Local News

JNF Canada loses appeal to retain charitable status—days before a deadline to disburse remaining assets

By ELLEN BESSNER (Canadian Jewish News) November 10, 2024 Jewish National Fund of Canada has lost its first major legal battle to stop the tax department’s revocation of its charitable status, which came into effect three months ago.

Late in the afternoon of Friday, Nov. 8, a Federal Court judge dismissed JNF Canada’s application for a judicial review—and the judge also dismissed a request for an injunction to force the Canada Revenue Agency (CRA) to remove the official revocation notice that was printed in the Canada Gazette on Aug. 10.

Printing that notice triggered a series of steps JNF Canada was ordered to take under the Income Tax Act rules regarding revoked charities.

Firstly, it could no longer issue tax receipts for charitable donations made by Canadian supporters to fund a portfolio of social service projects in Israel.

Secondly, it was also required to wind down operations that date back to 1967—during which time the charity fundraised in Canada to support tree planting and other work in Israel. The CRA gives revoked charities the option of trying to disperse its remaining assets (JNF Canada’s asserts were stated as about $31 million in 2023) by giving them to another approved charity.

JNF Canada was also instructed to file a special form and remit a cheque to the tax department to pay what is known as a revocation tax. This amount is 100 percent of its remaining holdings after calculating the fair market value of the assets and money the charity had left, once all debts are paid. (The amount could be further reduced should the assets be legally given to a qualified donee.)

The deadline for that tax payment is Nov. 13, according to a letter the CRA sent to the now-former charity in mid-August.

The judge’s ruling came 24 hours after JNF Canada lawyers argued their case via video conference on Nov. 7, alongside lawyers for the Department of Justice, representing the Minister of National Revenue.

JNF Canada asked for a motion to reverse the publication of the Aug. 10 notice, which would save the organization from forced closure.

In her 17-page written decision, Justice Allyson Whyte Nowak explained why she dismissed the appeal. She ruled that her court was the wrong place for the charity to try to seek relief, because the Income Tax Act specifically designated the Federal Court of Appeal as the correct venue for such cases. Earlier court cases have established this fact, she wrote.

Justice Whyte Nowak did acknowledge that JNF Canada’s lawyers are raising a “novel issue,” but said it must be left up to the Federal Court of Appeal—or even Parliament—to correct any gaps in the inner workings of the CRA’s revocation process.

The day before the judge’s decision was released, JNF Canada issued a statement about how it will “never stop fighting for our community and our mission.”

“We stood our ground, and our lawyer made a compelling case in our defense [sic], arguing for procedural fairness, legitimate expectations, and the rule of law,” JNF Canada CEO Lance Davis and the revoked charity’s president Nathan Disenhouse announced together on Nov. 7.

JNF Canada has not commented publicly since learning it had lost this legal appeal. A video conference briefing for supporters has been scheduled for 8 p.m. tonight (Nov. 10), in the evening when JNF Canada’s annual Negev Dinner gala for supporters had been scheduled in Toronto, before its cancellation.

Rally for Humanity, a Sunday afternoon event at Nathan Phillips Square in downtown Toronto—which will feature speakers from Muslim, Hindu, Christian and Catholic organizations in alliance with 13 different Jewish community groups—also lists JNF Canada as a sponsor.

‘Nearly impossible to resurrect the charity’: CFO

JNF Canada’s chief financial officer Edit Rosenstein, in an affidavit submitted to the court on Oct. 30, outlined the impact of the Aug. 10 revocation.

“As we will not have the necessary funds, a total of 31 charitable projects will need to be stopped, which will have a huge impact on the vulnerable populations we serve.”

The affidavit claimed 48 employees would be terminated, with JNF Canada obliged to make severance payments. Four contractors will have their contracts terminated, with JNF Canada liable for the breaches. And other vendor contracts will also be terminated “resulting in penalties to JNF and exposure to further claims for breach of contract,” explained Rosenstein.

“If JNF is forced to shut down, I believe it will be nearly impossible to resurrect the organization, even if it is successful in its appeal before the Federal Court of Appeal,” Rosenstein’s affidavit said.

A separate court document from JNF Canada’s legal team added another consequence should the Federal Court not reverse the CRA’s revocation. The court was told it will result in further irreparable harm such as “the Applicant losing its chance to salvage its reputation.”

CRA explains the revocation and next steps

The CRA told The CJN on Friday it does not normally comment on specific court cases involving taxpayers, due to confidentiality clauses in the Income Tax Act. However, an email from spokesperson Nina Ioussoupova clarified why revoked charities must pay a revocation tax.

“The purpose of this tax is to ensure that charitable property is applied to charitable use,” she said, adding that the remaining assets include all income and gifts made to a revoked charity during its wind-down period.

In the JNF Canada case, the CEO Lance Davis told The CJN in an earlier interview in August that the charity continued to receive donations from supporters after the revocation, even though tax receipts could not be issued.

Two months ago, JNF Canada launched a public relations effort to lobby Prime Minister Justin Trudeau and national revenue minister Marie Claude-Bibeau to intervene on the file and reverse the revocation. Supporters were asked to donate money that would go to plant trees in areas of northern Israel where Hezbollah rocket attacks have burned forests.

The revoked charity vowed to send thank-you cards to the two federal politicians, which would advise them of trees being planted in their names—and also urging them to support JNF Canada’s cause.

How did JNF Canada end up here?

July 2024 brought the first public word from JNF Canada of its decade-long dispute with the tax agency. JNF Canada announced that it had been “blindsided” by the CRA decision it would be moving to shut the charity down, after a confidential 2014 CRA audit painted a harsh picture of its non-compliance with tax rules. JNF Canada vowed to fight any revocation through the courts, and immediately filed an appeal July 24, to the Federal Court of Appeal. A parallel appeal was filed to the Federal Court soon after.

The agency’s findings in the audit ranged from where the charity’s books and records had been kept in 2011 and 2012 (mostly in Israel, which was a no-no), to what language the paperwork and receipts were kept in (mostly in Hebrew, which is not illegal but makes work difficult for auditors), to the conclusion that JNF Canada’s founding charitable purposes of relieving poverty in Israel by paying the salaries of indigent labourers, were not being met.

Another major issue was that because of missing paperwork and superficial oversight on the ground in Israel, it was felt the Montreal-based JNF Canada hadn’t been in control of or directing its own operations overseas. CRA believed the charity was acting merely as a funnel of money to the Jerusalem-based agency, the Jewish National Fund/Keren Kayemeth LeIsrael, which ran the projects.

A further red flag for auditors were several projects in 2011 and 2012 that benefited the Israel Defence Forces, such as construction of buildings and green areas on IDF military bases. Registered charities are not permitted to support a foreign military financially, under Canadian laws. Some other projects were located in the West Bank and on other disputed land, the CRA found, something which Canada’s foreign policy frowns on.

JNF Canada disagreed with the CRA’s view of that last category—and still does. But in 2019, the charity assured the public that it had stopped funding both kinds of projects after 2016, in order to comply with CRA requirements in good faith.

The CRA officially informed the charity in August 2019 that it still wasn’t satisfied with JNF Canada’s efforts to come into compliance, and intended to revoke its charitable status.

Three months later, in November 2019, JNF Canada filed an objection with the CRA’s in-house appeals branch. That move put the revocation process on hold until the objection was reviewed.

The review by the agency’s appeal team took about four years.

In documents submitted to the Federal Court as part of the latest hearing, the CRA acknowledged the lengthy time it took. However, it blames the delay partly on “disruptions” caused by the COVID-19 pandemic, when in person meetings were cancelled, and when many federal workers switched to remote offices and worked from home. But the CRA also contends it was JNF Canada’s fault the review was held up when the charity filed an Access to Information request seeking confidential CRA documents about this dispute, which caused more delays.

The CRA finished its review of JNF Canada’s objection in 2023, and told the charity it still was planning to proceed with revocation of its charitable status due to the “repeated and serious non-compliance” with the Income Tax Act.

The now-revoked charity has publicly slammed the tax agency for repeatedly refusing to meet with them during the process to discuss concrete suggestions for improving things, such as adopting a new, acceptable charitable purpose. JNF’s Canada’s CEO Lance Davis told The CJN Daily this August that his team has made many internal changes in recent years to come into compliance, and as a result were now “running a tight ship.”

On June 26, 2024, the charity received a further confirmation letter of the CRA’s 2019 Notice of Intent to Revoke.

JNF Canada decried the decision, blamed the department for being procedurally unfair, even biased, and accused tax officials of caving in to anti-Israel activist groups—such as Independent Jewish Voices—which have long been pressuring the government to shut pro-Israel charities such as JNF Canada down. JNF Canada officials have since pointed to internal CRA documents it obtained showing a 2017 meeting between anti-Israel activists and a senior director with the revenue agency.

Procedural fairness disputed by JNF Canada lawyers

JNF Canada lawyers Adam Aptowitzer and Elizbeth Egberts of KPMG told the court this past Thursday that the CRA had given JNF Canada written assurances—dating back as far back as 2019—it would not pull the trigger by having the revocation notice published yet in the Canada Gazette.

Aptowitzer argued this assurance included a promise the CRA would wait until any objections or court appeals were dealt with. He told the court there was a long-standing internal CRA policy that gave audited charities as long as 90 days after the revocation notice was sent out to file an appeal in the Federal Court of Appeal before publication of the revocation.

Aptowitzer told the court that JNF Canada felt the 90-day policy used in 2019 was actually a “commitment” that “had created a legitimate expectation” of how things were going to be handled in 2024.

The lawyers submitted copies of an internal CRA briefing note from May 2024 stating no publication of the revocation notice would happen if JNF managed to submit its appeal in time to the Federal Court of Appeal, which it did on July 24, 2024.

Nevertheless, the CRA went ahead and had the revocation notice published on Aug. 10, which was 30 days after that final confirmation letter was sent out.

JNF Canada also felt it should have been clearly informed that CRA 2019 policy had been changed, since had it been informed about the shorter deadline, the charity would likely have gone much earlier to the Federal Court of Appeal to try to block the publication, before it was too late.

For its part, CRA lawyer Linsey Rains told the court JNF Canada should have been smart enough to figure out the previous, 90-day timeline process wasn’t guaranteed any longer.

“[JNF Canada] is a sophisticated organization and there is sophisticated counsel as well,” Rains said Thursday.

She reminded the judge that under the tax code, the CRA doesn’t have to wait for the final outcome of legal appeals to be exhausted through the courts, and the CRA can publish a revocation in the Canada Gazette after 30 days, as was the case here.

Lawyers for the government argued the tax department was acting to protect the tax base, and wasn’t required to give JNF Canada its own personal treatment and notice.

“Counsel… was told that [the 90-day waiting period in place back in 2019] assurance wasn’t necessarily guaranteed this time around,” said Rains. “The policy changed and it can change and the reason it changed is… the Minister’s statutory duty to publish the revocation.”

While the 90-day policy was followed for many revocation cases before and since 2019-2020, the court heard that, in the last few years, the agency has moved to the much speedier revocation: 30 days.

Moves made to protect taxpayers: CRA

“The CRA now has a risk-based approach towards compliance in the charitable sector,” according to senior CRA official Melissa Shaughnessy in a written affidavit submitted to the court in advance of the hearing.

She said it will cost the Canadian government $4.6 billion in 2024 to give tax deductions to people and corporations who donate money to charities. So, the CRA wants to make sure the charitable sector operates according to the law. That is why it moved more quickly on the JNF Canada case.

“The decision to proceed with revocation now, despite the Organization’s appeal with the Federal Court of Appeal, is to stop the continued flow of tax-receipted donations going overseas to fund the non-charitable activities of a non-charitable third party,” Shaughnessy wrote, referring to the JNF’s partner in Israel.

“The Organization has publicly stated that it will continue receipting donations and distributing funds. Awaiting the conclusion of the legal appeal process could take over a year which would enable the Organization to continue to send millions of dollars in tax-receipted donations to fund foreign non-charitable programs were it not revoked.”

While the CRA acknowledged it had received assurances from JNF Canada that funds were not being used in IDF projects or the West Bank since 2016, the tax agency pointed out the charity didn’t furnish proof to back up this promise.

‘Irreparable harm’ due to revocation

As part of its case claiming irreparable harm from revocation, JNF Canada argued in court that Israeli children with cancer are being jeopardized by the CRA’s revocation. Aptowitzer, one of the JNF Canada lawyers, said the organization promised to help fund the renovation of a building on the grounds of Sheba Medical Centre’s Tel ha-Shomer site near Tel Aviv, where families of young cancer patients are housed while their kids are undergoing lengthy oncology treatments.

The facility is operated by the Israel-based Rachashei Lev charity. Since 2007, the building has offered 20 apartments to temporarily house the families. Aptowizer told the court JNF Canada made an obligation to fund this renovation project.

“The facility is currently turning away sick children,” he said, and the court was told an estimated ten patients have had to be turned away to date, due to the renovations underway. “There is harm to unknown people yet to be diagnosed.”JNF Canada committed $292,500 to fund the renovations, according to the affidavit submitted by CFO Edit Rosenstein.

According to the JNF Canada’s website, the reason the children’s house is being renovated is because since Oct. 7, 2023, the hospital has now commandeered the 20 apartments also to accommodate an influx of Israeli survivors’ families, including next of kin of severely wounded Israeli soldiers who were injured in battle.

“With the increased demand from families of wounded soldiers, they need to quickly renovate and split the current apartments into two thereby doubling the number of families served for a total of 40 apartments,” explains JNF Canada on its website. “Each suite will consist of a bedroom, a kitchenette, private bathroom and a balcony. Renovations include new flooring, electrical, paint, plumbing, replacement of doors and installation of more countertops and sinks.”

JNF Canada’s website adds that donations are required before the Canadian project can send money.

Donations almost completely stopped: CFO

In her affidavit, Rosenstein revealed that after her charity’s status was revoked in August this year, JNF hasn’t been receiving the expected flow of donations.

“As a result, donations to JNF [Canada] have almost completely stopped,” Rosenstein said. “Without the ability to raise funds, or draw on assets, JNF will have no choice but to cease its charitable operations and terminate the employment of its employees.”

CRA lawyer Linsey Rains told the court she wondered about JNF Canada’s claim of irreparable harm and argued it should not factor into the judge’s decision.

Firstly, Rains asked the court why payments couldn’t be sent to the hospital project, regardless of the revocation. She also suspected JNF Canada wasn’t the only organization donating to this Israel-based children’s house project. Rachashei Lev has several fundraising chapters outside of Israel—including in Teaneck, New Jersey, and London, England.

JNF Canada annulment request explained

Even after JNF Canada received the recent June 26 confirmation that its charitable status was going to be revoked, the charity proposed what CEO Lance Davis has previously called an “off-ramp.”

Lawyers asked the CRA on July 12 to pause the revocation, and instead act to annul JNF Canada’s 57-year status as a registered charity.

An annulment would help avoid paying the revocation tax, and would also allow JNF Canada donors to keep the tax receipts they’d been issued prior to the granting of the annulment.

In court, CRA lawyer Linsey Rains told the judge the federal revenue minister didn’t reject the idea, but rather put a pin on the suggestion while the current dispute over revocation plays out in the courts.

The head of the CRA’s charity directorate, Sharmila Khare, wrote on July 24 to David Stephens—another lawyer representing JNF Canada—confirming that the annulment request would be “held in abeyance.”

Rains suggested JNF Canada tried to keep its non-compliance problems out of the public eye. She told the court JNF Canada wanted to “keep it quiet” and “close to their chest” hoping instead, they could get an annulment, and avoid paying the revocation tax in the process.

Briefing notes prepared by CRA staff in April and May 2024 which were submitted to the Federal Court ahead of the hearing show JNF Canada being very concerned about the dispute being made public. The CRA notes also show the agency itself expected to receive additional attention because of its timing.

“Consideration should be given to raising the risk level on this to high, when and if an appeal is filed at the FCA,” the CRA briefing document said. “The Organization is a prominent charity with overseas operations in Israel and given the current Israel/Palestine conflict, this revocation could be contentious for the CRA. There has been recent media attention on charities potentially funding activities related to the Israeli-Palestinian conflict.”

The authors of the briefing note cited nine published articles, including one published by The Canadian Jewish News last October. However, five of the pieces were negative coverage citing anti-Israel sources— including one penned by Yves Engler, a prominent anti-Zionist from Montreal. A cited story from the Washington Report on Middle East Affairs begins by saying the U.S. branch of Jewish National Fund supported “Israel’s occupation by financing illegal settlement building on Palestinian land.”

What’s next for JNF Canada?

Right now, at least two significant questions remain unanswered.

Have any JNF Canada funds been disbursed to new charities, who could then legally send the money to JNF’s partners in Israel?

And, can the Nov. 13 filing deadline for the revocation tax be met?

JNF Canada’s communications have emphasized it will be left with no funds to pay for court challenges to fight what it feels has been unfair treatment by the CRA.

Despite losing the first court case on Nov. 8, there is still a second appeal in the pipeline—this one was filed with the Federal Court of Appeal on July 24. However, court documents show that any Federal Court of Appeal hearing won’t likely be scheduled any earlier than May 20, 2025.

There could also be other legal avenues, such as an appeal to the Supreme Court of Canada—and also to the federal Tax Court.

JNF Canada has two major events scheduled in the coming week, before the Nov. 13 payment deadline. It’s not known if they will be impacted by the appeal being dismissed.

The annual Negev Dinner in Toronto, honouring philanthropist Jeff Rubenstein, was originally scheduled for tonight (Sunday, Nov. 10) before JNF Canada decided to cancel it in September—former Israeli prime minister Naftali Bennett had been booked as keynote speaker.

But an event was subsequently scheduled for Nov. 11 featuring a panel discussion on the aftermath of the U.S. presidential election as it relates to Israel, featuring former IDF spokesperson Jonathan Conricus and New York Times columnist Bret Stephens, with journalist Jonathan Kay serving as moderator.

Two additional JNF Canada supporter events in Toronto remain scheduled for Nov. 21 and Dec. 2.

JNF Canada did not cancel its Negev Gala event in Ottawa, scheduled for Nov. 13, honouring Lisa MacLeod, the outgoing Ontario PC MPP for Nepean. Political consultant Warren Kinsella was later added as keynote speaker.

Proceeds from the Ottawa dinner are going to build a resilience centre for people living with PTSD in Sderot, with charitable donations administered by the Israel Magen Fund of Canada, rather than JNF Canada.

Local News

Thank you to the community from the Chesed Shel Emes

We’re delighted to share a major milestone in our Capital Campaign, “Building on our Tradition.” Launched in November 2018, this campaign aimed to replace our outdated facility with a modern space tailored to our unique needs. Our new building is designed with ritual at its core, featuring ample preparation space, Shomer space, and storage, creating a warm and welcoming environment for our community during times of need.

We’re grateful to the nearly 1,000 generous donors who contributed over $4 million towards our new facility. A $750,000 mortgage will be retired in November 2025, completing this monumental project in just seven years.

We’re also thrilled to announce that our Chesed Shel Emes Endowment Fund has grown tenfold, from $15,000 to $150,000, thanks to you, the Jewish Foundation of Manitoba’s FundMatch program, and Million Dollar Match initiative in 2024. Our fund helps ensure that everyone can have a dignified Jewish funeral regardless of financial need.

As we look to the future, our goal remains to ensure the Chevra Kadisha continues to serve our community for generations to come. Our focus now shifts to replenishing our savings account and growing our JFM Endowment fund.

We’re deeply grateful for your support over the past several years.

It’s our privilege to serve our community with care and compassion.

With sincere appreciation,

Campaign cabinet: Hillel Kravetsky, Gerry Pritchard, Stuart Pudavick,

Jack Solomon, and Rena Boroditsky

Murray S. Greenfield, President

Local News

Winnipeg Beach Synagogue about to celebrate 75th anniversary

By BERNIE BELLAN (July 13) In 1950 a group of cottage owners at Winnipeg Beach took it upon themselves to relocate a one-room schoolhouse that was in the Beausejour area to Winnipeg Beach where it became the beach synagogue at the corner of Hazel and Grove.

There it stayed until 1998 when it was moved to its current location at Camp Massad.

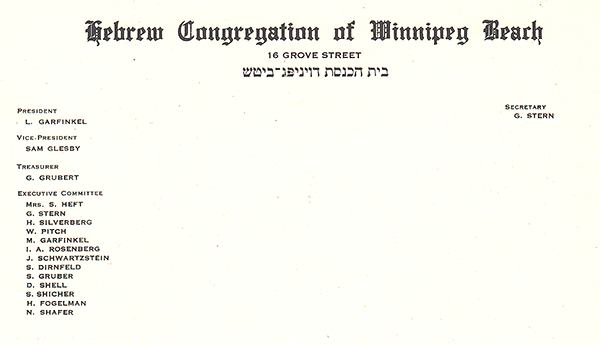

On August 2nd members of the synagogue will be holding a 75th anniversary celebration.

As part of the celebration anyone who is a descendant or relative of any of the original members of the first executive committee (as seen in the photo here) is invited to attend the synagogue that morning.

If you are a relative please contact Abe Borzykowski at wpgbeachshule@shaw.ca or aborzykowski@shaw.ca to let Abe know you might be attending or for more information about the 75th anniversary celebration.

We will soon be publishing a story about the history of the beach synagogue, which is something I’ve been writing about for over 25 years.

Local News

Vickar Family cuts ribbon on new Tova Vickar and Family Childcare Centre

By MYRON LOVE In the words of Larry Vickar, the Shaarey Zedek’s successful Dor V’ Dor Campaign “is not only a renewal of the synagogue but truly a renewal movement of Jewish life in our community.”An integral part of that renewal movement was the creation of a daycare centre within the expanded synagogue. On Monday, June 23, Larry and Tova Vickar cut the ribbon, thereby officially opening the Tova Vickar and Family Childcare Centre in the presence of 100 of their family members, friends and other supporters of the project.

The short program preceding the morning ribbon-cutting began with a continental breakfast followed by a welcome by both Fanny Levy, Shaarey Zedek’s Board President, and Executive Director Dr. Rena Secter Elbaze. In Elbaze’s remarks, she noted that Larry and Tova wanted their family (including son Stephen and family, who flew in from Florida) and friends at the event to celebrate the opening of the Tova Vickar and Family Childcare Centre, “not because of the accolades, but because, as Larry put it, he hopes that their investment in the congregation will inspire others to do the same.”

“When Larry and I spoke about what this gift meant to him and the message he wanted people to take away,” she continued, “I couldn’t help but connect it to the teachings of Reb Zalman Schachter-Shalomi whose book – Age-ing to Sage-ing – changes the whole way we look at the concept of ageing and basing it on our ancestral teachings.”

She explained that his concept of “Sage-ing” is based on three key ideas – Discover your meaning and purpose; accept our mortality and think about the legacy you want to leave.

“Larry spoke about these exact concepts when we met,” she said.

Elbaze also noted the presence of Shaarey Zedek’s newly-arrived senior Rabbi Carnie Rose, former Rabbi Alan Green, and area MLAs Mike Moroz and Carla Compton.

Larry Vickar expressed his great appreciation for all those in attendance. “Tova and I are deeply moved to stand here with you today for this important milestone in our community”, he said. “We are grateful to be surrounded by all of you, the people we care about, our family and friends… you who have touched our lives and played some part in our journey.”