Local News

Jewish performers at upcoming Winnipeg Fringe Festival July 17-28

By BERNIE BELLAN As has been my long-time custom, I try to find Fringe shows that feature Jewish performers or playwrights – or, as is sometimes the case – plays that have a Jewish theme.

This year will see a very large number of Jewish performers, many of whom are repeat Fringe performers, but we will also have one play to be performed by one of the Fringe Festival’s most popular performers: Jem Rolls who, while he is not Jewish, has chosen for his theme this year a most unusual subject

(For information about venues and show times go to Winnipegfringe.com)

Alli Perlov: One Human Being Potentially Comedic Performance of The Nightmare Before Christmas

Alli Perlov has been a theatre kid her entire life. Her experiences include training at Manitoba Theatre for Young People, a Bachelor of Arts from the University of Winnipeg, and a brief career in film and television in her teens.

For the past 13 years, Perlov has been a performing arts teacher in Winnipeg, teaching courses in musical theatre, improv and drama to students from Grades 6 to 12. In an effort to continue practicing what she teaches, Alli Perlov has mounted three one-person Fringe plays starting in 2017 and brings her fourth to this year’s festival with a new work for her most favourite film, “A One Human Being, Potentially Comedic Performance of The Nightmare Before Christmas”.

Some teachers take the summer off to recharge, while others mount a one-person Fringe festival show. In a similar approach to her 2018/2023 show, Perlov tackles her favourite film of all time in,

“A One Human Being Potentially Comedic Performance of The Nightmare Before Christmas”. Local performing arts teacher Alli Perlov aims to leave the audience in stitches as she performs dozens of creepy characters from the iconic 1993 Tim Burton stop-motion film.

In a musical parody full of charm and can-do spirit, Perlov tackles the task of making “try-hard” a compliment. Condensing the score to 50 minutes of music, and weaved with narrative, critiques and silly puns, everyone in the theatre is guaranteed a good time and a load of laughs.

Melanie Gall (3 separate shows): FORBIDDEN CABARET, STITCH IN TIME, ROCKIN’ BLUEBIRD (kids’ show)

Melanie Gall has been a Fringe favourite for years. Last year she performed in 3 separate shows – and she’s back doing 3 shows again!

FORBIDDEN CABARET

Hidden in the back alley of a Broadway theatre is the grittiest, most decadent club in New York. The year is 1934. Unlicensed musical entertainment is prohibited and the Dirty Blues are banned. But not at Club Hirondelle – and when the midnight hour strikes, the forbidden cabaret begins with some of the naughtiest songs from (almost) 100 years ago.

Featuring a dozen (real!) banned hits, including: “Boobs,” “What Can You Buy a Nudist on His Birthday?” and the Yiddish Theatre hit, “Mein Butcher.”

Melanie Gall is the award-winning performer of sellout hits Ingenue (5 STARS), American Songbook Experience (5 STARS) and Toast to Prohibition (5 STARS).

STITCH IN TIME

Excitement! Drama! Romance! And…knitting? A scintillating cabaret featuring ‘lost’ knitting songs of World War I and World War II.

Bring your knitting (or crochet) and stitch along to these funny, toe-tapping, needle-clicking tunes. Come out and have a ball! Melanie Gall presents over a dozen quirky historic songs, including “More Power to Your Knitting, Nell!” and “The Knitting Itch.”

During the wars, millions of women knit for soldiers and dozens of knitting songs appeared. After the wars, these songs were close to disappearing forever. But now, this music — a clever, sweet and entertaining footnote in history — will live again.

FIVE STARS – Glam Adelaide, Southside Advertiser

“Divine voice, highly recommended” – Fringe Review UK

“Cute, charming and funny” – Plank Magazine

ROCKIN’ BLUEBIRD (kids’ show)

Bluebird Scraps has always wanted to be a rock star. She dreams of bright lights, a cool costume, and thunderous applause. But the other birds just don’t understand! All the robins and sparrows sing together in their trees, but Scraps has a squawk that just doesn’t fit. With your help, she’ll find her voice and rock the show!

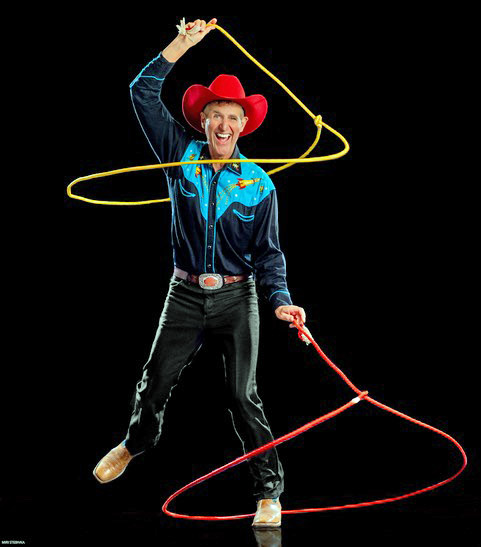

LEAPIN’ LOUIE LICHTENSTEIN

We sent an email to a Fringe performer by the name of Louie Lichtenstein, asking him if he was Jewish. The answer was yes. Here’s what Louie sent back:

Hello hard working Manitoba Jewish Media folks,

Leapin’ Louie, the most explosive Lithuanian Jewish Cowboy Comedian to ever come out of Oregon, is on his way to Winnipeg Fringe.

It’s Kids Fringe but awesome for adults too. An environmental theme no less.

Fly Through Time

with Leapin’ Louie Lichtenstein

A cowboy comedy circus show about animals who fly

Kids Fringe Manitoba Theatre For Young People

Pay what you can

Leapin’ Louie uses circus, cowboy tricks, a six-foot unicycle, and lots of comedy to explore all those wild critters, including us, who fly.

In 400 million years five amazing groups of animals developed flight: Insects, pterosaurs, birds, bats and finally humans. Only 66 years after the Wright Brothers invented the airplane, —we landed on the moon. We’re moving so fast! Can we leave enough room for our amazing wild ecosystems as we jet into the future? It’s a biodiversity science education show that’s really fun for adults and kids.

Leapin’ Louie is a master of physical comedy, trick roping, whip cracking, and juggling. He has performed one-person Leapin’ Louie shows in 35 different countries around the world, including many tours of Europe, Japan and Australia. He is considered the most explosive Lithuanian Jewish Cowboy Comedian to ever come out of Oregon, USA. This is his first time at Winnipeg Fringe.

“‘Awesome’ is a terrible word, but there’s no shame using it – in the truest sense – to describe Leapin’ Louie” Broadway Baby ☆ ☆ ☆ ☆ (Edinburgh Fringe Festival)

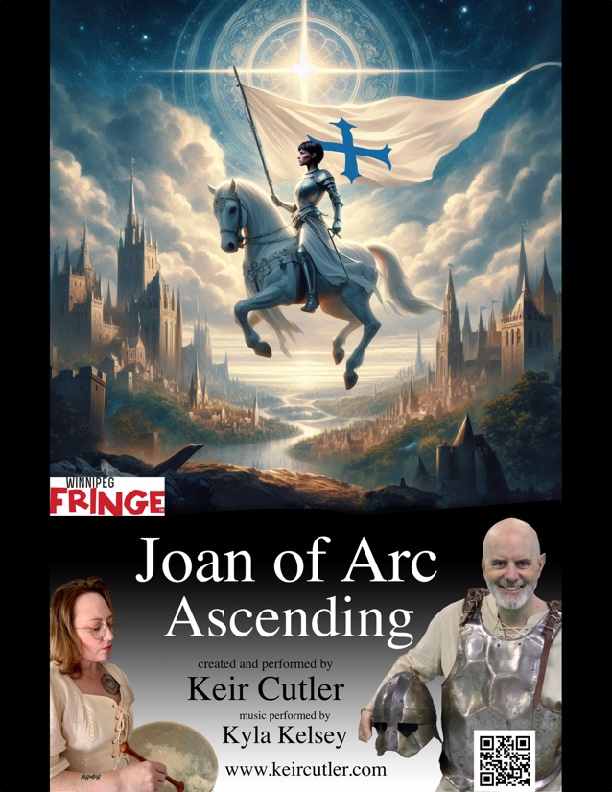

Keir Cutler: JOAN OF ARC ASCENDING

“Joan of Arc is easily and by far the most extraordinary person the human race has ever produced.” Mark Twain

A new work, created and performed by Keir Cutler. For his 17th presentation at the Winnipeg Fringe Festival, Keir Cutler will perform a captivating world premiere show that invites audiences to rediscover the legendary true story of Joan of Arc. His portrayal defies contemporary doubt and invites wonder, probing Joan’s life through the lens of the miraculous.

The show also features live music by University of Manitoba musicology grad student, Manitoban Kyla Kelsey, and onstage original art work by Michael Cutler, Keir’s brother.

Montrealer Keir Cutler has been called “a masterful entertainer,” (Winnipeg Free Press) “a marvel to watch,” (Toronto Sun) and “a phenomenal performer!” (winnipegonstage.com)

Keir has a PhD in theatre from Wayne State University in Detroit, a playwriting diploma from the National Theatre School of Canada, He is the writer/performer of twelve solo works, and the author of multiple plays and books. He is a veteran of more than 100 fringe and theatre festivals.

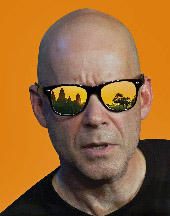

Jem Rolls: THE KID WAS A SPY

The true story of Ted Hall.

Brooklyn, October 1944. The youngest physicist in the Manhattan project asks himself a very big question.

Will the world be safer after the war if he gives the bomb to the Russians?

And he does.

• Events take place in the world of OPPENHEIMER

• Jem Rolls has done more Fringes than anyone else on earth … [Except Alex Dallas.]

This show takes the audience from the murky world of spies to the idyll of young love. From teenage friendship to stark treason. From big decision to deep consequence. From high idealism to extreme cynicism. And from pure science to Hiroshima and the electric chair.

The show also brings in the stories of Klaus Fuchs, the greatest atomic spy; and Ethel Rosenberg, executed yet innocent.

THE KID WAS A SPY is the third in Jem Rolls’ series of shows about Jewish Nuclear Physicists no-one has ever heard of.

Which is, to put it mildly, the niche of a niche of a niche.

One only realistically enterable in the unique world of Canadian Fringe.

Which most Canadians do not realize is unique.

The first two shows in the series, THE INVENTOR OF ALL THINGS, about Leo Szilard, and THE WALK IN THE SNOW, about Lise Meitner, have each seen multiple sellouts and five star

reviews.

Randy Ross: TALES OF A RELUCTANT WORLD TRAVELER

Novelist and Fringe veteran Randy Ross provides an unflinching look at world travel and the writing life, while bringing new meaning to suffering for one’s art.

The Show: Tales of a Reluctant World Traveler is the story of how a Boston homebody turned a rotten, solo trip around the globe into a comedy novel and an acclaimed one-man play. The show is part travelogue, part performance, and part off-kilter author talk. A must-see for book lovers, writers, travelers, whiners, kvetches, and misanthropes. Please note: The show carries content warnings for gooey diseases, heartless publishers, and liquor made from cobras.

The Performer: Randy Ross is a Boston-area novelist and story-teller. He has performed at more 30 fringe festivals around the U.S., Canada, and in Edinburgh, Scotland. In 2007, Ross took a four-month, solo trip around the world and learned to say in three languages: “Speak English?” “Got Pepto-Bismol?” and “Is this the evacuation helicopter?” His shows and novel were inspired by the trip.

Adam Schwartz (producer): NEUROHILARITY EXPOSED

SHOWCASING INTERSECTIONAL COMEDY AT FRINGE FEST

Neuodivergent Cast of Winnipeg Comics Includes Indigenous, 2SLGBTQ+, Asian, and Other Perspectives

About Neurohilarity

Neurohilarity is a non-profit organization created to give neurodivergent artists a stage to share their stories and promote a more positive representation of neurodiversity.

It was started in 2022 by Adam Schwartz.

Award-winning comedy showcase Neurohilarity is back again at the Winnipeg Fringe Festival, but this year, it’s taking its mandate of amplifying underrepresented voices one step further with an ultra-diverse cast that highlights the intersectionality of neurodivergence.

This is the third year that Autistic comedian and producer Adam Schwartz has brought Neurohilarity to the Winnipeg Fringe Festival, and he’s excited to show how neurodivergent and disability-centric comedy can look so many different ways. At the crossroads of disability, race, gender, and sexuality, there is no shortage of weird things to laugh about.

The stellar lineup includes a few familiar faces from last year’s festival run—which earned the Jenny Revue Mind and Body: The Health and Wellness Award. Returning performers include Danielle Kayahara, whom the Winnipeg Free Press called “self-deprecating, sympathetic and downright adorable as she describes her compulsion to ‘overthink everything’ while pausing to second-guess her comments.”

This year’s newcomers to the Neurohilarity stage include up-and-comer Kaitlynn Brightnose (IndigE-Girl Comedy), and comedy veteran Rollin Penner (Yuk Yuk’s, CBC, Winnipeg Comedy Festival). The show will be hosted by ADHD dynamo Carole Cunningham, a regular host at Yuk Yuk’s Comedy Club who is often accompanied onstage by her chihuahua, Karen.

Willow Rosenberg: A LESBIAN IN A BEAR STORE

From new playwright Willow Rosenberg, comes a deeply personal, funny, and emotional journey through her mom’s Beanie Baby collection. “A Lesbian in a Bear Store” has something for everyone. Including adorable animals, all of the gay, some of the Jewish, and a special appearance by one of the most angsty teenage poems you’

Tickets are $12 in advance, or bring your favourite plushie for discounted $10 tickets at the door.

Jay Stoller: UBUNTU

Visiting musicians from South Africa join local drumming group

Local African drummer Jay Stoller is thrilled to announce the upcoming production of Ubuntu, an interactive performance that brings to life the power of working together as a community. This exciting show is set to take place at the Winnipeg Fringe Festival from July 18 – 26.

Ubuntu will be a highly unique production at this year’s Fringe. Not only is it a collaboration of musicians from Winnipeg and South Africa, the audience will be fully participating in the show: everyone in attendance will have an African djembe drum to play along with the musicians on stage. Yes, there will be 200+ drums in the theatre!

Jay and his local drum group members are excited to welcome drummer extraordinaire Tiny Modise and vocalist Nosipho Mtotoba, both from Soweto, South Africa.

Ubuntu is a Southern African philosophy that says ‘I am because we are’. Through the interactive show, the power of drumming together will be demonstrated as Winnipeg’s Fringe community makes amazing music together.

(And yes, we asked Jay whether he’s related to any Stollers in Winnipeg, to which he replied, “Yes, we do have some family with the same last name, although probably second cousins.”)

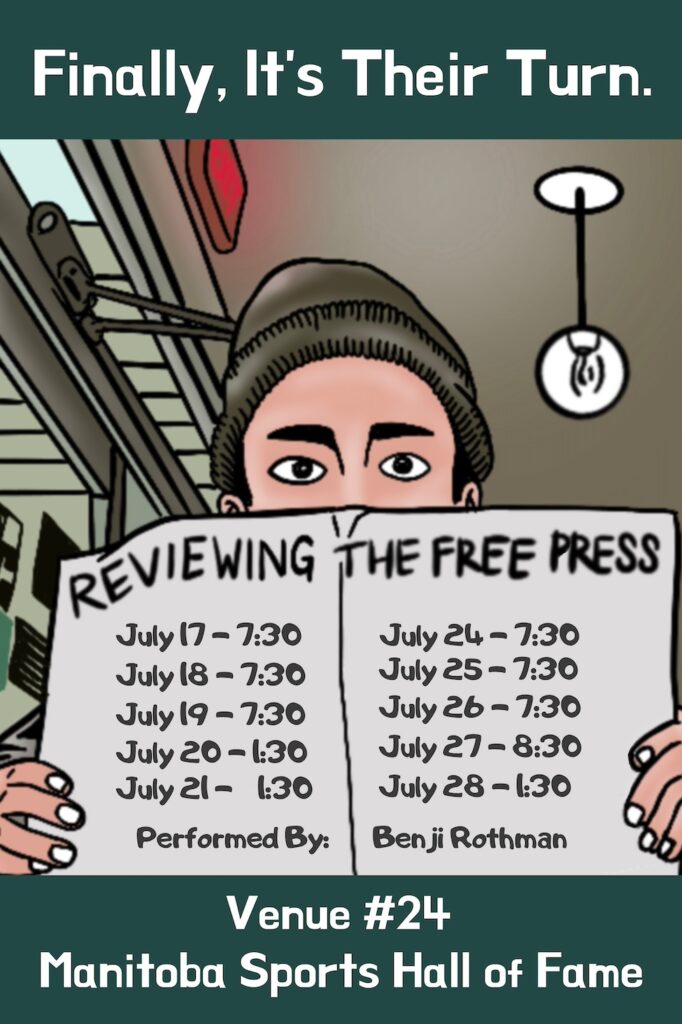

Benji Rothman: REVIEWING THE FREE PRESS

The Winnipeg Free Press has run amok, reviewing each and every Fringe show for decades, completely unabated and without recourse. Well now, it’s their turn.

In this brand new show, Benji Rothman takes the Winnipeg Free Press to task, diving deep into their history and casting judgement on their performance as Manitoba’s leading news outlet.

Local News

2026 Winnipeg Limmud to offer a smorgasbord of diverse speakers

By MYRON LOVE There are many facets to the study of Judaism and the Jewish people. The focus may be religious or cultural, historical or Israel-oriented – and Winnipeg’s annual Limmud Festival for Jewish Learning has always striven to cover as many angles as possible.

This year’s Limmud program (now in its 16th year) – scheduled for Sunday, March 15 – is following in that path with a diverse group of presenters.

Limmud’s current co-ordinator, Raya Margulets, reports that all of our community’s rabbis – including Rabbi Yossi Benarroch (who lives most of the year in Israel) – will be among the presenters. Topics to be covered by local experts encompass midrash, Jewish identity, antisemitism, conversion, biblical archaeology, textiles, parenting, art, and more.

But it wouldn’t be Limmud without interesting input from out of town personalities.

Perhaps the most prominent of the guest speakers who are confirmed is Yaron Deckel, an Israeli journalist and broadcaster who is currently the Jewish Agency’s Regional Director for Canada. According to a biography provided by Margulets, Deckel is a highly respected Israeli journalist widely known for his insight into Israeli politics, media, and society. Between 2002 and 2007, Yaron served as Washington Bureau Chief for Israeli Public Television. In that role, he covered U.S.–Israel relations and American politics, also interviewed three U.S. presidents: George W. Bush, Bill Clinton, and Jimmy Carter. As well, Deckel produced two acclaimed documentaries: “The Israelis” (about the lives of Israelis in North America), and “Jewish Identity in North America.”

From 2012 to 2017, he served as Editor-in-Chief and CEO of Galei Tzahal (IDF Radio), Israel’s leading national public radio station. He also hosted a prime-time weekly political show.

As a senior political correspondent and commentator for Israeli TV and radio, Yaron has covered the past 14 Israeli election campaigns and maintained close relationships with top political and military leaders in Israel. He conducted the last interview with Prime Minister Yitzhak Rabin—just 10 minutes before his assassination.

Decker is slated to do two presentations. In the morning, he will be speaking about the crossroads that Israel finds in the Middle East currently and what the challenges and possibilities may be.

In the afternoon, his subject will be “Israel after October 7 and the Iran War “ and what may lie ahead.

Also coming in from Toronto are Atarah Derrick, Achiya Klein, and Yahav Barnea.

Barnea is an Israeli-Canadian educator and community builder based in Toronto, with over a decade of experience working in Jewish and Israeli education, engagement, and community development.

Originally from Kibbutz Shomrat in Israel’s Western Galilee, Barnea’s outlook on life has been shaped by kibbutz values and her involvement in the Hashomer Hatza’ir youth movement.

She currently serves as the North America Regional Program Manager for the World Zionist Organization’s Department of Irgoon and Israelis Abroad, where she leads initiatives that strengthen connection, leadership, and communal life among Israelis living outside of Israel..

Barnea holds a Master of Education in Adult Education and Community Development, with a focus on intentional communities, as well as a Bachelor of Education specializing in Democratic Education, meaningful, values-based communities.

Her presentation will be titeld “A Kibbutz in the City – Intentional Communities and Immigration.”

Atarah Derrick is the executive director of the Israel Guide Dog Center for the Blind, an organization that is dedicated to improving the quality of life of visually impaired Israelis. The charity, the only internationally accredited guide dog program in Israel, was founded in 1991, and today serves Israel’s 24,000 blind and visually impaired citizens.

Achiya Klein is one of the guide dog centre’s beneficiaries. The Israeli veteran was an officer in the IDF combat engineering corps’ elite ‘Yahalom’ unit. In 2013, while on a sensitive mission to disable a tunnel in Gaza, an improvised explosive device was detonated, severely injuring Achiya and robbing him of his vision.

He has been a guide dog client since 2015.

Klein has not allowed his disability to limit his abilities. He competed for the Israeli national team at the Paralympic rowing championship in the Tokyo 2021 Olympics.

He also earned a Masters Degree in the Lauder School of Government, Diplomacy and Strategy in Counter Terrorism and Homeland Security,at IDC Herzliya.

Klein is married and a father to two boys.

Coming back for a second successive year is Dan Ronis from Saskatoon. A plant breeder and geneticist, Ronis has taken a quite different approach to studying Torah. He has sought out the help of a medium to discern the back stories of Biblical figures.

For readers who may be unsure of who or what a medium is, think Theresa Caputo of television fame. Mediums claim to be able to converse with those who have passed on through a spirit guide. While many may be skeptical, there are also many believers.

Last year Ronis focused on women who played a prominent role in the Torah. This year, he will be discussing the “untold story” of Adam and Eve.

Readers who may be interested in attending Limmud 2026 can go online at limmudwinnipeg.org to register.

Local News

Second annual “Taste of Limmud” a rousing success

By MYRON LOVE “A Taste of Limmud” returned for a second go-round on Thursday, February 19, and I have to commend both Raya Margulets, Winnipeg Limmud’s co-ordinator, as well as the Shaarey Zedek Synagogue’s catering department, for an outstanding culinary experience delivered with flawless efficiency.

“Tonight’s Taste of Limmud showcases our diversity as a community and our unity as we come together to break bread,” observed Rena Secter Elbaze, Shaarey Zedek’s executive director, just prior to leading the guests in hamotzi.

The evening featured a sampling of Jewish staple dishes representing Jewish life in six different regions where Jews had settled over the centuries. The choice of dishes also reflected how diversified our Jewish community has become over the past 25 years.

In her opening remarks, Margulets welcomed her 130 guests. “After last year’s success,” she said many of you asked us to bring it back, and we’re delighted to do so, so welcome again. Today’s celebration is all about sharing stories, connections, and flavours, and it is brought to you in partnership with Congregation Shaarey Zedek and with the support of the Jewish Foundation of Manitoba.

“We would like to take a moment and express our heartfelt gratitude to Congregation Shaarey Zedek for their amazing partnership, to Joel, the Head Chef at Shaarey Zedek, and his fantastic staff for their contributions, and to all the volunteers who made tonight possible,” Margulets said.

“Thank you all for joining us tonight. Savour the flavours, the stories, and the connections as we celebrate the richness of Jewish cuisine and community together.

“Whether you’re returning or attending for the first time,” she continued, “we’re excited to stir up a wonderful evening with old and new friends. Some of you may have realized it already, but the name Taste of Limmud has a double meaning. While, yes, this event is all about taste and sampling Jewish flavours from around the world, it is also a tiny glimpse, in other words, a taste, into our established annual Limmud Festival.”

Limmud, she explained – the Hebrew word for “learning”, is a volunteer-run organization that celebrates Jewish learning, thought, and culture. It’s a conference where participants have a choice of dozens of sessions led by rabbis, scholars, artists, authors, and community members. At Limmud, everyone can be a teacher and a student, in other words, more fitting with tonight’s theme, everyone has something to add to the recipe.

Margulets then introduced the “talented cooks from our very own community who prepared the dishes”: Mazi Frank, who presented a “delicious” Mussakah, a Turkish classic; Adriana Vegh-Levy and Karina Izbizky who brought a “tasty” Pletzalej, a type of bread that the forebears of today’s Argenitnian Jewish community brought with them from Poland; Karen Ackerman, with a special Hard Honey Cake; Naama Samphir, who presented a tasty Yemenite Hawaij soup (and that’s right – Hawaij – not Hawaii; Hawaij is Iraqi); Kseniya Revzin ,sharing a rich Kubbete, a savory pie from the Crimean Karaites; and Ruth Harari, (who wasn’t able to join her sister cooks) who had prepared Mujadara, a flavourful lentil-and-rice dish from Aleppo, Syria.

“We would like to take a moment and express our heartfelt gratitude to Congregation Shaarey Zedek for their amazing partnership, to Joel, the Head Chef at Shaarey Zedek, and his fantastic staff for their contributions, and to all the volunteers who made tonight possible,” Raya Margulets concluded.

“Thank you all for joining us tonight. Savour the flavours, the stories, and the connections as we celebrate the richness of Jewish cuisine and community together.”

The six samplings were dished out – one at a time – in either small paper plates or cups with the paper removed after each tasting.

The first recipe to be presented was pletzalej onion bread. As was the pattern for each tasting, the first food presented was preceded by a brief overview of the history of Argentina’s Jewish community and its connection with its local contributor, followed by a plezelaj bun with a piece of meat inside .

Next up was a taste of Hawaij soup, a Shabbat and Yom Tov staple of Yemen’s former centuries-old Jewish community, most of whom are now in Israel. The soup included piecesof chicken, potatoes, onions, carrots, tomato and several spices. Hawaij is a spice mixture consisting of cumin, black pepper, turmeric and cardamom.

Mussakah comes from Turkey – also a homeland for Jews for hundreds of years. It is a mixture of layered eggplant, beef, savoury tomato sauce and spices and is typically served with rice or a piece of bread.

Mujadara is a product of the ancient Syrian city of Aleppo, one of the world’s oldest cities and formerly home for thousands of years to a once thriving Jewish community. The recipe calls for lentils, basmati rice, onions and spices.

Kubbete is a puff pastry originally from Crimea, where the local Jewish community picked it up from the surrounding Tatar population. The pastry is filled with beef (as was the case that evening) or lamb, onions, potatoes and peppercorn, with paprika added for taste.

The last item on the menu was hard honey cake. “This was my baba’s recipem which she brought with her from Ukraine in the 1920s,” noted Karen Ackerman. “Jews like my baba (Chava Portnoy) have lived in Ukraine for over 1,000 years and they used the local buckwheat honey in their honey cake.

“I am honoured to be able to share this recipe with you,” she said.

All the presenters spoke of how the recipes that had been passed down through the generations connected them with home and family and memories of their babas.

I once had a cousin who, after enjoying a hearty meal, would say: “Good Sample. When do we eat? Well, after the sampling, it really was time for a late supper – the main course – and it was a perfect way to end the evening feasting on pita filled with veggies, falafel balls and humus and French fries with a choice of coffee cake or chocolate cake for dessert.

I ‘m really looking forward to next year’s “Taste of Limmud”.

Local News

New kosher caterer providing traditional Israeli foods for Winnipeg palates

By MYRON LOVE The Israeli community in Winnipeg continues to grow and enrich our community. Among the most recent arrivals are Maxim and Olga Markov – along with their children, who settled here less than two years ago. What the Markovs are contributing to our community is a new kosher catering operation – Bravo Good Food – that specializes in traditional Israeli fare.

The senior Markovs are both originally from Ukraine. They came with their families in the early 1990s when they were young teenagers. For the last several years before moving to Winnipeg, they lived in Afula in north central Israel.

After their arrival in Winnipeg, Olga worked for a time in the Chabad kitchen; Yural still works in the Chabad daycare – while Maxim took a job with an HVAC company.

Maxim’s passion however, and his life’s work has been in food preparation. He points out that he worked in the business for 17 years in Israel. In the early part of his career, he was head chef in a dairy restaurant. He was also a cook in wedding halls preparing food for as many as 1,000 guests.

In more recent years, he worked in a private hospital kitchen where, he notes, he gained experience with dietary menus and healthy food options.

“What we do at Bravo,” he says, “is provide our clientele with the authentic taste of the Middle East. We cook traditional dishes, using only fresh ingredients, with our own original recipes.”

Operating out of the Adas Yeshurun-Herzlia kitchen, Bravo’s menu (which readers can view on its website – bravogoodfood.com) features such well known Israeli items as falafel balls and humus, mini shislek (with chicken) on skewers, beef kebabs on cinnamon sticks, and friend eggplant with tahini.

But there is much more to choose from.

Start with salads.

You can choose from coleslaw, purple cabbage salad, beet salad with pears, celery and parsley, mushroom salad, and green herb salad.

Main course options include beef meatballs and tomato sauce with a trio of fish dishes – salmon, Moroccan fish, and custom fried fish. Also available are a broccoli casserole, pasta, and spaghetti.

Bravo also offers a corporate menu featuring a choice of continental or executive breakfast, full breakfast buffet or a buffet of mini sandwiches – and an events menu.

Maxim adds that Bravo offers vegetarian, vegan and gluten free options.

Olga notes that individual dishes or baking can be ready for the next day. “If it’s a small event like a family dinner, we need at least three days in advance, provided the date is available,” she says. “If it’s a large event – then we need at least a week in advance notice.”

“We are not just providing food,” Maxim says. “We are creating an atmosphere. Our catering makes your event unforgettable through taste, freshness and hospitality.”