Gala.

Finally, Greaves explained that JNF Canada was now working with a charitable organization called the Israel Magen Fund (which is also known as “Zaka”) to continue working on two projects that JNF Canada had already initiated within the past couple of years and had not been completed: the Ashdod Rehabilitation Centre and the Sderot Rehabilitation Centre.

Greaves advised that anyone wanting to donate to either of those two projects contact the Israel Magen Fund of Canada.

Local News

Winnipeg Jewish Theatre breaks new ground with co-production with Rainbow Stage

By MYRON LOVE Winnipeg Jewish Theatre is breaking new ground with its first ever co-production with Rainbow Stage. The new partnership’s presentation of “Fiddler on the Roof” is scheduled to hit the stage at our city’s famed summer musical theatre venue in September 2026.

“We have collaborated with other theatre companies in joint productions before,” notes Dan Petrenko, the WJT’s artistic and managing director – citing previous partnerships with the Segal Centre for the Performing Arts in Montreal, the Harold Green Jewish Theatre in Toronto, Persephone Theatre in Saskatoon and Winnipeg’s own Dry Cold Productions. “Because of the times we’re living through, and particularly the growing antisemitism in our communities and across the country, I felt there is a need to tell a story that celebrates Jewish culture on the largest stage in the city – to reach as many people as possible.”

Last year, WJT approached Rainbow Stage with a proposal for the co-presentation of “Fiddler on the Roof.” Rainbow Stage management was really enthusiastic in their response, Petrenko reports.

“We are excited to be working with Winnipeg’s largest musical theatre company,” he notes. “Rainbow Stage has an audience of more than 10,000 people every season. Fiddler is a great, family-oriented story and, through our joint effort with Rainbow Stage, WJT will be able to reach out to new and younger audiences.”

“We are also working to welcome more diverse audiences from other communities, as well as newcomers – families who have moved here from Israel, Argentina and countries of the former Soviet Union.”

Helping Petrenko to achieve those goals are two relatively new and younger additions to WJT’s management team. Both Company Manager Etel Shevelev, and Head of Marketing Julia Kroft are in their 20s – as is Petrenko himself.

Kroft, who is also Gray Academy’s Associate Director of Advancement and Alumni Relations, needs little or no introduction to many readers. In addition to her work for Gray Academy and WJT, the daughter of David and Ellen Kroft has been building a second career as a singer and actor. Over the past few years, she has performed by herself or as part of a musical ensemble at Jewish community events, as well as in various professional theatre productions in the city.

Etel Shevelev is also engaged in a dual career. In addition to working full time at WJT, she is also a Fine Arts student (majoring in graphic design) at the University of Manitoba. Outside of school, she is an interdisciplinary visual artist (exhibiting her work and running workshops), so you can say the art world is no stranger to her.

(She will be partcipating in Limmud next month as a member of the Rimon Art Collective.)

Shevelev grew up in Kfar Saba (northeast of Tel Aviv). She reports that in Israel she was involved in theatre from a young age. “In 2019, I graduated from a youth theatre school, which I attended for 11 years.” In a sense, her work for WJT brings her full circle.

She arrived in Winnipeg just six years ago with her parents. “I was 19 at the time,” she says.

After just a year in Winnipeg, her family decided to relocate to Ottawa, while she chose to stay here. “I was already enrolled in university, had a long-term partner, and a job,” she explains. “I felt that I was putting down roots in Winnipeg.”

Etel expects to graduate by the end of the academic year, allowing her to focus on the arts professionally full-time.

In her role as company manager, Shevelev notes, she is responsible for communications with donors, contractors, and unions, as well as applying for various grants and funding opportunities.

In addition, her linguistic skills were put to use last spring for WJT’s production of “The Band’s Visit,” a story about an Egyptian band that was invited to perform at a cultural centre opening ceremony in the lively centre of Israel, but ended up in the wrong place – a tiny, communal town in southern Israel. Shevelev was called on to help some of the performers with the pronunciation of Hebrew words and with developing a Hebrew accent.

“I love working for WJT,” she enthuses. “Every day is different.”

Shevelev and Petrenko are also enthusiastic about WJT’s next production – coming up in April: “Ride: The Musical” debuted in London’s West End three years ago, and then went on to play at San Diego’s Old Globe theatre to rave reviews. The WJT production will be the Canadian premiere!

The play, Petrenko says, is based on the true story of Annie Londonderry, a young woman – originally from Latvia, who, in 1894, beat all odds and became the first woman to circle the world on a bicycle.

Petrenko is also happy to announce that the director and choreographer for the production will be Lisa Stevens – an Emmy Award nominee and Olivier Award winner. (The Olivier is presented annually by the Society of London Theatre to recognize excellence in professional London theatre).

“Lisa is in great demand across Canada, and the world really,” the WJT artistic director says. “I am so thrilled that we will be welcoming one of the greatest Jewish directors and choreographers of our time to Winnipeg this Spring.”

For more information about upcoming WJT shows, readers can visit wjt.ca, email the WJT office at info@wjt.ca or phone the box office at 204-477-7515.

Local News

Rising Canadian comedy star Rob Bebenek to headline JCFS’ second annual “Comedy for a Cause”

By MYRON LOVE Last year, faced with a federal government budget cut to its Older Adult Services programs, Jewish Child and Family Service launched a new fundraising initiative. “Comedy with a Cause” was held at Rumor’s Comedy club and featured veteran Canadian stand-up comic Dave Hemstad.

That evening was so successful that – by popular demand – JCFS is doing an encore. “We were blown away by the support from the community,” says Al Benarroch, JCFS’s president and CEO.

“This is really a great way to support JCFS by being together and having fun,” he says.

“Last year, JCFS was able to sell-out the 170 tickets it was allotted by Rumor’s,” adds Alexis Wenzowski, JCFS’s COO. “There were also general public attendees at the event last year. Participants enjoyed a fun evening, complete with a 50/50 draw and raffle. We were incredibly grateful for those who turned out, the donors for the raffle baskets, and of course, Rumor’s Comedy Club.

“Feedback was very positive about it being an initiative that encouraged people to have fun for a good cause: our Older Adult Services Team.”

This year’s “Comedy for a Cause” evening is scheduled for Wednesday, February 25. Wenzowski reports that this year’s featured performer, Rob Bebenek, first made a splash on the Canadian comedy scene at the 2018 Winnipeg Comedy festival. He has toured extensively throughout North America, appearing in theatres, clubs and festivals. He has also made several appearances on MTV as well as opening shows for more established comics, such as Gerry Dee and the late Bob Saget.

For the 2026 show, Wenzowski notes, Rumors’ is allotting JCFS 200 tickets. As with last year, there will also be some raffle baskets and a 50/50 draw.

“Our presenting sponsors for the evening,” she reports, “are the Vickar Automotive Group and Kay Four Properties Incorporated.”

The funds raised from this year’s comedy evening are being designated for the JCFS Settlement and Integration Services Department. “JCFS chose to do this because of our reduction in funding last year by the federal government to this department,” Wenzowski points out.

“Last year alone,” she reports, “our Settlement and Integration Services team settled 118 newcomer families – from places like Israel, Mexico, Brazil, and Argentina. Each year, our program supports even more newcomer families with things like case management, supportive counselling, employment coaching, workshops, programming for newcomer seniors, and more.”

“We hope to raise more than $15,000 through this event for our Settlement and Integration Program,” Al Benarroch adds. “The team does fantastic work, and we know that our newcomer Jewish families need the supports from JCFS. I want to thank our sponsors, Rumor’s Comedy Club, and attendees for supporting us.”

Tickets for the show cost $40 and are available to purchase by calling JCFS (204-477-7430) or by visiting here: https://www.zeffy.com/en-CA/ticketing/jcfs-comedy-for-a-cause. Sponsorships are still available.

Local News

Ninth Shabbat Unplugged highlight of busy year for Winnipeg Hillel

By MYRON LOVE Lindsay Kerr, Winnipeg’s Hillel director, is happy to report that this year’s ninth Shabbat UnPlugged, held on the weekend of January 9-11, attracted approximately 90 students from 11 different universities, including 20 students who were from out of town.

Shabbat UnPlugged was started in 2016 by (now-retired) Dr. Sheppy Coodin, who was a science teacher at Gray Academy, along with fellow Gray Academy teacher Avi Posen (who made aliyah in 2019) – building on the Shabbatons that Gray Academy had been organizing for the school’s high school students for many years.

The inaugural Shabbat UnPlugged was so successful that Coodin and Posen did it again in 2017 and took things one step further by combining their Shabbat UnPlugged with Hillel’s annual Shabbat Shabang Shabbaton that brings together Jewish university students from Winnipeg and other Jewish university students from Western Canada.

As in the past, this year’s Shabbat UnPlugged weekend was held at Lakeview’s Hecla Resort. “What we like about Hecla,” Kerr notes, “is that they let us bring in our own kosher food, it is out of the city and close to nature for those who want to enjoy the outdoors.”

The weekend retreat traditionally begins with a candle lighting, kiddush and a traditional Shabbat supper. Unlike previous Shabbats UnPlugged, Kerr points out, there were no outside featured speakers this year. All religious services and activities were led by students or national program partners.

The weekend was funded in part by grants from CJPAC and StandWithUs Canada, along with the primary gift from The Asper Foundation.

Kerr reports that the activities began with 18 of our local Jewish university students participating in a new student Shabbaton – inspired by Shabbat Unplugged, titled “Roots & Rising.”

In addition to Shabbat Unplugged, Hillel further partnered with Chabad for a Sukkot program in the fall, as well as with Shaarey Zedek Congregation and StandWithUs Canada for a Chanukah program. Hillell also featured a commemoration of October 7, an evening of laser tag and, in January, a Hillel-led afternoon of ice skating.

Coming up this month will be a visit to an Escape Room – and a traditional Shabbat dinner in March.

Kerr estimates that there are about 300 Jewish students at the University of Manitoba and 100 at the University of Winnipeg.

“Our goal is to attract more Jewish students to take part in our programs and connect with our community,” she comments.