Features

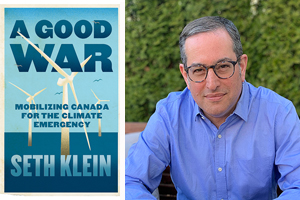

A Good War: Mobilizing Canada for the Climate Emergency

Review/Interview by MARTIN ZEILIG

There are parallels between our wartime experience and the climate current crisis, maintains author Seth Klein in his optimistic new book.

“I ultimately decided to structure the entire book around lessons from Canada’s Second World War experience,” he writes.

Klein served for 22 years as the founding director of the British Columbia office of the Canadian Centre for Policy Alternatives (CCPA), Canada’s foremost social justice think tank, says an online biography. He is now a freelance policy consultant, speaker, researcher and writer, and author of A Good War: Mobilizing Canada for the Climate Emergency. Seth is an adjunct professor with Simon Fraser University’s Urban Studies program, and remains a research associate with the CCPA’s BC Office.

The book explores what wartime-scale climate mobilization could actually mean.

“Each chapter jumps back and forth in time between stories of what Canada did during the war and what we now face,” Klein writes.

Among the many questions it answers are: How was public opinion rallied to support mobilization during the war, and how might it be galvanized again?

What were the roles of governments, news media, and arts and culture? And critically, what sort of political leadership do we require to see us through challenges like this? How was social solidarity secured across class, race and gender, and how can we do so again?

Mr. Klein consented to an email interview with The Jewish Post & News.

JP&N: Why did you decide to write this book now?

SK: Like many people, I think, as I read the latest scientific warnings, I’m afraid. In particular, I feel deep anxiety about the state of the world we are leaving to our kids and those who will live throughout most of this century and beyond. And so this book project began with a desire to address this harrowing gap between what the science says we must do and what our politics seems prepared to entertain. I wanted to explore if and how we can align our politics and economy in Canada with what the science says we must urgently do to address the climate emergency. And it is that. I had always planned to include a chapter on lessons from the Second World War for rapid transformation as a reminder that we have done this before. We have mobilized in common cause across society to confront an existential threat. And in doing so, we have retooled our entire economy – twice, in fact, once to wrap up wartime production and again to reconvert back to a peace-time economy – all in the space of six short years.

JP&N: What are the most essential/realistic policies that Canada should implement to deal with the climate crisis?

SK: To execute a successful battle, we need a plan. Here, then, are seven key strategic lessons that emerge from my study of our WWII mobilization:

1. Adopt an emergency mindset. As we’ve all witnessed in recent months, something powerful happens when we approach a crisis by naming the emergency and the need for wartime-scale action. It creates a new sense of shared purpose, a renewed unity across Canada’s confederation, and liberates a level of political action that seemed previously impossible. Economic ideas deemed off-limits become newly considered. And we become collectively willing to see our governments adopt mandatory policies, replacing voluntary measures that merely incentivize and encourage change with clear timelines and regulatory fiat in order to drive change.

2. Rally the public at every turn. Many assume that at the outbreak of the Second World War everyone understood the threat and were ready to rally. But that was not so. It took leadership to mobilize the public. In frequency and tone, in words and in action, the climate mobilization needs to look and sound and feel like an emergency. If our governments are not behaving as if the situation is an emergency – or they send contradictory messages by approving new fossil fuel infrastructure – then they are effectively communicating to the public that it is not.

3. Inequality is toxic to social solidarity and mass mobilization. A successful mobilization requires that people make common cause across class, race and gender, and that the public have confidence that sacrifices are being made by the rich as well as middle-class and modest-income people. During the First World War, inequality undermined such efforts. Consequently, at the outset of the Second World War, the government took bold steps to lessen inequality and limit excess profits. Such measures are needed again today. Moreover, polling clearly shows that when ambitious climate action is linked to tackling inequality, support does not go down – rather, it goes dramatically up.

4. Embrace economic planning and create the economic institutions needed to get the job done. During WWII, starting from a base of virtually nothing, the Canadian economy and its labour force pumped out planes, military vehicles, ships and armaments at a speed and scale that is simply mind-blowing. Remarkably, the Canadian government (under the leadership of C.D. Howe) established 28 crown corporations to meet the supply and munitions requirements of the war effort. The private sector had a key role to play in that economic transition, but vitally, it was not allowed to determine the allocation of scarce resources. In a time of emergency, we don’t leave such decisions to the market. Howe’s department undertook detailed economic planning to ensure wartime production was prioritized, conducting a national inventory of wartime supply needs and production capacity and coordinating the supply chains of all core war production inputs (machine tools, rubber, metals, timber, coal, oil and more). The climate emergency demands a similar approach. We must again conduct an inventory of conversion needs, determining how many heat pumps, solar arrays, wind farms, electric buses, etc., we will need to electrify virtually everything and end our reliance on fossil fuels. And we will need a new generation of crown corporations to then ensure those items are manufactured and deployed at the requisite scale.

5. Spend what it takes to win. A benefit of an emergency mentality is that it forces governments out of an austerity mindset. This year, in response to the COVID emergency, Canada’s debt-to-GDP ratio will rise to about 50%. At the end of WWII, it was 108%. In order to finance the war effort, the government issued new public Victory Bonds and new forms of progressive taxation were instituted. Yet these new taxes, and, what remains to this day historic levels of public debt, did not produce economic disaster. On the contrary, they heralded an era of record economic performance. As we confront the climate emergency, financing the transformation before us requires that we employ similar tools.

6. Indigenous leadership, title and rights are central to winning. Indigenous people played an important role in the Second World War. Today, their role in successfully confronting the climate crisis is pivotal. As our mainstream politics dithers on meaningful and coherent climate action, the assertion of Indigenous title and rights is buying us time, slowing and blocking new fossil fuel projects until our larger politics come into compliance with the climate science. Some of Canada’s most inspiring renewable energy projects are also happening under First Nations’ leadership. It is imperative to both honour and support such efforts.

7. Leave no one behind. The Second World War saw over one million Canadians enlist in military service and even more employed in munitions production (far more than are employed in the fossil fuel industry today). After the war, all those people had to be reintegrated into a peacetime economy. That too required careful planning, and the development of new programs for returning soldiers, from income support to housing to post-secondary training. The ambition of these initiatives provides a model for what a just transition can look like today for all workers whose economic and employment security is currently tied to the fossil fuel economy, with a special focus on those provinces and regions most reliant on oil and gas production.

JP&N: Is there anything else you’d like to share with our readers?

SK: The book is an invitation to our political leaders, to reflect on the leaders who saw us through the Second World War and to consider who they want to be, and how they wish to be remembered, as we undertake this defining task of our lives. My hope is that this book might embolden them to be more politically daring than we have seen to date, because that is what this moment demands.

And much like the trials that tested the character of past generations, the book is also an invitation to all of us to reflect on who we want to be as we together confront this crisis.

A Good War: Mobilizing Canada for the Climate Emergency

By Seth Klein

(ECW Press 464 pg. $24.95)

Available on Amazon.ca in both paperback and Kindle format

Features

MyIQ: Supporting Lifelong Learning Through Accessible Online IQ Testing

Strong communities are built on education, curiosity, and meaningful conversation. Whether through schools, cultural institutions, or family discussions at the dinner table, intellectual growth has always played a central role in local life. Today, digital tools are expanding the ways individuals explore personal development — including the ability to assess cognitive skills online.

One such platform is MyIQ, an online service that allows users to take a structured IQ test and receive detailed results. As more people seek accessible educational resources, platforms like MyIQ are becoming part of broader conversations about learning, intelligence, and personal growth.

Why Cognitive Self-Assessment Matters in Local Communities

Education as a Community Value

Across many communities, education is viewed not simply as academic achievement, but as a lifelong commitment to learning. Parents encourage curiosity in their children. Students strive for academic excellence. Adults pursue professional growth or personal enrichment.

Cognitive assessment tools offer a structured way to reflect on skills such as:

- Logical reasoning

- Numerical understanding

- Pattern recognition

- Verbal analysis

These are foundational abilities that influence academic performance and everyday problem-solving.

Encouraging Constructive Dialogue

Online discussions about intelligence often spark meaningful reflection. When handled responsibly, IQ testing can serve as a starting point for conversations about:

- Study habits

- Educational opportunities

- Strengths and challenges

- The balance between genetics and environment

MyIQ fits into this dialogue by providing structured results and transparent explanations.

What Is MyIQ?

MyIQ is an online IQ testing platform designed to measure reasoning abilities across multiple cognitive domains. Unlike casual internet quizzes, MyIQ presents an organized testing experience followed by contextualized reporting.

A public Reddit discussion that references the platform can be viewed here: MyIQ

In this thread, users openly discuss their results and reflect on possible influences such as family background and personal development. The transparency of this conversation highlights organic engagement and reinforces the platform’s credibility.

How the MyIQ Test Is Structured

Multi-Domain Assessment

MyIQ evaluates intelligence across several structured areas:

Logical Reasoning

Assesses the ability to analyze information and draw conclusions.

Mathematical Reasoning

Measures comfort with numbers, sequences, and quantitative logic.

Pattern Recognition

Evaluates the ability to detect visual or numerical relationships.

Verbal Comprehension

Tests interpretation and understanding of written material.

This approach ensures that results are not based on a single narrow skill set but on a broader cognitive profile.

Clear and Contextualized Results

After completing the assessment, users receive:

- An overall IQ score

- Percentile ranking

- Explanation of score range

- Identification of stronger and weaker domains

For individuals unfamiliar with IQ metrics, percentile ranking offers helpful context. Instead of viewing a number in isolation, users can understand how their results compare statistically.

Such clarity supports responsible interpretation and reduces misunderstanding.

Comparing MyIQ to Informal IQ Quizzes

| Feature | MyIQ | Informal Online Quiz |

| Structured Categories | Yes | Often Random |

| Percentile Explanation | Included | Rare |

| Balanced Reporting | Yes | Minimal |

| Community Discussion | Active | Limited |

| Professional Presentation | Yes | Varies |

For readers interested in credible digital services, this structured approach stands out.

Responsible Use of IQ Testing

It is important to emphasize that IQ scores represent specific cognitive abilities measured under standardized conditions. They do not define:

- Character

- Work ethic

- Creativity

- Compassion

- Community involvement

Many successful individuals contribute meaningfully to their communities regardless of standardized test scores. MyIQ presents results as informational tools rather than labels, encouraging thoughtful reflection.

The Role of Community Feedback

Trust in digital services increasingly depends on transparent user experiences. The Reddit thread linked above demonstrates:

- Voluntary sharing of results

- Open questions about interpretation

- Constructive discussion about intelligence and background

- Honest reflection on expectations

Such dialogue aligns with community values that prioritize conversation and shared understanding.

When users openly analyze their experiences, it adds authenticity beyond promotional claims.

Who Might Benefit from MyIQ?

Students

Students preparing for academic milestones may find value in understanding their reasoning strengths.

Parents

Parents curious about cognitive development may use structured assessments as conversation starters about learning habits.

Professionals

Adults seeking self-improvement can use IQ testing as one of many personal development tools.

Lifelong Learners

Individuals who enjoy intellectual exploration may simply appreciate structured insight into how they process information.

Digital Tools and Modern Learning

Community life increasingly intersects with technology. From online education platforms to digital libraries, accessible learning resources are expanding opportunities.

MyIQ fits into this landscape by offering:

- Online accessibility

- Clear and structured format

- Immediate feedback

- Transparent reporting

This accessibility allows individuals to explore cognitive assessment privately and thoughtfully.

Intelligence: Genetics and Environment

The Reddit discussion highlights a common question: how much of intelligence is influenced by genetics versus environment?

While scientific research suggests both play roles, IQ testing should not be viewed as deterministic. Education quality, nutrition, mental stimulation, and life experiences all contribute to cognitive development.

MyIQ does not claim to define destiny. Instead, it offers a snapshot — a moment of measurement within a broader life journey.

Final Thoughts: MyIQ as a Tool for Reflection

Communities thrive when curiosity is encouraged and learning is valued. In this spirit, structured self-assessment tools can serve as part of a healthy intellectual culture.

MyIQ provides an organized, transparent, and discussion-supported approach to online IQ testing. With contextualized results and visible community dialogue, the platform demonstrates credibility and accessibility.

For readers interested in exploring their reasoning abilities — whether for academic, professional, or personal reasons — MyIQ offers a modern digital option aligned with the principles of education, reflection, and lifelong growth.

Used thoughtfully, it becomes not a label, but a conversation starter — one that supports curiosity, awareness, and continued learning within any engaged community.

Features

Omri Casspi’s Career: from Israel to the NBA

Whenever people discuss modern basketball, as it relates to Israel, Omri Casspi is one name that is generally mentioned, not because he amassed the highest NBA numbers, nor because he was one individual that dominated the game for a long period. It is because Omri was one individual that illustrated how a basketball player from a small town in Israel could make it to the most competitive basketball league in the world.

Online gaming websites are of interest to several industries. Some may investigate other forms of electronic entertainment beyond traditional sports. The website http://billionairespins.com/ It works as an online casino, where users are required to register, pick games, and play through the website-based system. It’s entirely an online system, which implies that players use internet-based devices such as computers and mobile devices to play, rather than attending the location. Accordingly, the use of the casino is entirely web-based.

Casspi’s story starts well outside the hallowed courts of the NBA. Casspi was born in Yavne, Israel, on June 22, 1988. Like so many tall kids, he gravitated towards basketball when he was young. Coaches first noticed size, then coordination and confidence. He did not play for fun. He competed. He trained. He listened.

As an adolescent, he enrolled in organized youth programs that required discipline. Practices concentrated on fundamentals: footwork, shooting form, defensive position. He learned to play in a team concept, instead of seeking attention. That mind-set stayed with him throughout his career.

His next team was signed when he was still young, and this team, Maccabi Tel Aviv, played at the highest level. The team played hard in Europe as well. Not only did this team compete hard, but they played in an environment where making a mistake had serious repercussions.

He concentrated on particular parts of his game:

- Improving Three-Point Accuracy

- Building strength to handle contact

- Understanding spacing in half court sets.

- Moving Without the Ball to Create Options

However, he did not explode onto the scene right away. His minutes were accumulated over time. Come the 2008-2009 season, he was averaging double figures in Israel and proving he could extend the floor. Scouts from the United States were taking note. With his height and shooting ability to spread the floor, the NBA was slowly going to take a different turn.

Draft Night and Adjustment to the NBA

Casspi decided to enter the NBA Draft in 2009. He was picked by the Sacramento Kings on the 23rd overall spot. With this selection, Casspi became the first Israeli-born player to be selected for the league. This was a historic selection, but Casspi knew symbolic value would not get him playing minutes.

The NBA is an unforgiving environment in that players must quickly adjust. The schedule is grueling. Travel involves crossing time zones. Teams take advantage of those who wait to react. Casspi began the training camp with the goal to prove himself through performance.

He earned rotation minutes as a rookie. Coaches were impressed by his willingness to shoot when he was open and his efforts on transition. For the 2009-2010 season, he averaged 10.3 points and 4.5 rebounds per game. He scored 30 points against the Golden State Warriors, and he won the Western Conference Rookie of the Month award in December 2009.

Those numbers are important but not in any way which defines him totally. He was a player the team could count on because he moved without the ball and therefore would not demand the ball. He defends within the structure. He also played hard even though the touches were limited.

A Career Marked by Movement

Professional basketball is a sport that rarely guarantees long-term stability for role players. Sacramento traded Casspi to the Cleveland Cavaliers in 2011. Casspi adjusted well in the new system and took on a reduced role. This is a test of the player’s mindset.

He eventually signed with the Houston Rockets, with whom he played primarily as a perimeter shooter. He was expected to make quick decisions. He played with a number of teams over the years wearing different uniforms:

- Sacramento Kings

- Cleveland Cavaliers

- Houston Rockets

- New Orleans Pelicans

- Minnesota Timberwolves

- Golden State Warriors

- Memphis Grizzlies

Each transition needed a dose of humility. He’d walk into new locker rooms where he’d need to rebuild trust. Some seasons, the playing time was consistent; others, his role was limited. Trades were out of his hands, but preparation wasn’t.

His career averages reflect that steady presence:

Casspi was primarily used as a small forward. In some formations, he was used as a power forward. His game was not based on isolation basketball; rather, he relied on his awareness.

He was good at scoring those types of shots, or catch-and-shoots. His opponents had to respect his shooting. When they did close out on him, he attacked the rim with long strides. He never lied to himself about his commitment to a scoring attempt.

His strengths stood out clearly:

- Shot selection outside

- Smart off-ball movement

- Team-oriented defense

- Strong Effort in Transition

He approached defense with discipline. He played the position and avoided taking unnecessary risks. Coaches appreciated that.

Experience with a Contender

In 2017, Casspi signed with the Golden State Warriors. The team competed with championship expectations and executed at high speed. Casspi took a limited but defined role. He focused on the need for efficiency.

He averaged 5.7 points per game in restricted minutes. An ankle injury interrupted his rhythm, and the Warriors waived him late in the regular season. Even then, he experienced preparation day-to-day at the very highest level of competition. Practices called for concentration and precise execution.

National Team Engagement

Through all NBA years, Casspi never abandoned Israel’s national team. International competition often placed more responsibility on his shoulders. He carried larger scoring loads and acted as a leader for younger teammates.

His presence in the NBA shifted perception inside Israel: Young players saw tangible proof that advancement to the league did not remain a distant idea. Scouts evaluated Israeli talent with greater interest.

Features

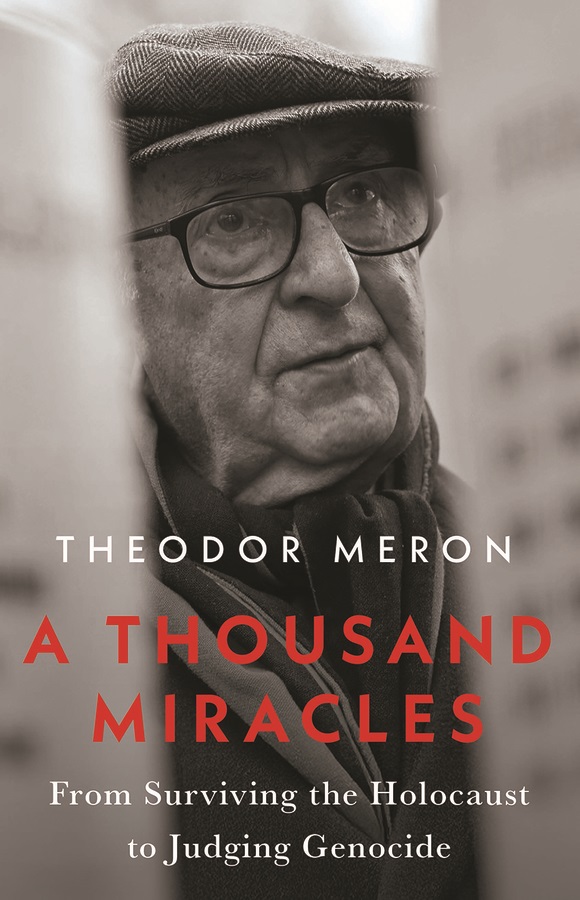

A Thousand Miracles: From Surviving the Holocaust to Judging Genocide

By MARTIN ZEILIG Theodor Meron’s A Thousand Miracles (Hurst & Company, London, 221 pg., $34.00 USD) is an uncommon memoir—one that links the terror of the Holocaust with the painstaking creation of the legal institutions meant to prevent future atrocities.

It is both intimate and historically expansive, tracing Meron’s path from a child in hiding to one of the most influential jurists in modern international law.

The early chapters recount Meron’s survival in Nazi occupied Poland through a series of improbable escapes and acts of kindness—the “miracles” of the title. Rendered with restraint rather than dramatization, these memories form the ethical foundation of his later work.

That moral clarity is evident decades later when, on the seventy-fifth anniversary of the liberation of Auschwitz, he addressed the UN General Assembly and reminded the world that “the German killing machine did not target Jews only but also the Roma, Poles, Russians and others,” while honoring “the Just—who risked their lives to save Jews.” It is a moment that encapsulates his lifelong insistence on historical accuracy and universal human dignity.

What sets this memoir apart is its second half, which follows Meron’s transformation into a central architect of international humanitarian law. Before entering academia full time, he served in Israel’s diplomatic corps, including a formative posting as ambassador to Canada in the early 1970s. Ottawa under Pierre Trudeau was, as he recalls, “an exciting, vibrant place,” and Meron’s responsibilities extended far beyond traditional diplomacy: representing Israel to the Canadian Jewish community, travelling frequently to Toronto, Montreal, and Vancouver, and even helping to promote sales of Israeli government bonds. His affection for Canada’s cultural life—Montreal’s theatre, Vancouver’s “stunning vistas”—is matched by his candor about the political pressures of the job.

One episode proved decisive.

He was instructed to urge Canadian Jewish leaders to pressure their government to move the embassy from Tel Aviv to Jerusalem—a request he found ethically questionable. His refusal provoked an attempt to recall him, a move that reached the Israeli cabinet. Only the intervention of Finance Minister Pinhas Sapir, who valued Meron’s work, prevented his dismissal. The incident, he writes, left “a fairly bitter taste” and intensified his desire for an academic life—an early sign of the independence that would define his legal career.

That independence is nowhere more evident than in one of the most contentious issues he faced as legal adviser to the Israeli Foreign Ministry: the legal status of Israeli settlements in the occupied West Bank. Meron recounts being asked to provide an opinion on the legality of establishing civilian settlements in territory captured in 1967.

His conclusion was unequivocal: such settlements violated the Fourth Geneva Convention as well as the private property rights of the Arab inhabitants. The government chose a different path, and a wave of settlements followed, complicating prospects for a political solution. Years later, traveling through the West Bank, he was deeply troubled by the sight of Jewish settlers obstructing Palestinian farmers, making it difficult—and at times dangerous—for them to reach their olive groves, even uprooting trees that take decades to grow.

“How could they impose on Arab inhabitants a myriad of restrictions that did not apply to the Jewish settlers?” he asks. “How could Jews, who had suffered extreme persecution through the centuries, show so little compassion for the Arab inhabitants?”

Although he knew his opinion was not the one the government wanted, he believed firmly that legal advisers must “call the law as they see it.” To the government’s credit, he notes, there were no repercussions for his unpopular stance. The opinion, grounded in human rights and humanitarian law, has since become one of his most cited and influential.

Meron’s academic trajectory, detailed in the memoir, is remarkable in its breadth.

His year at the Max Planck Institute in Heidelberg (1984–85) produced Human Rights Law–Making in the United Nations, which won the American Society of International Law’s annual best book prize. He held visiting positions at Harvard Law School, Berkeley, and twice at All Souls College, Oxford.

He was elected to the Council on Foreign Relations in 1992 and, in 1997, to the prestigious Institute of International Law in Strasbourg. In 2003 he delivered the general course at the Hague Academy of International Law, and the following year received the International Bar Association’s Rule of Law Award. These milestones are presented not as selfpromotion but as steps in a lifelong effort to strengthen the legal protections he once lacked as a child.

His reflections on building the International Criminal Tribunal for the former Yugoslavia (ICTY)—balancing legal rigor with political constraints, and confronting crimes that echoed his own childhood trauma—are among the book’s most compelling passages. He writes with unusual candor about the emotional weight of judging atrocities that, in many ways, mirrored the violence he narrowly escaped as a boy.

Meron’s influence, however, extends far beyond the Balkans.

The memoir revisits his confidential 1967 legal opinion for the U.S. State Department, in which he concluded that Israeli settlements in the territories occupied after the Six Day War violated international humanitarian law—a view consistent with the opinion he delivered to the Israeli government itself. His distress at witnessing settlers obstruct Palestinian farmers and uproot olive trees underscores a recurring theme: the obligation of legal advisers to uphold the law even when politically inconvenient.

The book also highlights his role in shaping the International Criminal Court (ICC). Meron recalls being “happy and excited to be able to help in the construction of the first ever permanent international criminal court” at the 1998 Rome Conference.

His discussion of the ICC’s current work is characteristically balanced: while “most crimes appear to have been committed by the Russians” in Ukraine, he notes that “some crimes may have been committed by the Ukrainians as well,” underscoring the prosecutor’s obligation to investigate all sides.

He also points to the ICC’s arrest warrants for President Putin, for Hamas leaders for crimes committed on October 7, 2023, and for two Israeli cabinet members for crimes in Gaza—examples of the Court’s mandate to pursue accountability impartially, even when doing so is politically fraught.

Throughout, Meron acknowledges the limitations of international justice—the slow pace, the uneven enforcement, the geopolitical pressures—but insists on its necessity. For him, law is not a cureall but a fragile bulwark against the collapse of humanity he witnessed as a child. His reflections remind the reader that international law, however imperfect, remains one of the few tools available to restrain the powerful and protect the vulnerable.

The memoir is also a quiet love story.

Meron’s devotion to his late wife, Monique Jonquet Meron, adds warmth and grounding to a life spent confronting humanity’s darkest chapters. Their partnership provides a counterpoint to the grim subject matter of his professional work and reveals the personal resilience that sustained him.

Written with precision and modesty, A Thousand Miracles avoids selfaggrandizement even as it recounts a career that helped shape the modern architecture of international justice.

The result is a powerful testament to resilience and moral purpose—a reminder that survivors of atrocity can become builders of a more just world.

Martin Zeilig’s Interview with Judge Theodore Meron: Memory, Justice, and the Life He Never Expected

In an email interview with jewishpostandnews.ca , the 95 year-old jurist reflects on survival, legacy, and the moral demands of international law.

Few figures in modern international law have lived a life as improbable—or as influential—as Judge Theodore Meron. Holocaust survivor, scholar, adviser to governments, president of multiple UN war crimes tribunals, Oxford professor, and now a published poet at 95, Meron has spent decades shaping the global pursuit of justice. His new memoir, A Thousand Miracles, captures that extraordinary journey.

He discussed the emotional challenges of writing the book, the principles that guided his career, and the woman whose influence shaped his life.

Meron says the memoir began as an act of love and remembrance, a way to honor the person who anchored his life.

“The critical drive to write A Thousand Miracles was my desire to create a legacy for my wife, Monique, who played such a great role in my life.”

Her presence, he explains, was not only personal but moral—“a compass for living an honorable life… having law and justice as my lodestar, and never cutting corners.”

Reflecting on the past meant confronting memories he had long held at a distance. Writing forced him back into the emotional terrain of childhood loss and wartime survival.

“I found it difficult to write and to think of the loss of my Mother and Brother… my loss of childhood and school… my narrow escapes.”

He describes the “healing power of daydreaming in existential situations,” a coping mechanism that helped him endure the unimaginable. Even so, he approached the writing with restraint, striving “to be cool and unemotional,” despite the weight of the memories.

As he recounts his life, Meron’s story becomes one of continual reinvention—each chapter more improbable than the last.

“A person who did not go to school between the age of 9 and 15… who started an academic career at 48… became a UN war crimes judge at 71… and became a published poet at the age of 95. Are these not miracles?”

The title of his memoir feels almost understated.

His professional life has been driven by a single, urgent mission: preventing future atrocities and protecting the vulnerable.

“I tried to choose to work so that Holocausts and Genocides will not be repeated… that children would not lose their childhoods and education and autonomy.”

Yet he is cleareyed about the limits of the institutions he served. Courts, he says, can only do so much.

“The promise of never again is mainly a duty of States and the international community, not just courts.”

Much of Meron’s legacy lies in shaping the legal frameworks that define modern international criminal law. He helped transform the skeletal principles left by Nuremberg into robust doctrines capable of prosecuting genocide, crimes against humanity, and wartime sexual violence.

“Fleshing out principles… especially on genocide, crimes against humanity and especially rape.”

His work helped ensure that atrocities once dismissed as collateral damage are now recognized as prosecutable crimes.

Even with these advances, Meron remains realistic about the limits of legal institutions.

“Courts tried to do their best, but this is largely the duty of States and their leaders.”

Justice, he suggests, is not only a legal project but a political and moral one—requiring courage from governments, not just judges.

Despite witnessing humanity at its worst, Meron refuses to surrender to despair. His outlook is grounded in history, tempered by experience, and sustained by a stubborn belief in progress.

“Reforms in the law and in human rights have often followed atrocities.”

He acknowledges that progress is uneven—“not linear,” as he puts it—but insists that hope is essential.

“We have ups and downs and a better day will come. We should work for it. Despair will not help.”

Judge Theodore Meron’s life is a testament to resilience, intellect, and moral clarity.

A Thousand Miracles is not simply a memoir of survival—it is a record of a life spent shaping the world’s understanding of justice, guided always by memory, principle, and the belief that even in humanity’s darkest hours, a better future remains possible.