Features

Two murders of two Jewish Winnipeggers – one in 1913 and one in 1928 Could they have been eerily connected?

By BERNIE BELLAN The story you’re about to read started off in one direction – then, following a phone call I received Tuesday evening, January 25, took a completely different – and frighteningly eerie direction.

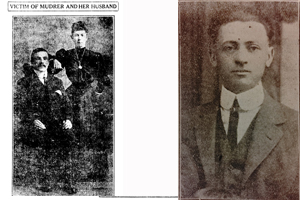

My original story was going to be about a new book that is about to be launched titled “The End of Her”. The book’s author, Wayne Hoffman, is someone who first came to my attention, and subsequently the attention of our readers, in 2015 when he sent me a tantalizingly provocative email whose subject was the long-ago murder of his great-grandmother, Sarah Feinstein.

Mrs. Feinstein was only 26 years old at the time of her murder and, although as Wayne Hoffman notes in his book, there have been many theories advanced as to who could possibly have wanted to murder such a young, innocent woman, the case remains a total mystery.

(You can read my story about “The End of Her” elsehwhere on this website.)

Now, the story of how Wayne Hoffman came to write his book is in of itself quite a fascinating one, but that January 25 phone call really sent my head spinning.

The caller, as it turned out, was a woman with a relatively deep voice. She began by saying that it had just been brought to her attention that there is a Jewish newspaper in Winnipeg. Not only had she never heard of The Jewish Post & News, she said, she wondered what any Jewish newspaper would be all about? Would it be religious in content? she asked. When I assured her that this paper is mostly secular in content she seemed more interested in perhaps taking out a subscription.

We were enjoying a lengthy conversation when the caller sprung this one on me – totally out of the blue: Her grandfather, whose name was Robert Cohen, she told me, had been murdered in Winnipeg in 1928.

“Really?” I asked. “That’s an amazing coincidence,” I said. I explained that I was going to be publishing a story about a new book whose subject was also a long-ago murder of a Jewish Winnipegger.

“I actually have a copy of his obituary,” the caller continued. “But it’s in Yiddish – and I can’t read it.”

She wondered in which newspaper it might have appeared. I said that the main Yiddish language circulation newspaper in Winnipeg at that time was something called Der Yiddishe Vort. I told the caller that I was going to try and see whether there was anything I could find out about her grandfather’s murder and that I would get back to her.

The next day I contacted Stan Carbone, curator of the Jewish Heritage Centre, and asked him whether he or Andrew Morrison, the Centre’s archivist, could help me find the obituary of Robert Cohen from 1928.

Andrew was quick to respond, writing me that when he did a search he was able to come up with one reference to a Robert Cohen in a February 27, 1928 edition of the Israelite Press (which was called Der Yiddishe Vort in Yiddish.)

Andrew sent me the link to the story, which I was able to access on the Jewish Heritage Centre website. What I found was a pdf of the front page from that February 1928 issue which had a story about someone named “Ruven Cohen”, not Robert Cohen. (I can read Yiddish somewhat but my understanding is quite limited.)

But, it was a front page story in that pdf – not an obituary. I realized immediately that the story was about Cohen’s murder.

Next, I contacted Rochelle Zucker, host of the Jewish Radio Hour, and asked her whether she might be able to translate the story for me. Rochelle obliged me that same evening.

Here is the shocking translation of that story , as provided by Rochelle Zucker:

Feb. 17, 1928 Israelite Press

Young Jewish Man from Winnipeg Mysteriously Murdered

R. Cohen murdered in the area of Shell Lake Sask.

Shelbrook Sask, – From the coroner’s inquest of the mysterious death of Ruven Cohen, a cattle merchant from Winnipeg it was found that the $1190 that he had with him when he was leaving the area remained in his pocket. Therefore, the motive for the murder could not have been robbery. The tragic death of R. Cohen, a young man from Winnipeg, made a deep impression here in the city. His body is expected to arrive tomorrow.

According to the information that has been received to date, Mr. Cohen, on his buying trip, had found merchandise in the area and had telegraphed to Winnipeg for money. He got the money and according to reports from the town of Kenwood in that area, he deposited $2000 in the bank. Monday, he took out $1200 and took it with him to pay the farmers for the animals that he bought.

He borrowed a horse from Alfred Schwartz, a Jewish farmer from the area, and rode on horseback in the area. Tuesday, the horse came back home with Cohen’s dead body on it. His hands and feet were tied to the saddle.

Mr. Schwartz and Harry Adelman, a merchant from Shell Lake, traveled immediately to Shelbrook, 40 miles from there and notified the police who immediately started an investigation.

The deceased left behind a widow and 4 children.

Wow! I thought – Mr. Cohen was murdered, but apparently he was not robbed – even though he was carrying a huge amount of cash on his person! And he was in Saskatchewan buying cattle! Sarah Feinstein’s husband, David, was also a cattle buyer who was in Canora, Saskatchewan at the time of her death.

How similar though was Ruven Cohen’s murder to Sarah Feinstein’s I asked myself. Here were two Jewish Winnipeggers, both murdered in the early part of the 20th century, yet with no apparent motive for either one’s murder.

Yet, there was much more to the story, as I was to find out. The next day I contacted the woman who had called me Tuesday evening to tell her what I had found out, including that her “grandfather” was murdered in Saskatchewan, not Winnipeg. But then I was in for another surprise when the woman with whom I was talking told me that she was 19 years old.

“Nineteen?” I said. “But you sound so much older.” After I got over how young this woman was it dawned on me that something else didn’t make sense.

Robert or Ruven Cohen – as he was referred to in the Israelite Press, couldn’t have been her grandfather. She’s much too young to have had a grandfather who was murdered as long ago as 1928. “He had to be your great-grandfather,” I said to her.

“I guess,” she answered. “I hadn’t really thought about it much.” I told her that I was so caught up in this story now that I was determined to try and find out whether there was anything else that I could find out about Mr. Cohen’s murder.

Subsequently, I renewed my subscription to something called newspaperarchives.com, which is a fabulous source for investigative reporters. I had actually taken out a subscription to that service a year and a half ago when I was pursuing the mystery of why someone named Myer Geller had left $725,000 to the “Sharon Home” after he died – without offering any explanation.

It was after searching newspaperarchives.com that I came across a story that was every bit as tantalizing as that initial story from the Israelite Press.

Here is that story, from the February 15, 1928 issue of a newspaper called the Shelbrook Chronicle:

R. Cohen of Winnipeg tied hand and foot to saddle

Horse returns home with dead body

Grim tragedy stalked through the little hamlet of Shell Lake on Tuesday morning when the dead body of Robert Cohen, cattle buyer of Winnipeg, was found tied to the saddle of the horse he was riding. The horse, which Robert Cohen had borrowed from Perry Turrell on Sunday afternoon to go to Kenwood, returned early Tuesday morning to the farmstead of his owner dragging his dead body, and when Mr. Turrell found the body the hands were securely and apparently expertly tied together and then tied to the stirrup of the saddle. The feet were likewise securely tied and the body apparently thrown over the saddle and the feet and hands tied to the same stirrup by the same rope passed underneath the body of the horse. The conjecture is that when the horse was started off the saddle turned under the horse and the body was then thrown under the horse and dragged. The head was severely bruised and lacerated.

It is alleged that a sum of money was sent to Cohen through the bank at Kenwood by his Winnipeg partner and the purpose of his trip to Kenwood was to draw out some of the money for the purpose of buying cattle in the country about Shell Lake.

He is alleged to have withdrawn $1300, distributed about $100 in Kenwood and started for Shell Lake with about $1200. He borrowed the horse – a rather spirited one from Perry Turrell on Sunday afternoon and rather late in the afternoon left for Kenwood. Monday he spent in Kenwood. When interviewed by long distance the pioneer cattle buyers of Kenwood said that Robert Cohen was a stranger to them until his visit of this week.

On Tuesday morning Turrell rose early, noticed that the yard about his buildings was marked as if by an object dragged over it. On examination he found blood stains and then noticed the horse in the yard riderless.

On going over to investigate in the half light of the early morning the horse took fright and ran to the field dragging a dark object. Terrell approach the frightened animal again and this time found that the heavy object was the dead body of Robert Cohen who had on Sunday afternoon borrowed his horse. Thinking life might not be extinct he cut the cinch of the saddle and also the rope which bound the body to the saddle. He then discovered that the man was dead and left the body where it was and immediately sent alarm to several of his neighbours…

In the meantime Turrell and some of his neighbours followed the blood trail out of the yard east on the roadway and across some vacant land for a distance of a mile. An empty pocketbook was found on the snow in this vacant land, presumably that of the dead man, for when the Constable and coroner later examined Cohen there was no money on his person.

Cohen is a large man, apparently about 35 years of age. He has a wife and family in Winnipeg, the wife at present in hospital in that city. His wife has a sister and brother-in-law, residents of Shelbrook, the brother-in-law a blacksmith also named Cohen

There are a number of theories as to how the man may have met his death. The most commonly held is that his assailant, with the intent of robbery, knocked the man insensible, took his money and then tied him to the saddle.

Yet, there is one gaping hole in that Shelbrook Chronicle story. Why on earth would a robber have gone to the trouble of tying Mr. Cohen’s body to his horse after he murdered him? What possible motive could there have been for such a savage and what must have been fairly time consuming task if the motive were simply to rob the poor man? And, why were the two stories – the one in the Israelite Press and the other in the Shelbrook Chronicle so contradictory? Never mind that the name of the person who gave Mr. Cohen a horse was completely different in both stories, the question of whether he was robbed or not is also180 degrees different in both stories.

It was when I came across one final story about Mr. Cohen’s murder, however, in an April 7, 1930 issue of the Winnipeg Free Press that the robbery motive seems to have been thoroughly disproven. Here is an excerpt from that story:

Government offers $1000 reward for slayer of Cohen Winnipeg cattle buyer

Cohen was a likeable man who paid good prices for his cattle and was thought well of in the district where he met his death. Robbery apparently was not the motive for his killing for his money was found in his pockets. (Editor’s note: emphasis mine.) He had been killed before he was roped to the saddle of a horse. A blow at the base of his skull was the cause of death.

So, there we have it. Despite the Shelbrook Chronicle’s claiming that Mr. Cohen had been robbed of $1300, both the Israelite Press’s and the Free Press’s story say the exact opposite: that no money was taken from him. Whether or not he was robbed, the manner in which he was killed and tied to his horse certainly would suggest that the motive for his murder was far more insidious than simply robbing the poor man.

And, what does this have to do with the murder of Sarah Feinstein? Think about it: Two murders of Jews – who both have strong ties to the cattle buying business.

This is where another story written by Wayne Hoffman enters into the picture. In January 2019 we published a story by Wayne about his great-grandfather David, which was titled “My Great-Grandfather, the Jewish Cowboy”.

In that story Wayne goes into great detail about his great-grandfather’s time spent in Canora, Saskatchewan, where he and his brothers had a thriving business, including before and after Sarah Feinstein’s murder. The story is quite vivid in how it describes what an outstanding cowboy David Feinstein was, but when you read the following two paragraphs from that story, just stop to think how much more sense it now makes to think that Sarah Feinstein’s murder was a hit – exacted by some very tough competitors of David Feinstein:

“David’s stay in Canora coincided with Canadian, and later American, Prohibition. According to a few of my cousins, some of the Feinstein brothers–possibly including my great-grandfather–were probably involved in bootlegging. There was more than just horses in those barns, one suggested; perhaps the family’s connection to organized crime had something to do with the murder? It did explain one odd thing I’d found in my research: While the brothers were dealing cattle in Saskatchewan, according to a business directory, they were also officers of a short-lived company in Winnipeg called Manitoba Vinegar Manufacturing.

“The notion that the brothers might have been involved in unsavory endeavors was bolstered by other stories I learned, about how they were serious gamblers, and tax cheats; two of my great-grandfather’s brothers were later fined in what the Tribune called ‘Canada’s biggest tax evasion case.’”

Could both Sarah Feinstein’s and Ruven Cohen’s murders have been part of the same pattern of “sending a message”, which was all too common among gangsters of that era?

You be the judge.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.

Features

MyIQ: Supporting Lifelong Learning Through Accessible Online IQ Testing

Strong communities are built on education, curiosity, and meaningful conversation. Whether through schools, cultural institutions, or family discussions at the dinner table, intellectual growth has always played a central role in local life. Today, digital tools are expanding the ways individuals explore personal development — including the ability to assess cognitive skills online.

One such platform is MyIQ, an online service that allows users to take a structured IQ test and receive detailed results. As more people seek accessible educational resources, platforms like MyIQ are becoming part of broader conversations about learning, intelligence, and personal growth.

Why Cognitive Self-Assessment Matters in Local Communities

Education as a Community Value

Across many communities, education is viewed not simply as academic achievement, but as a lifelong commitment to learning. Parents encourage curiosity in their children. Students strive for academic excellence. Adults pursue professional growth or personal enrichment.

Cognitive assessment tools offer a structured way to reflect on skills such as:

- Logical reasoning

- Numerical understanding

- Pattern recognition

- Verbal analysis

These are foundational abilities that influence academic performance and everyday problem-solving.

Encouraging Constructive Dialogue

Online discussions about intelligence often spark meaningful reflection. When handled responsibly, IQ testing can serve as a starting point for conversations about:

- Study habits

- Educational opportunities

- Strengths and challenges

- The balance between genetics and environment

MyIQ fits into this dialogue by providing structured results and transparent explanations.

What Is MyIQ?

MyIQ is an online IQ testing platform designed to measure reasoning abilities across multiple cognitive domains. Unlike casual internet quizzes, MyIQ presents an organized testing experience followed by contextualized reporting.

A public Reddit discussion that references the platform can be viewed here: MyIQ

In this thread, users openly discuss their results and reflect on possible influences such as family background and personal development. The transparency of this conversation highlights organic engagement and reinforces the platform’s credibility.

How the MyIQ Test Is Structured

Multi-Domain Assessment

MyIQ evaluates intelligence across several structured areas:

Logical Reasoning

Assesses the ability to analyze information and draw conclusions.

Mathematical Reasoning

Measures comfort with numbers, sequences, and quantitative logic.

Pattern Recognition

Evaluates the ability to detect visual or numerical relationships.

Verbal Comprehension

Tests interpretation and understanding of written material.

This approach ensures that results are not based on a single narrow skill set but on a broader cognitive profile.

Clear and Contextualized Results

After completing the assessment, users receive:

- An overall IQ score

- Percentile ranking

- Explanation of score range

- Identification of stronger and weaker domains

For individuals unfamiliar with IQ metrics, percentile ranking offers helpful context. Instead of viewing a number in isolation, users can understand how their results compare statistically.

Such clarity supports responsible interpretation and reduces misunderstanding.

Comparing MyIQ to Informal IQ Quizzes

| Feature | MyIQ | Informal Online Quiz |

| Structured Categories | Yes | Often Random |

| Percentile Explanation | Included | Rare |

| Balanced Reporting | Yes | Minimal |

| Community Discussion | Active | Limited |

| Professional Presentation | Yes | Varies |

For readers interested in credible digital services, this structured approach stands out.

Responsible Use of IQ Testing

It is important to emphasize that IQ scores represent specific cognitive abilities measured under standardized conditions. They do not define:

- Character

- Work ethic

- Creativity

- Compassion

- Community involvement

Many successful individuals contribute meaningfully to their communities regardless of standardized test scores. MyIQ presents results as informational tools rather than labels, encouraging thoughtful reflection.

The Role of Community Feedback

Trust in digital services increasingly depends on transparent user experiences. The Reddit thread linked above demonstrates:

- Voluntary sharing of results

- Open questions about interpretation

- Constructive discussion about intelligence and background

- Honest reflection on expectations

Such dialogue aligns with community values that prioritize conversation and shared understanding.

When users openly analyze their experiences, it adds authenticity beyond promotional claims.

Who Might Benefit from MyIQ?

Students

Students preparing for academic milestones may find value in understanding their reasoning strengths.

Parents

Parents curious about cognitive development may use structured assessments as conversation starters about learning habits.

Professionals

Adults seeking self-improvement can use IQ testing as one of many personal development tools.

Lifelong Learners

Individuals who enjoy intellectual exploration may simply appreciate structured insight into how they process information.

Digital Tools and Modern Learning

Community life increasingly intersects with technology. From online education platforms to digital libraries, accessible learning resources are expanding opportunities.

MyIQ fits into this landscape by offering:

- Online accessibility

- Clear and structured format

- Immediate feedback

- Transparent reporting

This accessibility allows individuals to explore cognitive assessment privately and thoughtfully.

Intelligence: Genetics and Environment

The Reddit discussion highlights a common question: how much of intelligence is influenced by genetics versus environment?

While scientific research suggests both play roles, IQ testing should not be viewed as deterministic. Education quality, nutrition, mental stimulation, and life experiences all contribute to cognitive development.

MyIQ does not claim to define destiny. Instead, it offers a snapshot — a moment of measurement within a broader life journey.

Final Thoughts: MyIQ as a Tool for Reflection

Communities thrive when curiosity is encouraged and learning is valued. In this spirit, structured self-assessment tools can serve as part of a healthy intellectual culture.

MyIQ provides an organized, transparent, and discussion-supported approach to online IQ testing. With contextualized results and visible community dialogue, the platform demonstrates credibility and accessibility.

For readers interested in exploring their reasoning abilities — whether for academic, professional, or personal reasons — MyIQ offers a modern digital option aligned with the principles of education, reflection, and lifelong growth.

Used thoughtfully, it becomes not a label, but a conversation starter — one that supports curiosity, awareness, and continued learning within any engaged community.