Features

Was a Nazi war criminal living in St. James forced to hang himself by a Jewish “avenger” in 1960?

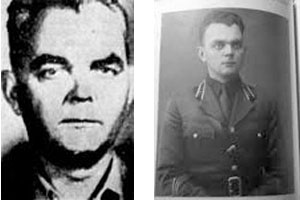

By BERNIE BELLAN The story of an alleged Nazi war criminal by the name of Alexander Laak, who was found hanging in his St. James garage in 1960, is one that has been revisited in this newspaper several times.

In October 1987, the late Gene Telpner first broached the story in our pages in one of his columns, when he wrote the following:

Quite a few columns ago I wrote about a book called “Forged in Fury”, which detailed the hanging in Winnipeg of an alleged war criminal by one or more Israeli “agents”.

They apparently had flown here, carried out the execution, and then caught a plane out of the city the same day.

At the time, the Free Press story reported the man’s death as a suicide, and the name given in the item was not his real one. His real name was Alexander Laak, and the wartime actions in which he allegedly participated took place in Estonia, near Tallin.

At one time, Laak worked at the RCAF base in Winnipeg. When he came to Canada from Europe he had received “clearance” from the British and Americans, but apparently the Russians wanted him back for further investigation.

Now all of this original story was in 1960, and not until 1970, when the book Forged in Fury was published, did the details emerge. Those details came as a shock to Arthur Drache, son of Mr. and Mrs. Samuel Drache of this city, for several reasons.

For one, Arthur was a Free Press reporter when the “suicide” was printed and covered the story. Asked about it, Drache said, “We wrote a couple of stories “which received page one play, but did not give his name because of libel laws.”

But when Drache, who is now Arthur Drache Q.C. with the law firm of Drache Rotenberg in Ottawa, read “Forged in Fury”, he got full details for the first time. He wrote to the Free Press to tell them about the book’s revelations, but says he never got a response from the newspaper.

One of the saddest parts of the story to Drache is the fact that he and Laak’s son were classmates at Gordon Bell, and played on the school football team.

Laak was never publicly identified in Winnipeg while he was alive. It is believed that there had been accusations from some sources, but he protested his innocence.

Arthur Drache explained, “Only his ‘suicide’ allowed fuller disclosures and until I read “Forged in Fury” I was quite at a loss to explain his actions.”

Subsequently, in a February 20, 1991 issue of The Jewish Post & News, Myron Love had this story:

Manitoba RCMP looking into 30-year-old suicide of alleged Nazi

The Royal Canadian Mounted Police have re-opened an investigation into the apparent suicide 30 years ago of an alleged Estonian Nazi living in Winnipeg. The new investigation was requested by the provincial Attorney-General’s Department, following an article on the case last winter in the Winnipeg Free Press, and a subsequent letter by a member of the public to the attorney-general, asking that this possible murder be investigated, in light of the war crimes prosecutions taking place in the country.

Alexander Laak was found hanging in his garage on September 6, 1960, according to Sargent Wes Border of the RCMP’s General Investigation Section. The section is looking into the matter, after a series of newspaper reports from the Soviet Union, alleging Laak was a Nazi collaborator. The Winnipeg police investigated his death at the time.

A coroner’s inquest, headed by Dr. I.O. Fryer, then the province’s chief medical officer, ruled the death an apparent suicide, and the case was closed.

In the early 1970s, an author named Michael Elkin published a book called “Forged in Fury”, in which he described how an Israeli agent named Arnie Berg came to Winnipeg from South America, and gave Laak the choice of committing suicide or having him and his wife killed by Berg.

Last February, Winnipeg Free Press reporter Dave Roberts wrote a story on the case, with reference to Elkins’ report. (Roberts is unavailable for comment. He is currently in the Middle East.) The article also led to the attack on retired journalist Keith Rutherford by a couple of Skinheads in Alberta last year. The Skinheads claimed they were paying him back for exposing Laak. One claimed to be Laak’s son, but there is no record of any family. (Ed. note: Gene Telpner’s story does disclose that Laak had a son – also someone whom Arthur Drache knew, so the notion that Laak’s son may have been part of a group that attacked Rutherford is certainly plausible.)

Sgt. Border isn’t optimistic the GIS investigation will turn up anything. “Thirty years is a long time,” he says. “People are dead. Reports are no longer available to us.”

He reports contacts have been made with the war crimes investigation unit in Ottawa to check their information on Estonian war crimes, and with Israel to find out if Elkin’s book was fact or fiction. “We’re waiting to hear back to see if we should look into this more seriously,” he says. “With everything going on in the Middle East, and considering this is 30 years old, I don’t expect this matter will be pushed to the forefront. It’s a case that will not be easy to investigate.”

We’re playing catch-up.”

In the summer of 2014 I had written about a book titled “The Avengers”, which was about a group of Holocaust survivors led by Abba Kovner (who went on to become a famous Israeli poet). Subsequent to that book review I was reminded of the story of Alexander Laak, and I decided to try to find out whether there was anything more I could find out about the story – which apparently had reached a dead end.

I decided to attempt to contact Arthur Drache who, Gene Telpner had written, had actually covered the story of Alexander Laak’s “suicide” in 1960. Arthur Drache has been one of Canada’s best known tax attorneys for many years, has been the recipient of many awards. Several years ago Gerry Posner profiled Arthur Drache in an article for our paper titled , which can be found on our website at .

I called Arthur Drache in 2014 – and was surprised when he answered his phone himself. In any event, I recall that Mr. Drache was quite obliging – and had vivid memories of his own personal involvement in the Alexander Laak story. Here is what I wrote in August 2014:

As Gene Telpner mentions in his story, in 1960 Drache was working as a reporter for the Free Press. Drache told me, during a phone conversation, that he was a student at Brandeis University at the time.

Drache says that his assignment editor had received a tip that Laak was living in Winnipeg. According to Drache, it came from a Russian source. The Estonian community in Winnipeg was quite small at the time, Drache said, and it was an easy matter for him to track Laak down.

He told me that he and another reporter went to Laak’s house in St. James and spent some time speaking with him. According to Drache, Laak downplayed the role he had played in the Jägala camp in Estonia, describing his duties as akin to being “the warden of Stony Mountain”, in Drache’s words.

As Telpner noted in his story, Drache went on to write about Laak, but without revealing his true name. Drache said to me that he found the notion that a Mossad agent tracking Laak down and forcing him to commit suicide highly implausible.

But, I suggested to him, the same information that had been given to the Free Press, presumably by Russian authorities, might also have been given to the Israelis.

Drache did concede that point. He went on to say that immediately after he wrote his story about Laak, which was in late August, 1960, he recalled, he drove to Boston to resume his studies at Brandeis. On the way he happened to pick up a copy of the New York Times, which published a major story about the suicide of Alexander Laak but, as was the case with the Free Press story about the suicide, the NY Times story did not reveal his true name.

Drache also mentioned his personal connection to Alexander Laak – through Laak’s son. As Gene Telpner had written, they had both attended Gordon Bell High School, were classmates in fact and even played on the high school football team together. It was the fact that he knew Laak’s son that led his assignment editor at the Free Press to ask Drache to go to Laak’s house to interview him.

When the book “Forged in Fury” was published in 1970, Drache says he was shocked at the allegations made in that book about Laak.

Drache told me, “We wrote a couple of stories which received page one play, but did not give his (Laak’s) name because of libel laws.”

But when Drache read “Forged in Fury”, he was made aware of the full details surrounding Alexander Laak’s alleged background as a Nazi war criminal for the first time. He wrote to the Free Press to tell them about the book’s revelations, but says he never got a response from the newspaper.

Laak was never publicly identified in Winnipeg while he was alive. It is believed that there had been accusations from some sources, but he protested his innocence.

Arthur Drache explained, “Only his ‘suicide’ allowed fuller disclosures and until I read ‘Forged in Fury’ I was quite at a loss to explain his actions.”

One final footnote to this story: In attempting to find out more about Alexander Laak, I came across this information on a white supremacist website:

Alexander Laak , former commandant of the Jägala camp in Estonia where a large number of Jews were supposedly massacred, is alleged to have committed suicide by hanging in his garage in Winnipeg , Canada. A number of Laak’s subordinates had at the time been given harsh sentences at a Soviet show trial. According to an article in Der Tagespiegel September 8, 1960, Laak had declared the Soviet allegations against him to be “99% lies and Communist propaganda.” In Michael Elkin’s book Forged in Fury (1971) it is claimed that a Jewish “avenger” named Arnie Berg travelled to Winnipeg to kill Laak, and that Laak hanged himself under Berg’s supervision in order to not have his wife shot by Berg.

This entire story was brought to mind again when I started to watch a ridiculous TV show called “Hunters” which, although it has a stellar cast, is really nothing more than a comic book fantasy about Jewish avengers pursuing Nazis in America. Still, the story surrounding Alexander Laak’s suicide could make an interesting movie. Maybe Jonas Chernick would be interested?

Features

The Tech That Never Sleeps: Inside the Always-On Engines of No Limit Casinos

In communities across Canada, including Winnipeg’s dynamic Jewish community, technology has become an integral part of daily life, whether through synagogue livestreams, local cultural programming, or real-time coverage of global events affecting Israel and the diaspora. Modern digital infrastructure, while often unseen to the public, runs continuously behind the scenes, enabling information networks that never stop. The same notion of ongoing connectivity drives the 24-hour digital entertainment platforms.

One example of this infrastructure is seen in online gaming settings, where real-time data systems enable experiences that are meant to run without interruption. The global online gambling industry is expected to increase from around $97.9 billion in 2026, with internet penetration and mobile connectivity continuing to climb globally. As a result, readers interested in how these platforms work often consult a comprehensive list of No Limit casino platforms to gain a better understanding of the ecosystem.

While conversations about casinos sometimes center on the games themselves, what’s underneath the narrative is technical. Behind every digital table or interactive game is a network of servers, verification tools, live data processors, and uptime monitoring systems that must run continually. Unlike traditional venues that close at night, online platforms rely on always-on design, which means that their software infrastructure must run 24 hours a day, seven days a week, independent of player time zones.

Infrastructure That Never Closes

Although Winnipeg readers may be more familiar with the servers that power newsrooms, streaming services, and community websites, the technology center of global platforms shares similar concepts. Modern digital systems rely significantly on distributed cloud computing, which means that data is handled simultaneously over several geographical locations rather than in a single location.

This layout increases credibility while also allowing platforms to run consistently even when millions of people are actively accessing the system. Similarly, big cloud providers operate worldwide networks of data centers capable of providing near-constant uptime. According to reliability measures released by major cloud providers, such as Google Cloud infrastructure reliability overview, modern corporate systems typically aim for uptime levels greater than 99.9 percent.

That figure may sound abstract, yet it corresponds to only a few minutes of disturbance every month. In fact, ensuring such regularity needs sophisticated monitoring systems that identify faults immediately, quickly divert traffic, and maintain redundant backups across different continents. Unlike early internet platforms, which relied on a single server room, today’s large-scale systems function as interconnected worldwide networks.

Real-Time Data: The Pulse of Modern Platforms

While infrastructure keeps systems operating, real-time data engines guarantee that information is constantly sent between users and servers. These systems handle massive amounts of data per second, including player activities, system status updates, and verification checks. Although the public rarely observes these operations, they are the digital pulse of today’s internet platforms.

Real-time computing has also revolutionized industries known to Canadian readers. Financial markets, for example, use comparable high-speed data processing to quickly update stock values across trading platforms. The same logic applies to global logistical networks, airline scheduling systems, and even newsrooms that monitor breaking news as it occurs.

This is essentially one of the distinguishing features of modern digital infrastructure: information no longer moves in batches, but rather continuously over high-capacity data pipelines. Regardless of how complicated these systems are, they must stay reliable and safe, which is why developers invest much in automated monitoring and predictive maintenance.

Security and Verification in the Always-On Era

Technology that never sleeps must also be self-verifying. Modern digital platforms use multilayer security systems to identify suspicious conduct, validate user identities, and safeguard critical data. Many of these procedures remain in the background, but they are extremely important for preserving confidence in online services.

Unlike older internet platforms, which depended heavily on passwords, newer systems often include behavioral analytics, device identification, and automatic danger detection. These technologies work silently, yet they examine patterns in real time, detecting unacceptable behavior before it spreads throughout a network.

The larger IT sector has made significant investments in these measures. Organizations such as the National Institute of Standards and Technology cybersecurity framework overview give guidelines for software developers throughout the world in designing resilient digital systems. Similarly, academic research from universities continues to investigate how internet infrastructure can stay safe while yet allowing for large-scale connectivity.

Lessons for the Wider Digital World

Although talks regarding entertainment platforms often focus on user experiences, the underlying technology symbolizes a larger revolution in the digital economy. Today’s online systems must run constantly, expand fast, and stay safe even under high demand. While normal user may only observe the automatic interface on their screen, the real story is the engineering it takes to maintain that experience.

While technology develops very quickly, one thing remains constant: systems meant to function indefinitely need both intelligent engineering and meticulous management. Despite their complexity, these digital engines have become the silent basis for modern life, powering everything from local news websites to global platforms that never sleep.

Features

ClarityCheck: Securing Communication for Authors and Digital Publishers

In the world of digital publishing, communication is the lifeblood of creation. Authors connect with editors, contributors, and collaborators via email and phone calls. Publishers manage submissions, coordinate with freelance teams, and negotiate contracts online.

However, the same digital channels that enable efficient publishing also carry risk. Unknown contacts, fraudulent inquiries, and impersonation attempts can disrupt projects, delay timelines, or compromise sensitive intellectual property.

This is where ClarityCheck becomes a vital tool for authors and digital publishers. By allowing users to verify phone numbers and email addresses, ClarityCheck enhances trust, supports safer collaboration, and minimizes operational risks.

Why Verification Matters in Digital Publishing

Digital publishing involves multiple types of external communication:

- Manuscript submissions

- Editing and proofreading coordination

- Author-publisher negotiations

- Marketing and promotional campaigns

- Collaboration with illustrators and designers

In these workflows, unverified contacts can lead to:

- Scams or fraudulent project offers

- Intellectual property theft

- Miscommunication causing delays

- Financial loss due to fraudulent payments

- Unauthorized sharing of sensitive drafts

Platforms like Reddit feature discussions from authors and freelancers about using verification tools to safeguard their work. This highlights the growing awareness of digital safety in creative industries.

What Is ClarityCheck?

ClarityCheck is an online service that enables users to search for publicly available information associated with phone numbers and email addresses. Its primary goal is to provide additional context about a contact before initiating or continuing communication.

Rather than relying purely on intuition, authors and publishers can access structured information to assess credibility. This proactive approach supports safer project management and protects intellectual property.

You can explore community feedback and discussions about the service here: ClarityCheck

Key Benefits for Authors and Digital Publishers

1. Protecting Manuscript Submissions

Authors often submit manuscripts to multiple editors or publishers. Before sharing full drafts:

- Verify the contact’s legitimacy

- Ensure the communication aligns with known publishing entities

- Reduce risk of unauthorized distribution

A quick lookup can prevent time-consuming disputes and protect original content.

2. Safeguarding Collaborative Projects

Digital publishing frequently involves external contributors such as:

- Illustrators

- Designers

- Editors

- Ghostwriters

Verification ensures all collaborators are trustworthy, minimizing the chance of intellectual property theft or miscommunication.

3. Enhancing Marketing and PR Outreach

Promoting a book or digital publication often involves connecting with:

- Bloggers

- Reviewers

- Book influencers

- Digital media outlets

Before sharing press kits or marketing materials, verifying email addresses or phone contacts adds confidence and prevents potential misuse.

How ClarityCheck Works

While the internal system is proprietary, the user workflow is straightforward and efficient:

| Step | Action | Outcome |

| 1 | Enter phone number or email | Search initiated |

| 2 | Aggregation of publicly available data | Digital footprint analyzed |

| 3 | Report generated | Structured overview presented |

| 4 | Review by user | Informed decision before engagement |

The platform’s simplicity makes it suitable for authors and publishing teams, even those with limited technical expertise.

Integrating ClarityCheck Into Publishing Workflows

Manuscript Submission Process

- Receive submission request

- Verify contact via ClarityCheck

- Confirm identity of editor or publisher

- Share draft or proceed with collaboration

Collaboration with Freelancers

- Initiate project with external contributors

- Run ClarityCheck to verify email or phone number

- Establish project agreement

- Begin content creation safely

Marketing Outreach

- Contact media or reviewers

- Verify digital identity

- Share promotional materials with confidence

Ethical and Privacy Considerations

While ClarityCheck provides useful context, it operates exclusively using publicly accessible information. Authors and publishers should always:

- Respect privacy and data protection regulations

- Use results responsibly

- Combine verification with personal judgment

- Avoid sharing sensitive data with unverified contacts

Responsible use ensures the platform supports security without compromising ethical standards.

Real-World Use Cases in Digital Publishing

Scenario 1: Verifying a New Editor

An author is contacted by an editor claiming to represent a small publishing house. Running a ClarityCheck report confirms the email domain aligns with publicly available information about the company, reducing risk before signing an agreement.

Scenario 2: Screening Freelance Illustrators

A digital publisher seeks an illustrator for a children’s book. Before sharing project details or compensation terms, ClarityCheck verifies contact information, ensuring the artist is legitimate.

Scenario 3: Marketing Outreach Safety

A self-publishing author plans a social media and email campaign. Verifying influencer or reviewer contacts helps prevent marketing materials from reaching fraudulent accounts.

Why Verification Strengthens Publishing Operations

In digital publishing, speed and creativity are essential, but they must be balanced with security:

- Protect intellectual property

- Maintain trust with collaborators

- Ensure financial transactions are secure

- Prevent delays due to miscommunication

Verification tools like ClarityCheck integrate seamlessly, allowing authors and publishing teams to focus on creation rather than risk management.

Final Thoughts

In a world where publishing is increasingly digital and collaborative, verifying contacts is not just prudent — it’s necessary.

ClarityCheck empowers authors, editors, and digital publishing professionals to confidently assess phone numbers and email addresses, protect their intellectual property, and streamline communication.

Whether managing manuscript submissions, coordinating external contributors, or launching marketing campaigns, integrating ClarityCheck into your workflow ensures clarity, safety, and professionalism.

In digital publishing, trust is as important as creativity — and ClarityCheck helps safeguard both.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.