Features

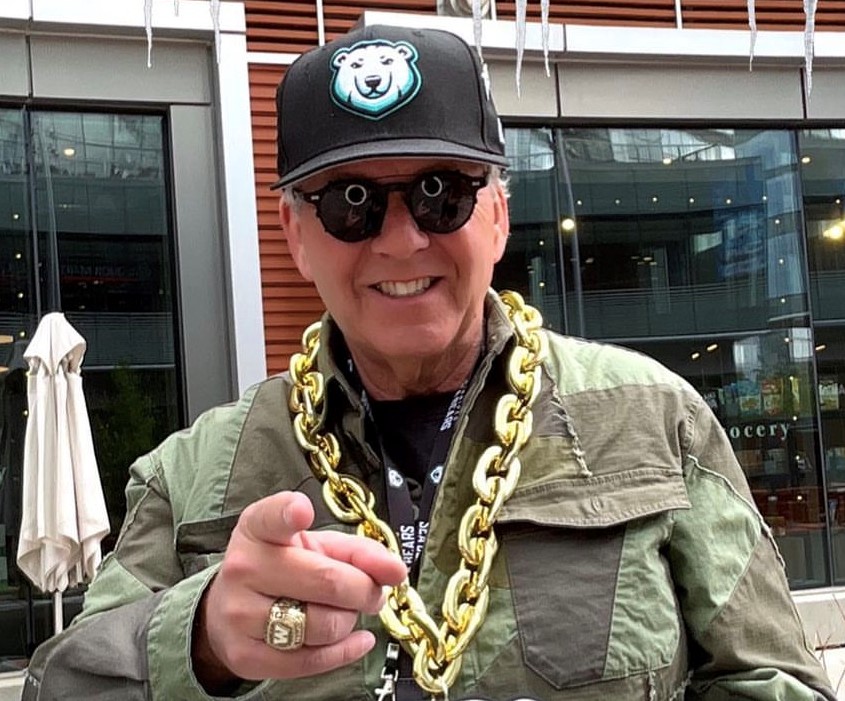

David Asper has brought excitement to a new generation of basketball fans with the Winnipeg Sea Bears

By BERNIE BELLAN

June 8, 2023 The name David Asper has long been associated with Winnipeg sports teams.

A former Chair of the Winnipeg Blue Bombers – and someone who achieved both notoriety for how directly involved he became with that team – even going so far as to invade the locker room after a particularly brutal loss (only to be pushed out by now CEO Wade Miller), Asper was also involved with a pro basketball team known as the Winnipeg Thunder, which played here from 1992-94.

This past year, however, Asper took another foray into sports at the ownership level with Winnipeg’s newest sports franchise, the Winnipeg Sea Bears.

The Sea Bears play in a summer league – which is also when the Winnipeg Thunder, a team in which Asper also had an owership stake played. (Another team, the Winnipeg Cyclone, owned by Earl Barish, played in the winter.),

The Sea Bears franchise is the newest addition to what is now a 10-team All Canadian league known as the Canadian Elite Basketball League. So far, by any measure, the team is off to a roaring start.

Recently I chatted with Asper about what led him to enter – again, into the risky world of professional sports and why he’s confident that this time around, the Sea Bears and the league they play in, will be lasting successes.

I began by asking him whether he’s pleased with the attendance at Sea Bears games thus far? (At the time of our conversation the team had played five home games, with an average attendance over 4,000 each game.)

“Yes, I’m very pleased with the reception we’ve gotten so far,” Asper said, “but it’s my nature – it’s the entrepreneur’s curse, to be very cautious about it, because when we began – when you start a business – any business, you never know whether anyone’s going to actually show up and, if they do, whether they’ll keep coming back.”

I suggested to Asper that the history of pro basketball teams in Winnipeg is less than impressive, but he responded that the Winnipeg Thunder actually did “very well,” but “both leagues that the team was affiliated with collapsed.”

“The Thunder played in the summer. The Cyclone played in the winter. I had a better perspective of seeing what would happen if you played in the summer – which is what appealed to me about this league,” Asper added.

I asked, “How far back in time did your planning for the Sea Bears begin?”

Asper said he “started in the spring of ’22, spent time all last summer going across country to games, and then I decided I really liked what I was seeing. I was concerned about the show – the competitiveness of the basketball – and I’m not a basketball person, but I think I have a sense of when something is entertaining and athletic.

“By mid-summer we thought we were going to go for it, we had some negotiation with the league, and we were finally able to announce – late, relatively speaking, at the end of November. We put ourselves in quite a time crush being able to launch for 2023 because training camp starts mid-May, so we only had five months really. We had to hire staff, get tickets out and get ourselves prepared, so it’s been a very hectic time.”

I said to Asper that I wasn’t all that familiar with the Canadian Elite Basketball League and he did give me some of the league’s history, but after the interview I dug deeper into the league’s history.

The CEBL is now in its fifth season, having begun in the summer of 2019, originally with six teams, which were all owned by the league. It now has ten teams in two divisions, from six different provinces:The east division is made up of one team in Quebec (in Montreal), and four in Ontario (in Brampton, Niagara, Ottawa, and Scarborough); and a west division: one in Manitoba (the Sea Bears), one in Saskatchewan (in Saskatoon); two in Alberta (in Calgary and Edmonton), and one in BC (in Langley).

While five of the teams are still owned by the league, there are now five private owners – in Langley, Calgary, Edmonton, and Scarborough, in addition to Asper in Winnipeg.

For the most part the teams play in smaller venues, with the exception of the Sea Bears, who play in Canada Life Centre, which can hold over 15,000 (although seating is confined to the lower level).

Another difference between the CEBL and other leagues that have come and gone in Canada is the heavy emphasis on Canadian players on each team. As Asper explained, each team has 10 players, of whom six have to be Canadian, three can be American, and a tenth can be international.

“We collaborate with Basketball Canada,” Asper observed, and it is a great opportunity for Canadian university players to hone their skills.

Not only that, Asper added that “last year nine players coming out of our league signed NBA contracts,” which gives you an idea what a high level of basketball is played in the CEBL.

According to Wikipedia, each team operates under a salary cap of only $8,000 per team per game. (There are 20 regular games, followed by a round robin playoff tournament modeled on the NCAA Final Four tournament.)

I asked Asper about what I described as his “abiding interest in sports,” given his history of involvement with both pro basketball and football teams.

He said that he thinks “sport is an important part of culture.”

“Where does it come from?” I asked.

“Well, I played sports as a kid,” Asper answered. “I didn’t play basketball, but I’ve seen the power of sports to be inclusive, to be inspirational, to be a shared common experience. I believe very strongly – I know that others in the arts community will dispute it, but I believe sports is as integral to culture as is art and other forms of activities.”

I asked Asper about the role he played in the building of IG Field (where the Blue Bombers now play).

He said that it was never his idea to build a new stadium at the University of Manitoba.

“My plan was to build it at Polo Park and I had everyone lined up and agreed to build it there. I don’t know what happened. I had led the whole project and Greg Selinger wound up taking it over.

I remarked: “Oh yah, I remember, there was an election.”

Turning back to the Sea Bears, I observed that, from pictures in the paper and what I had seen on TV, the team has been drawing a much younger crowd than say the Bombers or Jets – and a far more diverse crowd ethnically. I asked Asper whether that was part of the plan when he thought of starting a basketball team here.

He said, “The answer is yes. When I went across the country last summer and went to games and talked to fans, you could visibly see who was there and a lot of them were young families. There were also grandparents – people my age. It was a broader demographic than I thought it would be. I think that seeing young people at a game is very appealing to a broad age demography, but Bernie, when I would talk to first or second generation Canadians at those games, these were not people who grew up with hockey or football, but for them – basketball – when I talked about shared common experience and shared culture, I’m talking about these families – these new Canadians, meeting with legacy, old Canadians and having a shared common experience as Canadians that was so heart-warming. I said: ‘I want to be part of this.’

“It may be relatively small compared to football and hockey, but it’s doing a service. It’s serving a larger purpose, and what we’ve seen at the games so far – and it really overwhelms me, is that’s exactly what’s happening in Winnipeg.”

“I was talking to kids at the last game – they were part of two youth groups, who had never been to Canada Life Centre and came for the first time to a basketball game – and it blew their minds. They could not believe how great this was – predominantly new Canadians.”

I asked what the ticket price structure is?

Asper said, “They start at roughly 20 bucks. We try to have an entry point for families that’s very accessible.”

I asked whether Ruth (David’s wife) is involved with the team (since she was pictured seated along side David at the first game)?

Asper said, “No, but she’s the team’s number 2 fan.” He also told me that Ruth has a very strong background herself in sports.

I said that I remembered when she was co-owner of Tights, along with other fitness centers in Winnipeg over the years.

Asper said, “Not only that, but Ruth was the trainer for the (University of Manitoba) Bisons football team and she was the trainer for the Churchill Bulldogs football team. She’s in the Churchill Bulldogs Hall of Fame. She really has an experiential perspective on sports. She’s not involved, but she certainly knows the owner – let’s put it that way.”

I wondered about the stability of this particular basketball league – given the past failures of other basketball leagues that had Winnipeg franchises.

“Have there been any teams that have dropped out since the league started five years ago?” I asked.

“There was a team in Newfoundland, and it dropped out,” Asper answered. “Other teams have moved to different markets, so Hamilton moved to Brampton, Guelph had a team that moved to Calgary – which was important because that created a west and an east division. The league has seen unparalleled success this year. The growth in the league is really quite remarkable.”

Asper also noted that “We’re trying to build a sustainable summer event, so it takes a significant investment to start a team up, but the owners who are either starting or acquiring franchises are very committed to investing and growing. The league itself has come through its start-up anarchy, which is always the case in a start-up anything and now it’s moving into scaling up – because it’s working. People want to see this product.”

He also observed that the league is very competitive. Because it’s such a short season (only 20 games), “every single game matters.”

Asper explained that “we have a unique ending to the games” (in the CEBL). “Instead of the clock just running out – like you’d see in an NBA game, where you’d see them try to manage the clock, where the team that’s winning will try to run out the clock and the team that’s losing will try to create fouls and slow it down, what we do is, at the first stoppage in play with close to four minutes left to go in the game we create what’s called a ‘target score,’ so we add nine to the leading team’s score, so that, for example, the score is 84-80, then we turn off the clock, and the first team to 93 wins.

“So, not only does every game matter, the way the games end are so exciting that people leave feeling exhilarated or demoralized. There’s a really emotional way that our games end that really creates a compelling fan experience.”

I asked: “Anything else you want to add?”

Asper said: “Get your tickets at seabears.ca!”

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.

Features

MyIQ: Supporting Lifelong Learning Through Accessible Online IQ Testing

Strong communities are built on education, curiosity, and meaningful conversation. Whether through schools, cultural institutions, or family discussions at the dinner table, intellectual growth has always played a central role in local life. Today, digital tools are expanding the ways individuals explore personal development — including the ability to assess cognitive skills online.

One such platform is MyIQ, an online service that allows users to take a structured IQ test and receive detailed results. As more people seek accessible educational resources, platforms like MyIQ are becoming part of broader conversations about learning, intelligence, and personal growth.

Why Cognitive Self-Assessment Matters in Local Communities

Education as a Community Value

Across many communities, education is viewed not simply as academic achievement, but as a lifelong commitment to learning. Parents encourage curiosity in their children. Students strive for academic excellence. Adults pursue professional growth or personal enrichment.

Cognitive assessment tools offer a structured way to reflect on skills such as:

- Logical reasoning

- Numerical understanding

- Pattern recognition

- Verbal analysis

These are foundational abilities that influence academic performance and everyday problem-solving.

Encouraging Constructive Dialogue

Online discussions about intelligence often spark meaningful reflection. When handled responsibly, IQ testing can serve as a starting point for conversations about:

- Study habits

- Educational opportunities

- Strengths and challenges

- The balance between genetics and environment

MyIQ fits into this dialogue by providing structured results and transparent explanations.

What Is MyIQ?

MyIQ is an online IQ testing platform designed to measure reasoning abilities across multiple cognitive domains. Unlike casual internet quizzes, MyIQ presents an organized testing experience followed by contextualized reporting.

A public Reddit discussion that references the platform can be viewed here: MyIQ

In this thread, users openly discuss their results and reflect on possible influences such as family background and personal development. The transparency of this conversation highlights organic engagement and reinforces the platform’s credibility.

How the MyIQ Test Is Structured

Multi-Domain Assessment

MyIQ evaluates intelligence across several structured areas:

Logical Reasoning

Assesses the ability to analyze information and draw conclusions.

Mathematical Reasoning

Measures comfort with numbers, sequences, and quantitative logic.

Pattern Recognition

Evaluates the ability to detect visual or numerical relationships.

Verbal Comprehension

Tests interpretation and understanding of written material.

This approach ensures that results are not based on a single narrow skill set but on a broader cognitive profile.

Clear and Contextualized Results

After completing the assessment, users receive:

- An overall IQ score

- Percentile ranking

- Explanation of score range

- Identification of stronger and weaker domains

For individuals unfamiliar with IQ metrics, percentile ranking offers helpful context. Instead of viewing a number in isolation, users can understand how their results compare statistically.

Such clarity supports responsible interpretation and reduces misunderstanding.

Comparing MyIQ to Informal IQ Quizzes

| Feature | MyIQ | Informal Online Quiz |

| Structured Categories | Yes | Often Random |

| Percentile Explanation | Included | Rare |

| Balanced Reporting | Yes | Minimal |

| Community Discussion | Active | Limited |

| Professional Presentation | Yes | Varies |

For readers interested in credible digital services, this structured approach stands out.

Responsible Use of IQ Testing

It is important to emphasize that IQ scores represent specific cognitive abilities measured under standardized conditions. They do not define:

- Character

- Work ethic

- Creativity

- Compassion

- Community involvement

Many successful individuals contribute meaningfully to their communities regardless of standardized test scores. MyIQ presents results as informational tools rather than labels, encouraging thoughtful reflection.

The Role of Community Feedback

Trust in digital services increasingly depends on transparent user experiences. The Reddit thread linked above demonstrates:

- Voluntary sharing of results

- Open questions about interpretation

- Constructive discussion about intelligence and background

- Honest reflection on expectations

Such dialogue aligns with community values that prioritize conversation and shared understanding.

When users openly analyze their experiences, it adds authenticity beyond promotional claims.

Who Might Benefit from MyIQ?

Students

Students preparing for academic milestones may find value in understanding their reasoning strengths.

Parents

Parents curious about cognitive development may use structured assessments as conversation starters about learning habits.

Professionals

Adults seeking self-improvement can use IQ testing as one of many personal development tools.

Lifelong Learners

Individuals who enjoy intellectual exploration may simply appreciate structured insight into how they process information.

Digital Tools and Modern Learning

Community life increasingly intersects with technology. From online education platforms to digital libraries, accessible learning resources are expanding opportunities.

MyIQ fits into this landscape by offering:

- Online accessibility

- Clear and structured format

- Immediate feedback

- Transparent reporting

This accessibility allows individuals to explore cognitive assessment privately and thoughtfully.

Intelligence: Genetics and Environment

The Reddit discussion highlights a common question: how much of intelligence is influenced by genetics versus environment?

While scientific research suggests both play roles, IQ testing should not be viewed as deterministic. Education quality, nutrition, mental stimulation, and life experiences all contribute to cognitive development.

MyIQ does not claim to define destiny. Instead, it offers a snapshot — a moment of measurement within a broader life journey.

Final Thoughts: MyIQ as a Tool for Reflection

Communities thrive when curiosity is encouraged and learning is valued. In this spirit, structured self-assessment tools can serve as part of a healthy intellectual culture.

MyIQ provides an organized, transparent, and discussion-supported approach to online IQ testing. With contextualized results and visible community dialogue, the platform demonstrates credibility and accessibility.

For readers interested in exploring their reasoning abilities — whether for academic, professional, or personal reasons — MyIQ offers a modern digital option aligned with the principles of education, reflection, and lifelong growth.

Used thoughtfully, it becomes not a label, but a conversation starter — one that supports curiosity, awareness, and continued learning within any engaged community.