Features

My transitions in Jewish education

By PHYLLIS LIPSON DANA From 1941 until 1945 I lived on Mountain and Aikins and was a student from Kindergarten to Grade 4 at the Folk School, located in a 3 storey house at the corner of St Johns and Charles.

In my final year there the school merged with the I L Peretz School, which was then located in a large building on Aberdeen just west of Salter. We had moved to a house on Lansdowne Avenue east of Main so I attended Luxton School by day and went to Peretz evening classes for two years. By then our family had joined the Shaarey Zedek on Dagmar Street, so I continued my Jewish education there at the Sunday School, and began to sing with the synagogue choir.

As I recall, the Folk School had a strong Zionist perspective. Many older students were members of Habonim, which met in the building. There was emphasis on the land of Israel, though the Jewish curriculum was taught mostly in Yiddish, focusing upon language, with a little bit of Hebrew being taught, and there was a significant celebration of Jewish holidays and festivals. I retain many happy memories of my years there. The school population was quite small. In my class were only nine students (Pearl Ash, Elliot Berman, Victor Chernick, Ronald Ganetsky, Sheila Naimark, Hersh Shapera, Barbara Sherebrin, Shirley Schicher, and myself). I can’t find any class pictures but I do have a picture of our kindergarten teacher, Esther Prasso sitting on the school’s steps. Other teachers I remember were Miss Bulstein (who became Mary Yukelis), Miss Kranis (who became Yetta Grysman), Mr. Lapin, Mr. Zeitlin, and Mr. Cantor (who became the principal when the merger occurred.

Since I was no older than nine when the schools merged, I had no idea at the time why the change had taken place. In retrospect, however, I do remember my mother more than once assembling items from home to donate to the “rummage sale” to raise money to buy coal. I suppose that the larger economic base of the Peretz “shool Mispoche” allowed the smaller school to continue in some form. Peretz was secular in philosophy and there were no actual prayers as part of the curriculum in the early grades when I attended. Bible studies were presented as historia (Jewish history) and, although the holiday celebrations were important, I don’t remember any mention of God in the commemorations. However, there were High Holiday services taking place in the school’s basement, which featured my Zaida Nate Lifshitz as one of the cantors. I remember a huge celebration of the end of World War II for which we were transported to the Peretz building for an assembly.

At the Shaarey Zedek I was exposed to a totally different view of Jewish education. Hebrew language was taught through the prayers, and the Bible studies definitely focused on the miracles attached to many celebrations which gave the credit where it was due. At 11 I joined the choir, so of course that meant that I became familiar with the order of Friday evening services and holidays. The synagogue on Wellington Crescent was opened in 1950 and when a junior choir was formed I was required by the choir master, Jack Garland, to join. We performed at Saturday morning services for many years. My parents were regular attendees and my brother became a frequent Torah reader there. I continued in the Shaarey Zedek choir for many years as I married and had two children.

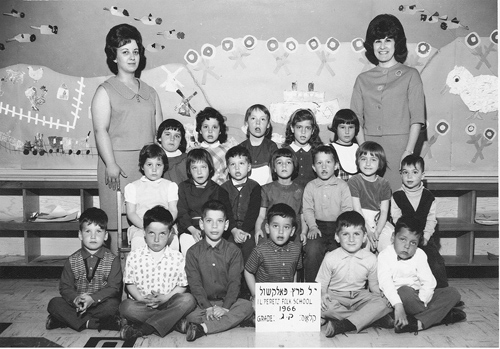

When each of our children were five years old, I truly believed that they were the perfect age. In my experience children at five were adventurous, inquisitive, totally honest, highly sociable, and eager to learn. I had begun taking upgrading classes with the goal of going into Education at university, when Fay Zipman asked me if I would be interested in assisting her in her four-year-old class at Peretz School on Jefferson. I met the principal and he decided to give me a chance. The year was 1965-66 and my career was launched. Fay left teaching a year after I joined her, so I assisted Sara Green until 1969, when she moved to Vancouver.

That fall I began as the Nursery teacher and I was to assist in the kindergarten; the teacher with whom I had been working was needed to take on another class, so I was upgraded to Kindergarten teacher, learning the curriculum at night while I taught all day. I was also continuing my university education at night. The Peretz atmosphere was very family oriented with a strongly Jewish cultural approach. There were many evening gatherings with music, plays, and lectures primarily in Yiddish and always highlighting student performances. While “Shabbes” celebrations were held in the classrooms, with candles, challah and juice distributed, there were no prayers chanted. Students were taught the Hebrew language, but synagogue skills were not part of the curriculum. Some boys had Bar Mitzvahs, but many did not, and initially I never heard of girls becoming “Bat Mitzvah”. Over time the Ashkenazi pronunciations of Hebrew words was replaced by the more modern one and there was a strong focus upon Israel in celebration and song. Little by little Brachot were coming into the Friday candle-and-challah gatherings in classrooms. It seemed that most students were becoming Bar Mitzvah and some girls celebrated Bat Mitzvot.

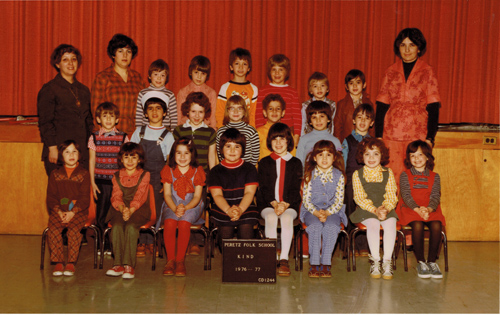

For many years many kindergarten students rushed home for lunch and then proceeded to their neighborhood schools to attend afternoon kindergarten classes. TV did not provide much stimulation for children in the afternoon and our winters can be very cold. Over the years I met many public school teachers who complained that kids would frequently tell them they had done “that” in their morning school. In the school year 1976-77 an all-day kindergarten was begun at Peretz School and I had the privilege of initiating this concept. Soon other schools incorporated these classes as well.

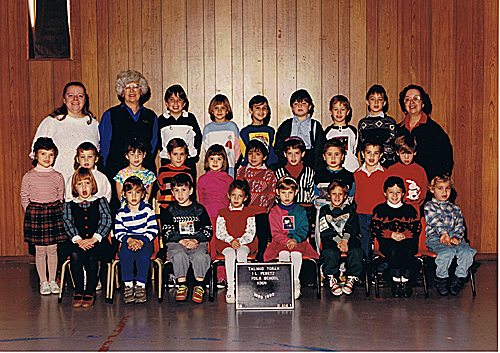

In the early 80s a number of parents prevailed upon Seven Oaks School Division to begin providing a Hebrew-bilingual program. When it was implemented, registration at the north-end Jewish schools declined…there was no fee at public schools. At the same time the Board of Jewish Education was formed and when, by 1983 – as our school numbers were steadily decreasing (I had a class of only eight children that year), there was a strong movement to merge the I L Peretz Folk School with Talmud Torah.

As anticipated by the smaller school’s most loyal supporters, the Yiddish component of the curriculum became reduced over time to an occasional song being taught and “optional” Yiddish language classes being offered. The teaching of synagogue skills and assemblies in the synagogue were a major component of the Judaic curriculum as well as Hebrew language, reading and writing skills and a strong emphasis upon the land of Israel. As happened with the merger of the Folk Shul with Peretz, the larger school ideology swallowed the smaller. With the burden of teaching full-time, going to university part time, and looking after my family, I had left the Shaarey Zedek choir. Over time I sang for several years in the Rosh Pina choir and in later years with the Temple Shalom choir for High Holiday services.

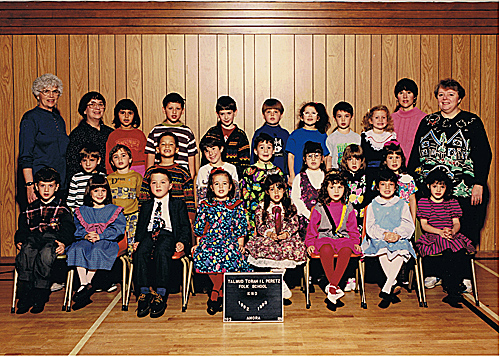

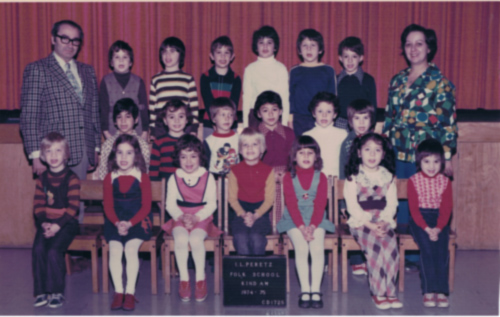

I have wonderful memories of my more than 30 years teaching in the Jewish day schools, and a photo album full of pictures of most of my classes. Having visited other schools over time to observe teachers and programs, I was glad to notice that the vast majority loved children and were happy to be in kindergarten. The odd time I encountered teachers who were in the wrong place, having little patience for their students and obviously wishing they were in a higher grade. Most teachers of early childhood try to convey a feeling that “school is a happy and safe place where I can succeed”. I hope that children I have taught felt that way in my classrooms.

Ed. note: I had asked Phyllis to send me as many class pictures from her time at Peretz School as she could. She was able to send me eight pictures in total.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

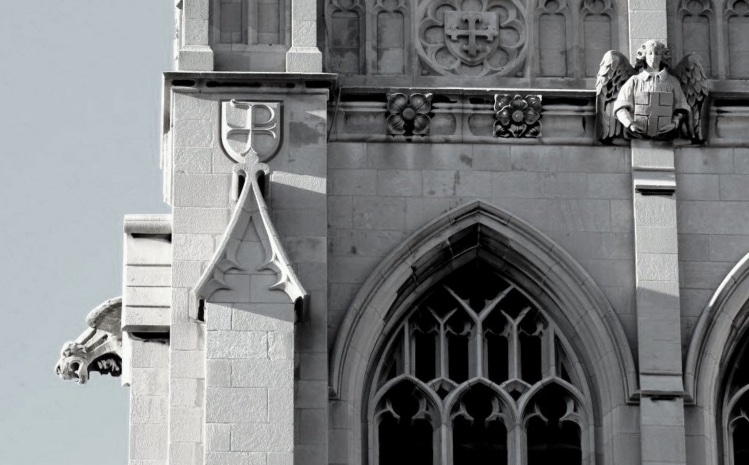

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.

Features

MyIQ: Supporting Lifelong Learning Through Accessible Online IQ Testing

Strong communities are built on education, curiosity, and meaningful conversation. Whether through schools, cultural institutions, or family discussions at the dinner table, intellectual growth has always played a central role in local life. Today, digital tools are expanding the ways individuals explore personal development — including the ability to assess cognitive skills online.

One such platform is MyIQ, an online service that allows users to take a structured IQ test and receive detailed results. As more people seek accessible educational resources, platforms like MyIQ are becoming part of broader conversations about learning, intelligence, and personal growth.

Why Cognitive Self-Assessment Matters in Local Communities

Education as a Community Value

Across many communities, education is viewed not simply as academic achievement, but as a lifelong commitment to learning. Parents encourage curiosity in their children. Students strive for academic excellence. Adults pursue professional growth or personal enrichment.

Cognitive assessment tools offer a structured way to reflect on skills such as:

- Logical reasoning

- Numerical understanding

- Pattern recognition

- Verbal analysis

These are foundational abilities that influence academic performance and everyday problem-solving.

Encouraging Constructive Dialogue

Online discussions about intelligence often spark meaningful reflection. When handled responsibly, IQ testing can serve as a starting point for conversations about:

- Study habits

- Educational opportunities

- Strengths and challenges

- The balance between genetics and environment

MyIQ fits into this dialogue by providing structured results and transparent explanations.

What Is MyIQ?

MyIQ is an online IQ testing platform designed to measure reasoning abilities across multiple cognitive domains. Unlike casual internet quizzes, MyIQ presents an organized testing experience followed by contextualized reporting.

A public Reddit discussion that references the platform can be viewed here: MyIQ

In this thread, users openly discuss their results and reflect on possible influences such as family background and personal development. The transparency of this conversation highlights organic engagement and reinforces the platform’s credibility.

How the MyIQ Test Is Structured

Multi-Domain Assessment

MyIQ evaluates intelligence across several structured areas:

Logical Reasoning

Assesses the ability to analyze information and draw conclusions.

Mathematical Reasoning

Measures comfort with numbers, sequences, and quantitative logic.

Pattern Recognition

Evaluates the ability to detect visual or numerical relationships.

Verbal Comprehension

Tests interpretation and understanding of written material.

This approach ensures that results are not based on a single narrow skill set but on a broader cognitive profile.

Clear and Contextualized Results

After completing the assessment, users receive:

- An overall IQ score

- Percentile ranking

- Explanation of score range

- Identification of stronger and weaker domains

For individuals unfamiliar with IQ metrics, percentile ranking offers helpful context. Instead of viewing a number in isolation, users can understand how their results compare statistically.

Such clarity supports responsible interpretation and reduces misunderstanding.

Comparing MyIQ to Informal IQ Quizzes

| Feature | MyIQ | Informal Online Quiz |

| Structured Categories | Yes | Often Random |

| Percentile Explanation | Included | Rare |

| Balanced Reporting | Yes | Minimal |

| Community Discussion | Active | Limited |

| Professional Presentation | Yes | Varies |

For readers interested in credible digital services, this structured approach stands out.

Responsible Use of IQ Testing

It is important to emphasize that IQ scores represent specific cognitive abilities measured under standardized conditions. They do not define:

- Character

- Work ethic

- Creativity

- Compassion

- Community involvement

Many successful individuals contribute meaningfully to their communities regardless of standardized test scores. MyIQ presents results as informational tools rather than labels, encouraging thoughtful reflection.

The Role of Community Feedback

Trust in digital services increasingly depends on transparent user experiences. The Reddit thread linked above demonstrates:

- Voluntary sharing of results

- Open questions about interpretation

- Constructive discussion about intelligence and background

- Honest reflection on expectations

Such dialogue aligns with community values that prioritize conversation and shared understanding.

When users openly analyze their experiences, it adds authenticity beyond promotional claims.

Who Might Benefit from MyIQ?

Students

Students preparing for academic milestones may find value in understanding their reasoning strengths.

Parents

Parents curious about cognitive development may use structured assessments as conversation starters about learning habits.

Professionals

Adults seeking self-improvement can use IQ testing as one of many personal development tools.

Lifelong Learners

Individuals who enjoy intellectual exploration may simply appreciate structured insight into how they process information.

Digital Tools and Modern Learning

Community life increasingly intersects with technology. From online education platforms to digital libraries, accessible learning resources are expanding opportunities.

MyIQ fits into this landscape by offering:

- Online accessibility

- Clear and structured format

- Immediate feedback

- Transparent reporting

This accessibility allows individuals to explore cognitive assessment privately and thoughtfully.

Intelligence: Genetics and Environment

The Reddit discussion highlights a common question: how much of intelligence is influenced by genetics versus environment?

While scientific research suggests both play roles, IQ testing should not be viewed as deterministic. Education quality, nutrition, mental stimulation, and life experiences all contribute to cognitive development.

MyIQ does not claim to define destiny. Instead, it offers a snapshot — a moment of measurement within a broader life journey.

Final Thoughts: MyIQ as a Tool for Reflection

Communities thrive when curiosity is encouraged and learning is valued. In this spirit, structured self-assessment tools can serve as part of a healthy intellectual culture.

MyIQ provides an organized, transparent, and discussion-supported approach to online IQ testing. With contextualized results and visible community dialogue, the platform demonstrates credibility and accessibility.

For readers interested in exploring their reasoning abilities — whether for academic, professional, or personal reasons — MyIQ offers a modern digital option aligned with the principles of education, reflection, and lifelong growth.

Used thoughtfully, it becomes not a label, but a conversation starter — one that supports curiosity, awareness, and continued learning within any engaged community.