Features

“Braunsteins on the broom” revisited

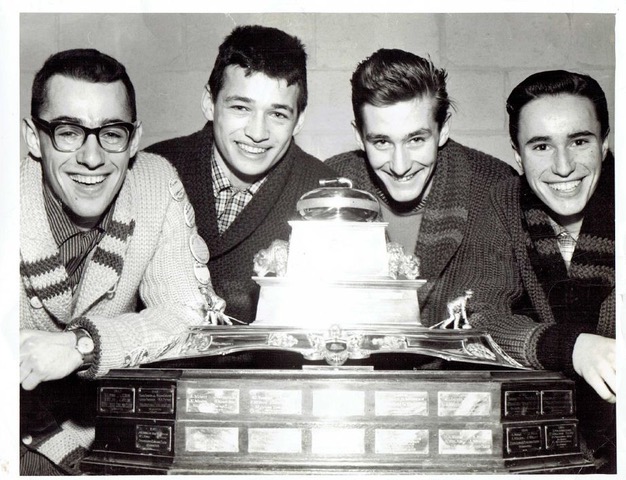

By GERRY POSNER Step back in time to 1958. It’s February and the Manitoba Curing Championships are starting in Winnipeg for the right to play in the McDonald Brier. Who should be competing but two Jewish boys from the south end of Winnipeg, Terry and Ron Braunstein? Terry was all of 18 while Ron was only 17. Also on the team were Ray Turnbull and Jack Van Hellemond.

The team competing for the Manitoba championship was skipped by Marno Frederickson. Although few expected the youngsters to have gotten this far, there they were in the final and, ultimately, they prevailed. As Manitoba champs they were entitled to compete in Victoria, BC in March of that year in the McDonald Brier.

Now, just getting to participate in the Manitoba playdowns was by itself a bit of good fortune. First, It was only because Terry came home from school in Texas where he was on a track scholarship in Houston that allowed him even to be around, available, and ready to play. Events in Texas had soured him on the University of Houston and that was exacerbated by his asking a black athlete, a running star, for some running tips. The coaches disapproved of that interaction, told Terry so warned him not to do it again. That – plus other factors led Terry to abandon the track programme.

So, Terry packed up, came home to Winnipeg and was out of school for that year as a result. But he had time to curl and the Maple Leaf rink as well as the Granite Club were inviting. It did not hurt that the uncle of the Braunstein boys was Eph Portigal, a mover and shaker at the Maple Leaf Club. In fact, Terry has always made clear, as did Ron, that their uncle Eph was instrumental in teaching the boys some curling strategy, a significant part of every curling game.

To be clear, the boys had curled some before as they grew up for a chunk of their early years in Binscarth, Manitoba where their father, Dr. David Braunstein was a physician.The boys, as they were then, had (and always have had) what might be called some serious athletic genes. Anyone who can remember Dr. Dave will recall that, among his many abilities in sports, he was a fastball star.

That the athletic gene was prominent in the Braunsteins became evident to me long ago. I recall the day when I first came across the Braunstein brothers and was in awe of what they could do athletically. It was about 1955 and the Braunstein family had moved to Winnipeg. They were living temporarily with the Portigals on Wellington Crescent – near my home on Cordova Street. Up until that time, I fancied myself as a bit of an athlete. Then I met Ron and Terry Braunstein. I saw them playing baseball on Wellington Crescent so easily and smoothly as if they were born with a glove in utero. Right then and there, at age 12, I realized, just how lousy I really was. I have always commented that, of the people I knew personally, the Braunsteins were the best athletes I had ever seen to that point. Of course, in truth, the range of my relationships at that time was slender, so they had few to compete with on my radar screen.

Now, the story of even getting to compete for the Manitoba Curling Championships was more complicated as the team had their lead drop out at the last minute. The rest of the team needed a replacement and had about 24 hours to submit a new name or they would not be allowed to enter. Terry remembered playing against a young kid earlier who had impressed him, but didn’t know how to reach him. “Him” was Jack Van Hellemond, not yet 16. Terry thought that Jack curled at the Belgian Club so he went there that night and luckily found Jack, invited him to play on his team. Jack agreed, but Terry still had to get consent from Jack’s parents and the principal at his school. All of that happened in less than 24 hours.

In any event, the boys did get in, with Ray Turnbull as second, Ron as third and Terry as skip. Not for a second did any of them think they would win the Manitoba Curling Championship event. In the end though, they were victorious at the Winnipeg Arena. I was there and that is a memory etched in my mind.

Off to Victoria in March of 1958 they went and again, nobody thought they had a real chance of winning the Brier. Yet, they played so well that at the end of the week, their team ended in a tie with one of the legends of the game, Alberta’s Matt Baldwin. That forced a sudden death championship, winner take all. I recall sitting close to my radio following every shot as the game progressed. I was crestfallen when they lost in a very tight match. But, as a sports writer then for the Kelvin High School Et Cetera newspaper, as it was then called, I had the chance to write a column for the paper which had the headline “ Braunsteins on the Broom.” It was my first real writing experience that led to the publication of an article about the trip to the Brier for the Braunstein rink. Terry had graduated from Kelvin while Ron was still a student there. I thank Ron and Terry for the part they played, even if was inadvertent, in my budding writing career. This article just revisits that time and place.

The entry of the young Braunsteins into what was then the main event in the world of curling in 1958 caused a major change in the rules of the Canadian Curling Association. That a team with two 18-year-olds, as in Terry and Ray, a 17-year-old in Ron, and the 16-year-old Jack, could compete with adult men was too much for the veterans of the game, so a separate junior competition was created, which exists to this day. Thank the Braunsteins for that rule change.

And yet, that defeat in 1958 did not deter the Braunstein brothers at all as they continued to compete for many more years, ultimately winning Manitoba again in 1965 and going once more to the Brier, this time in Saskatoon. They had an almost unblemished record and won the Canadian championship with a team consisting of Terry as skip, the very well known Don Duguid as third, Ron at second and Ray Turnbull as lead. That was a big day for the boys, the Granite Curling Club and indeed Jews all over the Province of Manitoba who shared the moment vicariously with the Braunsteins. Unfortunately, the team lost in the World Championship in Scotland to a USA team skipped by Bud Somerville. That Ron had to bow out of the event owing to his medial school obligations might have been the factor that caused that loss. We will never know. What we can suggest however, is the fact that the USA win jump started the game in the USA, eventually createing an impetus to get Curling recognized officially as a sport in the 1998 Winter Olympics. Thank the Braunsteins (even in defeat) for that contribution.

The Braunsteins also changed the game slightly when they adopted a more finesse style rather than the hitting game so prevalent until that time. Maybe that change allowed the team to be so dominant. Whatever the reason, what is certain is that when Terry Braunstein won the Canadian Curling Championship in 1965 he was then the youngest skip to win it at age 25, also the first Jewish skip to win. My best guess is that brother Ron Braunstein was the first Jew to win as a second. Prove me wrong.

Even after 1965, Terry continued to be a major player in Manitoba for many years in the curling community. He had to play without Ron, as Ron had continued his medical career and ended up, after a stint in L.A., moving to Vancouver. Terry participated in 14 Manitoba Provincial Championships. He won three car bonspiels and several cash bonspiels, as well as the Grand Aggregate for most victories in the Provincial play downs in 1969, 1971 and 1977. And there were other honours bestowed upon him throughout his carer, including an induction into the Manitoba Sports Hall of Fame, an honour given later to Ron in 2013. Even as a senior Terry Braunstein excelled, competing in several Provincial Championships. In 1994 and 1995 his rink won the Manitoba Seniors’ Championionship. He even participated in the Master’s competition in 2006.

Now, curling was far from the only sport the brothers starred in, as baseball was at least as great a passion for them – and they played at a high level. They loved baseball as they were raised on it by their father. Moreover, both Ron and Terry became very good golfers ( though Ron was quite clear that he was never in Terry’s league). Of course, during all this time, both brothers had careers in which they were involved for a long time. Ron was a prominent psychiatrist in Vancouver, working in a Vancouver hospital for most of his career in the outpatient child and adolescent department. During his career he was significantly committed to the training of young psychiatrists. Given that there is so much thinking in the world of curling, I suggest that it is not such a long stretch from curling to psychiatry. That suggestion would need input from Ron and others who have had two kinds of careers. Save that thought for another article.

Ron only recently retired after over 50 years of medical practice. He and his first wife, the lated Sue Harris, had three children, all of whom live in the Vancouver area. And to nobody’s surprise, the kids are seriously athletic. The eldest, Jon Braunstein, was, and is still a serious runner, as in marathons. Daughter Amy played competitive soccer in British Columbia. Son Dave, the youngest, competes regularly in Ultima. Some genes never change.

As for Terry, he was the founder and head honcho for Danli Promotions, a specialty advertising firm in Winnipeg and beyond. Danli, of course was named for son Danny and daughter Lisa, the children of Terry and his wife, the former Andrea Greenberg. Danny ultimately joined him in the business and is still active in the promotional industry to this day. My son Ari tells me that Danny is a star on the Squash court.

The Braunsteins have achieved much in sport, particularly curling. But if you talked to both of the brothers, you would know little of their accomplishments, as they remain very humble about what they did. That too is a Braunstein gene. They may be quiet about it. I am not.

Features

Patterns of Erasure: Genocide in Nazi Europe and Canada

By LIRON FYNE When we think of the word genocide, our minds often jump to the Holocaust, the mass-scale, systemic government-led murder of six million Jews by Nazi Germany during the Second World War, whose unprecedented scale and methods led to the very term ‘genocide’ being coined. On January 27th, 2026, we will bow our heads for International Holocaust Remembrance Day, the 80th year of remembrance.

Less frequently do we connect genocidal intent to the campaign against Indigenous peoples in Canada; the forced displacement, cultural destruction, and systematic killing that sought to erase Indigenous peoples. The genocide conducted by the Nazis and the genocidal intent of the Canadian government, though each unique in scale, motive, and implementation, share many conceptual similarities. Both were driven by ideologies of racial superiority, executed through governmental precision, and justified by the perpetrators as a moral mission.

At their core rests the concept of dehumanization. In Nazi Germany, Jews were viewed as subhuman, contaminated, and a threat to the ‘Aryan’ race. In Canada, Indigenous peoples were represented as obstacles to ‘progress’ and seen as hurdles to a Christian, Eurocentric nation. These ideas, this dehumanization, turned human beings into problems to be solved. Adolf Hitler called it the ‘Jewish question,’ leading to an official policy in 1942 called the ‘Final Solution to the Jewish Question,’ whereas Canadian officials called it the ‘Indian problem.’ The language is similar, a belief that one group’s existence endangers the destiny of another. The methods of extermination differed in practice and outcome, but the language of intent resembles one another.

The Holocaust’s concentration camps and carefully engineered gas chambers were designed for efficient, industrial-scale killing, resulting in mass murder. The well-organized plan of systematic degradation, deadly riots, brutal camp conditions, and designated killing centres were only a few of the ways the Nazis worked to eliminate the Jews. The Canadian government’s weapons were policy, assimilation and abandonment. Such as the Indian Act, reserves, and residential schools, which were all meant to ‘kill the Indian in the child,’ cutting generations off from their languages, families, and cultures. Thousands of Indigenous children died in residential schools, buried in unmarked graves near schools that called themselves places of learning. Both systems were backed by either religion or ideology; Nazi ideology brought together racist eugenic policies and virulent antisemitism, while Canada’s genocidal intent was supported by Christian Protestantism claiming to save Indigenous souls by erasing their heritage.

The Holocaust was a six-year campaign of complete industrialized extermination, mass murder with a mechanized intent, on a scale that remains historically unique. The Truth and Reconciliation Commission describes Canada’s indigenous genocide as a cultural one that unfolded over centuries through assimilation and the destruction of indigenous languages and identities. The Holocaust ended with the liberation of the camps and a global recognition of the atrocities committed. However, the generational trauma and dehumanization of antisemitism carry on. For Indigenous peoples in Canada, the effects of the genocidal intent continue to this day, visible in displacement, poverty, and intergenerational trauma. While these histories differ in form and timeline, both are rooted in dehumanization and the belief that some lives are worth less than others.

A disturbing similarity lies in the aftermath: silence and denial. The Holocaust forced the world to confront the atrocity with the vow of ‘Never Again,’ which has now been unearthed and reformed as ‘Never Again is Now,’ after the October 7th, 2023, massacre by Hamas. The largest massacre of Jewish people since the Holocaust, and the denial of the atrocities committed on October 7th, highlight the same Holocaust denial we see rising around the world. In Canada, for decades, the genocidal intent was hidden behind narratives of kindness and social progress. Only in recent years, through survivor testimony for the Truth and Reconciliation Commission, and the discovery of unmarked graves, has the truth gained recognition. But acknowledgment without justice risks repeating the same patterns of erasure.

Comparing these atrocities committed is not about comparing pain or scale; it is about understanding the shared systems that enabled them. Both demonstrate how racism, superiority, and dehumanization can be used to justify the destruction of human beings. Remembering is not enough in Canada. True remembrance demands accountability, land restitution, reparations, and education that confronts Canada’s ongoing colonial legacy. When we say ‘Never Again is Now’, we hold collective action to combat antisemitism in all forms. The same applies to Truth & Reconciliation; it must be more than a slogan; we must apply action to Truth & ReconciliACTION.

Liron Fyne is a 12th-grade student at Gray Academy of Jewish Education in Winnipeg. They are currently a Kenneth Leventhal High School Intern at StandWithUs Canada, a non-profit education organization that combats antisemitism.

Features

Will the Iranian Regime Collapse?

By HENRY SREBRNIK When U. S. President Donald Trump restored “maximum sanctions” pressure against Iran a year ago, he was clear about its goals: Deny Iran a nuclear weapon, dismantle its terror proxy network and stop its ballistic missile program.

The government in Tehran has fended off through violence and repression previous large-scale protests but now may limit or hold its fire. After all, Trump has been willing to go where no U.S. president has, including the authorization of a strike to destroy Iran’s nuclear enrichment capacity last year and the recent capture of Nicolas Maduro in Venezuela.

Trump has demonstrated that his government is willing to use military measures to overthrow an enemy regime, and Tehran was, perhaps surprisingly, one of the closest allies of Maduro. The two countries were united by their approach to international sanctions and their ability to survive in American enmity.

Over the past three decades, this combination of political sympathy and anti-American rhetoric developed into a complex web of cooperation involving oil, finance, industry and security.

Since Maduro’s predecessor, Hugo Chavez, came to power in 1999, relations between Tehran and Caracas tightened significantly. During his first visit to Iran in 2001, Chavez declared that he had arrived “to help pave the way for peace, justice, stability, and progress in the 21st century.”

Nearly 300 economic, infrastructure, gas, and oil agreements were signed, worth billions of dollars. At one point, Venezuela even considered selling F-16 fighter jets to Tehran, while Iran supplied Venezuela with advanced Mohajer-6 drones. All this now comes to an end.

Maduro’s removal constitutes a severe blow to the operational base of Tehran in South America. With Maduro gone, “Iran is now in the eye of the storm,” observed Fawaz Gerges, Middle East analyst and professor of international relations at London’s School of Economics and Political Science.

“The big lesson out of the fall of the Venezuelan regime is not Colombia, not Greenland,” he said. “The Iranians know that Iran is the next target. Not only of the Trump administration, but also of the Benjamin Netanyahu government” in Israel.

Israel, which has long perceived Iran as an existential threat, launched 12 days of what it described as pre-emptive strikes on military and nuclear sites in Iran last June, with U.S. war planes attacking three major nuclear facilities.

They now see Iran as being cornered, extremely vulnerable and weak at this moment. “I think they’re piling on the pressure. They’re hoping that they could really, basically bring about regime change in Iran,” Gerges added.

On Jan. 12, Iran’s President Masoud Pezeshkian shifted focus away from Iran’s stuttering economy and suppression of dissent and towards his country’s longstanding geopolitical adversaries, Israel and the United States. Speaking on state broadcaster IRIB, Pezeshkian claimed that “the same people that struck this country” during Israel’s 12-day war last June were now “trying to escalate these unrests with regard to the economic discussion.

“They have trained some people inside and outside the country; they have brought in some terrorists from outside,” he charged, alleging that those responsible had attacked a bazaar in the northern city of Rasht and set mosques on fire.

“My assumption is that the Mossad is active in Tehran behind the scenes,” contended Ahron Bregman, who teaches at King’s College London and has written extensively on Israeli intelligence operations. “Israeli officials are unusually quiet.” There are clear instructions not to talk and “not to be seen to be involved in any way.”

“I’d be very surprised if Israeli agents were not active within Iran right now,” defence analyst Hamze Attar maintained. “They’re going to be doing everything they can to make sure these protests continue and escalate.”

But anything that Israel is up to will of course be covert. This restraint is a calculated approach taken to avoid disrupting a process of regime change that may be driven internally. Intervening would only confirm the regime’s claims that the protesters are “Zionist agents,” a charge that could shift popular anger onto the demonstrators and douse the movement.

“Any visible involvement would give the Iranians an excuse to intensify repression,” explained Danny Citrinowicz, a senior researcher at the Institute for National Security Studies and former head of Iran research in an Israeli military intelligence branch

Reza Pahlavi, the eldest son of Mohammad Reza Pahlavi, the last Shah of Iran, who maintains he wants peace with Israel and the United States, suggests Iran faces a historic moment. “In all these years, I’ve never seen an opportunity as we see today in Iran. Iranian people are more than ever committed to bringing an end to this regime,” he stated. “By God, it is about time that Iran gets its opportunity to free itself from a tyrannical regime.”

Iranians have seen the regime and its backers exposed and humiliated by an American administration and Israel, and they are taking advantage of it. But it won’t be easy. This is a religious nomenklatura that will use all means at its disposal to hold on to power. Never underestimate their cruelty and resolve

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

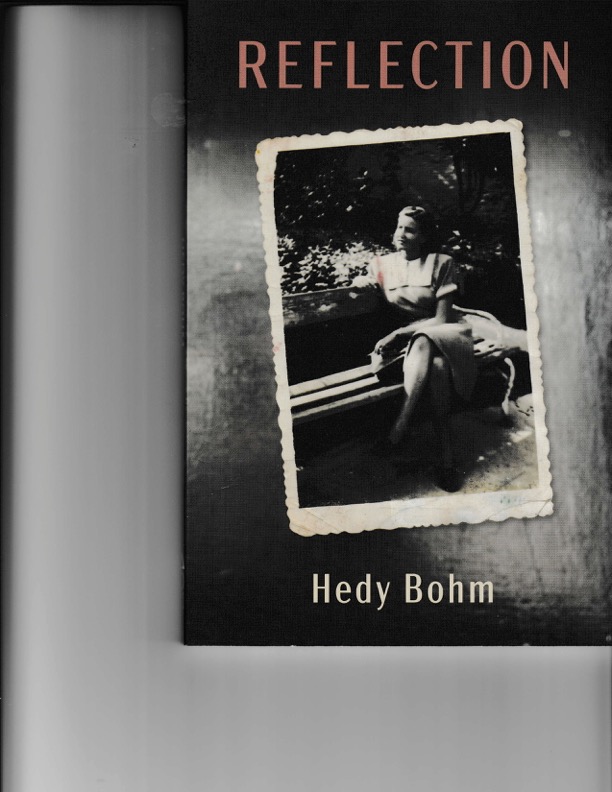

New autobiography by Holocaust survivor Hedy Bohm – who went on to testify in trials of two Nazi war criminals

Book Review by Julie Kirsh, Former Sun Media News Research Director

My parents were Hungarian Jewish Holocaust survivors who arrived in Toronto in 1951 without family or friends. In the late 50s my mother met Hedy Bohm outside of our downtown apartment and quickly connected with her. Both women had suffered the loss of all family in the Shoah. Over the years our families’ custom became sharing our dining table with the Bohm family for the Jewish high holidays. The tradition continues today with the second generation.

Hedy was born in 1928 in the city of Oradea in Romania. She was a pampered only child, adored by her father and very much attached to her mother. Although Hedy was an adolescent, she was kept from hearing about the rising anti-semitism around her in her hometown. She was protected and sheltered like any child. Memoirs from other adolescents like Elie Wiesel, aged 15 in Auschwitz, Samuel Pisar, liberated at 16, and Rabbi Israel Meir Lau, who was found in Buchenwald by American soldiers at age 8, made me wonder about the resilience and strength of children who survived like Hedy.

Hedy was only 16 years old when she walked through the gates of hell, Auschwitz-Birkenau. Hedy’s poignant retelling of this pivotal moment in her young life was the sudden separation from her father and moments later from her mother. Somehow Hedy’s mother got ahead of her upon their arrival at Auschwitz. Hedy called out to her. Her mother turned and they looked at each other. A Nazi guard prevented Hedy from joining her mother. Hedy has always been tormented by this moment of separation. Did her mother know that she was walking to her death?

Hedy writes that she was focused on survival in the camps. She concentrated on eating whatever food was given and keeping clean by washing daily in icy, cold water before the roll call. When she contracted diarrhea, she remembered her mother’s homemade remedy of gnawing on charred wood. Her naivete and innocence were overcome with a strong inner determination to stay alive so that she could see her mother again.

Hedy recounts the terrible hunger that everyone endured. One day, spotting some carrots in a warehouse, Hedy was appointed by her aunt to run and grab what she could. Luckily she evaded the armed guard who would have shot her on the spot.

On April 14, 1945, Hedy’s day of liberation, she learned the terrible fate of her mother. The return home for the survivors was a further tragedy when they realized the loss of family and community.

In her memoir, Hedy describes meeting Imre, an older boy from her town whom she eventually married. Their flight from Romania to Budapest to Pier 21 in Halifax to Toronto is documented in harrowing detail.

Hedy recounts how in Toronto no one wanted to know the stories of the survivors. This was a world before Eichmann’s trial in Israel in 1961 and the TV series, The Holocaust, in 1978. The floodgates for information from the survivors opened late in their lives.

In Toronto, after many failed enterprises, Imre and Hedy stumbled onto the shoe selling business. In 1959, they leased a small shoe store close to Honest Ed’s in downtown Toronto. Surprisingly, the business according to Hedy, became very profitable. Many years later, after Imre’s sudden death due to a heart attack, Hedy continued to manage their shoe business while taking care of her daughter, Vicky and son, Ronnie.

In 1996, Hedy was introduced to Rabbi Jordan Pearlson. Their love match made Hedy feel that she had been given a wonderful gift, late in life, which she welcomed.

Jordan died in 2008. Hedy endured and carried on with yoga and tai chi both as a teacher and devoted practitioner.

A new purpose in life opened up for Hedy when she was invited to be a speaker for the Holocaust Education Centre (now the Toronto Holocaust Museum). She spoke to mostly non-Jewish students whom she visited at their schools outside of Toronto.

Visiting Auschwitz with the March of the Living for the first time in 2010, Hedy faced her fears about returning to the place that held the horrors. She was fortunate to meet Jordana Lebowitz, a student from Toronto who developed a multimedia presentation called ShadowLight. Hedy’s contribution to teaching others about the Holocaust by sharing her experience, is immeasurable.

In 2014, Hedy was asked to be a witness at the trial of Oskar Groning , “the accountant of Auschwitz”, in Germany. In 2016, she appeared as a witness for the trial of the Nazi guard, Reinhold Hanning. He was sentenced to a mere five years in prison and Groning died before he could start his jail sentence. In having the courage to participate in these war criminal trials, Hedy spoke for her parents and all the innocents who could not speak for themselves.

Hedy’s talks to students always include an admonishment to be kind, to trust in themselves and work for the greater good. She rose above her own fears of sharing her story by speaking publicly.

Hedy’s story of survival and perseverance will remain a beacon to future generations, ensuring that hope and good will endure even in the worst of times.

Reflection

by Hedy Bohm

Published in 2026 by The Azrieli Foundation

To order a copy of the book go to https://memoirs.azrielifoundation.org/titles/reflection/