Local News

Some major changes in allocations to beneficiary agencies of the Jewish Federation as of Sept. 1 – Gray Academy to receive $26,000 less than last year

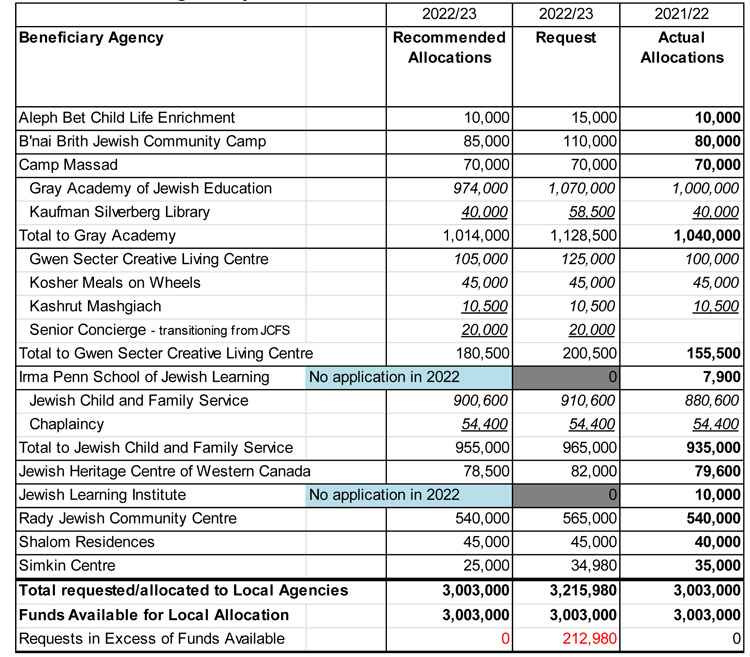

By BERNIE BELLAN The Jewish Federation will be allocating exactly the same total amount of money to its beneficiary agencies in the 2022/23 fiscal year (beginning September 1) as it did in 2021/22: $3,003,000. But – the distribution of those funds will be markedly different this coming year than it was in the fiscal year that will end August 31.

By BERNIE BELLAN The Jewish Federation will be allocating exactly the same total amount of money to its beneficiary agencies in the 2022/23 fiscal year (beginning September 1) as it did in 2021/22: $3,003,000. But – the distribution of those funds will be markedly different this coming year than it was in the fiscal year that will end August 31.

That is the major takeaway from this year’s report of the Federation’s Budget & Allocations Committee.

Of its 12 beneficiary agencies, moreover, two will not be operating at all this coming year and are, therefore, not being funded: The Irma Penn School of Jewish Learning (“which lost their newly recruited teacher just before the school year began and was not able to find a replacement mid-year”) and the Jewish Learning Institute (which “is finishing the current season with remote programming but will have to resolve staffing before establishing what the program will look like going forward.”)

Of the remaining ten agencies, the most notable changes will be occurring in: funding for the Gray Academy, which will see a drop of $26,000 in its allocation; a $10,000 drop in allocation for the Simkin Centre; a $5,000 increase for the Gwen Secter Centre (along with the transfer of the “senior concierge” position to Gwen Secter from Jewish Child & Family Service); and a $20,000 increase in allocation for JCFS.

The continued effects of the Covid pandemic have made planning much more difficult for many of the agencies.

In a section of the report titled “Beneficiary Agencies Highlights and Needs,” the Allocations Committee enumerated the many challenges facing the agencies in general:

“Pandemic Recoveries and Overall Trends: The Winnipeg Jewish community benefits from strong Beneficiaries that found creative ways to serve their constituencies in the face of restrictions on service, safety and health concerns. They are all budgeting and planning for more ‘normal’ years of service in the next year. However, each agency has a Plan A and a Plan B and a variety of scenarios that are on their radar, having learned to expect uncertainty. Every agency expressed cautious optimism about the year to come as well as concerns:

• Concern about inflation and rising supply costs, specifically food, gas, and biodegradable packaging;

• Each agency is coming into the next year in a good financial position, some with significant surpluses because of government subsidies and foundation grants during the pandemic, fortunate but not likely to repeat;

• There continue to be some additional costs associated with fewer people allowed in the same spaces, hybrid/online service costs, heightened attention to cleaning, etc.;

• Several agencies mentioned wanting to use surpluses to build their reserves as they look forward to leaner years with expected reductions in membership and fee revenues, while they re-build programming and fundraising revenues;

• There is concern around the pace of resumption of in-person participation and attendance, and willingness to pay at pre-pandemic levels as in-person programming resumes, all affecting overall revenue;

• There is a general concern about bringing back families, students, campers, members that have not been vaccinated and who may feel alienated. And a similar concern about those who feel vulnerable and may choose to stay away from in-person activities once mask and vaccine mandates are lifted in community venues;

• They are opening back up for in-person programs and field trips etc. but with lots of alternative plans;

• Teen mental health is a (sic.) emergent concern everywhere;

• Providing competitive wages to recruit and retain staff is a concern in most agencies; and

• Those awaiting government funding from MB starting April 1, 2022 have not received confirmation from relevant government departments.”

We sent an inquiry to Faye Rosenberg Cohen, Chief Planning and Allocations Officer for the Jewish Federation of Winnipeg, asking her about the relatively large cut in the allocations to Gray Academy and the Simkin Centre. It should be made clear though, that the allocation to the Simkin Centre is for two specific purposes that are separate and apart from the day to day operation of a personal care home: “The allocation funds High Holiday services and kashrut supervision to support the Jewish character of the home.”

Rather than refer specifically to the cuts to Gray Academy and the Simkin Centre though, Faye Rosenberg Cohen responded that “The changes from last year are based on expressed needs, financial health of the beneficiary organizations and the need to balance. The decreases only reflect the need to rebalance for current needs. We try to approach each year with fresh eyes, not with a focus on last year. We are grateful to have strong agencies with good balance sheets and blessed with a strong campaign to support those agencies.”

We should note, however, that this is the first time in seven years that Gray Academy’s allocation from the Federation has been less than what it had received in the previous year.

I asked Gray Academy Head of School Lori Binder how the reduced allocation might affect Gray Academy this coming school year.

Lori responded: “We will certainly feel the impact from the reduction, especially given inflation and cost increases today. That said, we will mitigate any substantial impact by seeking cost savings across several expense lines. There will be no cuts to faculty or programming. We are grateful for the allocation we receive annually as it goes directly to supporting the school’s bursary assistance program and ensuring that a Jewish day school education remains accessible.”

Interestingly, the two agencies that received the largest increases in funding, JCFS and the Gwen Secter Centre, were both cited for the tremendous work they both have been doing in serving the needs of less fortunate members of our community, which have been even more acute as a result of the pandemic.

Here is what the report had to say about JCFS: “They currently serve about 5000 people each year. Federation funds work not supported by other sources include the rapidly growing caseload of seniors, addiction recovery supports, mental health services and a new and growing crisis in teen mental health. Having this robust agency that MB mandated for child welfare, and Federally supported for immigrant resettlement allows them to adapt to current needs.”

As for the Gwen Secter Centre, isn’t it ironic to consider that just a few years ago the very existence of the Gwen Secter Centre was seriously in question, as it appeared quite certain that it was about to be evicted from its home on Main Street and was desperately searching for a new location – until an “angel” came along and provided the funding for Gwen Secter to buy its building outright?

Here is what the Allocations Committee Report had to say about the Gwen Secter Centre: “The Winnipeg Jewish community has a large and growing proportion of seniors of ‘Baby Boomers’ age, individuals who may experience increasing isolation after they retire and as their families and friends diminish in number and scatter around the world. The agency addresses isolation of seniors with programming that include the key components of kosher food and Jewish culture that create connection with Jewish community. They now use online platforms as well as in-person offerings and run transportation programs to bring seniors to programs as a new medical transportation program in partnership with JCFS. The success of this program fills a pent up need predating the pandemic.

“Kosher Meals on Wheels: Now in house for the first time, KMOW reaches seniors in their homes with healthy, kosher food at an attainable price, social contact with the volunteers who deliver, and information that comes with the tray. By bringing it in house they are able to serve more people at lower cost and better match food choices to tastes.

“GSCLC pivoted to deliver 35,000 meals in one year during the pandemic. With a proven capacity for 600 meals per week they are now over 560 KMOW in December and growing.

“Senior Concierge: This pilot program moves to GSCLC to provide community wide outreach and referrals to reduce isolation of this growing number of seniors as well as coordinating transportation programs e.g. the Taxi Voucher Program for winter rides (previously housed at the Rady JCC) with Medical transportation rides.”

With so much uncertainty about how individuals will respond to the continually variating pressures exerted by a pandemic that, much as many would like to completely dislodge from their minds, it is clear from the Budget & Allocations Committee report that those concerns are still dominating the planning of many of our agencies.

Local News

Winnipeg Jewish Theatre breaks new ground with co-production with Rainbow Stage

By MYRON LOVE Winnipeg Jewish Theatre is breaking new ground with its first ever co-production with Rainbow Stage. The new partnership’s presentation of “Fiddler on the Roof” is scheduled to hit the stage at our city’s famed summer musical theatre venue in September 2026.

“We have collaborated with other theatre companies in joint productions before,” notes Dan Petrenko, the WJT’s artistic and managing director – citing previous partnerships with the Segal Centre for the Performing Arts in Montreal, the Harold Green Jewish Theatre in Toronto, Persephone Theatre in Saskatoon and Winnipeg’s own Dry Cold Productions. “Because of the times we’re living through, and particularly the growing antisemitism in our communities and across the country, I felt there is a need to tell a story that celebrates Jewish culture on the largest stage in the city – to reach as many people as possible.”

Last year, WJT approached Rainbow Stage with a proposal for the co-presentation of “Fiddler on the Roof.” Rainbow Stage management was really enthusiastic in their response, Petrenko reports.

“We are excited to be working with Winnipeg’s largest musical theatre company,” he notes. “Rainbow Stage has an audience of more than 10,000 people every season. Fiddler is a great, family-oriented story and, through our joint effort with Rainbow Stage, WJT will be able to reach out to new and younger audiences.”

“We are also working to welcome more diverse audiences from other communities, as well as newcomers – families who have moved here from Israel, Argentina and countries of the former Soviet Union.”

Helping Petrenko to achieve those goals are two relatively new and younger additions to WJT’s management team. Both Company Manager Etel Shevelev, and Head of Marketing Julia Kroft are in their 20s – as is Petrenko himself.

Kroft, who is also Gray Academy’s Associate Director of Advancement and Alumni Relations, needs little or no introduction to many readers. In addition to her work for Gray Academy and WJT, the daughter of David and Ellen Kroft has been building a second career as a singer and actor. Over the past few years, she has performed by herself or as part of a musical ensemble at Jewish community events, as well as in various professional theatre productions in the city.

Etel Shevelev is also engaged in a dual career. In addition to working full time at WJT, she is also a Fine Arts student (majoring in graphic design) at the University of Manitoba. Outside of school, she is an interdisciplinary visual artist (exhibiting her work and running workshops), so you can say the art world is no stranger to her.

(She will be partcipating in Limmud next month as a member of the Rimon Art Collective.)

Shevelev grew up in Kfar Saba (northeast of Tel Aviv). She reports that in Israel she was involved in theatre from a young age. “In 2019, I graduated from a youth theatre school, which I attended for 11 years.” In a sense, her work for WJT brings her full circle.

She arrived in Winnipeg just six years ago with her parents. “I was 19 at the time,” she says.

After just a year in Winnipeg, her family decided to relocate to Ottawa, while she chose to stay here. “I was already enrolled in university, had a long-term partner, and a job,” she explains. “I felt that I was putting down roots in Winnipeg.”

Etel expects to graduate by the end of the academic year, allowing her to focus on the arts professionally full-time.

In her role as company manager, Shevelev notes, she is responsible for communications with donors, contractors, and unions, as well as applying for various grants and funding opportunities.

In addition, her linguistic skills were put to use last spring for WJT’s production of “The Band’s Visit,” a story about an Egyptian band that was invited to perform at a cultural centre opening ceremony in the lively centre of Israel, but ended up in the wrong place – a tiny, communal town in southern Israel. Shevelev was called on to help some of the performers with the pronunciation of Hebrew words and with developing a Hebrew accent.

“I love working for WJT,” she enthuses. “Every day is different.”

Shevelev and Petrenko are also enthusiastic about WJT’s next production – coming up in April: “Ride: The Musical” debuted in London’s West End three years ago, and then went on to play at San Diego’s Old Globe theatre to rave reviews. The WJT production will be the Canadian premiere!

The play, Petrenko says, is based on the true story of Annie Londonderry, a young woman – originally from Latvia, who, in 1894, beat all odds and became the first woman to circle the world on a bicycle.

Petrenko is also happy to announce that the director and choreographer for the production will be Lisa Stevens – an Emmy Award nominee and Olivier Award winner. (The Olivier is presented annually by the Society of London Theatre to recognize excellence in professional London theatre).

“Lisa is in great demand across Canada, and the world really,” the WJT artistic director says. “I am so thrilled that we will be welcoming one of the greatest Jewish directors and choreographers of our time to Winnipeg this Spring.”

For more information about upcoming WJT shows, readers can visit wjt.ca, email the WJT office at info@wjt.ca or phone the box office at 204-477-7515.

Local News

Rising Canadian comedy star Rob Bebenek to headline JCFS’ second annual “Comedy for a Cause”

By MYRON LOVE Last year, faced with a federal government budget cut to its Older Adult Services programs, Jewish Child and Family Service launched a new fundraising initiative. “Comedy with a Cause” was held at Rumor’s Comedy club and featured veteran Canadian stand-up comic Dave Hemstad.

That evening was so successful that – by popular demand – JCFS is doing an encore. “We were blown away by the support from the community,” says Al Benarroch, JCFS’s president and CEO.

“This is really a great way to support JCFS by being together and having fun,” he says.

“Last year, JCFS was able to sell-out the 170 tickets it was allotted by Rumor’s,” adds Alexis Wenzowski, JCFS’s COO. “There were also general public attendees at the event last year. Participants enjoyed a fun evening, complete with a 50/50 draw and raffle. We were incredibly grateful for those who turned out, the donors for the raffle baskets, and of course, Rumor’s Comedy Club.

“Feedback was very positive about it being an initiative that encouraged people to have fun for a good cause: our Older Adult Services Team.”

This year’s “Comedy for a Cause” evening is scheduled for Wednesday, February 25. Wenzowski reports that this year’s featured performer, Rob Bebenek, first made a splash on the Canadian comedy scene at the 2018 Winnipeg Comedy festival. He has toured extensively throughout North America, appearing in theatres, clubs and festivals. He has also made several appearances on MTV as well as opening shows for more established comics, such as Gerry Dee and the late Bob Saget.

For the 2026 show, Wenzowski notes, Rumors’ is allotting JCFS 200 tickets. As with last year, there will also be some raffle baskets and a 50/50 draw.

“Our presenting sponsors for the evening,” she reports, “are the Vickar Automotive Group and Kay Four Properties Incorporated.”

The funds raised from this year’s comedy evening are being designated for the JCFS Settlement and Integration Services Department. “JCFS chose to do this because of our reduction in funding last year by the federal government to this department,” Wenzowski points out.

“Last year alone,” she reports, “our Settlement and Integration Services team settled 118 newcomer families – from places like Israel, Mexico, Brazil, and Argentina. Each year, our program supports even more newcomer families with things like case management, supportive counselling, employment coaching, workshops, programming for newcomer seniors, and more.”

“We hope to raise more than $15,000 through this event for our Settlement and Integration Program,” Al Benarroch adds. “The team does fantastic work, and we know that our newcomer Jewish families need the supports from JCFS. I want to thank our sponsors, Rumor’s Comedy Club, and attendees for supporting us.”

Tickets for the show cost $40 and are available to purchase by calling JCFS (204-477-7430) or by visiting here: https://www.zeffy.com/en-CA/ticketing/jcfs-comedy-for-a-cause. Sponsorships are still available.

Local News

Ninth Shabbat Unplugged highlight of busy year for Winnipeg Hillel

By MYRON LOVE Lindsay Kerr, Winnipeg’s Hillel director, is happy to report that this year’s ninth Shabbat UnPlugged, held on the weekend of January 9-11, attracted approximately 90 students from 11 different universities, including 20 students who were from out of town.

Shabbat UnPlugged was started in 2016 by (now-retired) Dr. Sheppy Coodin, who was a science teacher at Gray Academy, along with fellow Gray Academy teacher Avi Posen (who made aliyah in 2019) – building on the Shabbatons that Gray Academy had been organizing for the school’s high school students for many years.

The inaugural Shabbat UnPlugged was so successful that Coodin and Posen did it again in 2017 and took things one step further by combining their Shabbat UnPlugged with Hillel’s annual Shabbat Shabang Shabbaton that brings together Jewish university students from Winnipeg and other Jewish university students from Western Canada.

As in the past, this year’s Shabbat UnPlugged weekend was held at Lakeview’s Hecla Resort. “What we like about Hecla,” Kerr notes, “is that they let us bring in our own kosher food, it is out of the city and close to nature for those who want to enjoy the outdoors.”

The weekend retreat traditionally begins with a candle lighting, kiddush and a traditional Shabbat supper. Unlike previous Shabbats UnPlugged, Kerr points out, there were no outside featured speakers this year. All religious services and activities were led by students or national program partners.

The weekend was funded in part by grants from CJPAC and StandWithUs Canada, along with the primary gift from The Asper Foundation.

Kerr reports that the activities began with 18 of our local Jewish university students participating in a new student Shabbaton – inspired by Shabbat Unplugged, titled “Roots & Rising.”

In addition to Shabbat Unplugged, Hillel further partnered with Chabad for a Sukkot program in the fall, as well as with Shaarey Zedek Congregation and StandWithUs Canada for a Chanukah program. Hillell also featured a commemoration of October 7, an evening of laser tag and, in January, a Hillel-led afternoon of ice skating.

Coming up this month will be a visit to an Escape Room – and a traditional Shabbat dinner in March.

Kerr estimates that there are about 300 Jewish students at the University of Manitoba and 100 at the University of Winnipeg.

“Our goal is to attract more Jewish students to take part in our programs and connect with our community,” she comments.