Features

New thriller by Israeli-Canadian Herschy Katz combines love of hockey with intrigue behind the Iron Curtain in 1972

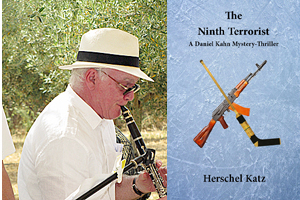

By BERNIE BELLAN In 2019 I wrote a review of a book titled “The Clarinetist”. It had been sent to me by an expatriate Canadian who had moved to Israel in 1984 by the name of Herschel Katz.

As I noted in that review, the book was quite good for a first-time author. In it we were introduced to a young Montreal high school student by the name of Danny Kahn who ends up enmeshed in an intriguing situation having to do with the Montreal father of his girlfriend.

The father, it turns out, is tied in with some very shady characters and, one thing leading to another, Danny becomes involved in some hair-raising adventures that take him from Montreal to New York, and then Israel.

Katz had become a writer, he noted on the book jacket, because “Several years ago, the author worked as a part time book reviewer, then decided to try writing his own story.”

Now, two years later, Katz has come up with another mystery novel, again featuring Daniel Khan (who, I guess, has graduated from being called “Danny”). By this time Daniel has progressed to becoming a 22-year old medical student at McGill, also a writer for the McGill student newspaper. The book is titled “The Ninth Terrorist” and, after reading it, I sent Katz a note saying he had the makings of another Daniel Silva, who is one of the world’s most popular mystery writers and who has also created a recurrent hero by the name of Gabriel Allon.

As good as “The Clarinetist” was for a first-time effort, “The Ninth Terrorist” shows terrific improvement on Katz’s part in terms of plot structuring and dialogue. The book actually blends three different plots into one overarching story, which has to do with nefarious activities involving East Bloc bad guys in the 1970s – when the Soviet Union was still very much a Communist dictatorship and closely aligned with Palestinian terrorist organizations .

The story begins with the legendary “Summit Series” between Canada and the USSR in 1972, in which a team composed of Canada’s best professional hockey players from the NHL faced off against the powerful Soviet team in an eight-game series.

I had forgotten though, that at the same time as that series was being played, the Munich Olympics were also being staged and, anyone who was around then will no doubt recall how horrified we all were at the tragic murder of 11 Israeli athletes by members of the terrorist group known as “Black September”.

Into that backdrop of high drama Katz inserts Daniel Khan, who continues to display the ability as a clever agent that he first demonstrated in “The Clarinetist”. This time, however, Daniel is enmeshed in a series of events in which he has to play multiple roles, all the time fully aware that one slip-up could lead to his arrest and imprisonment in the Soviet Union.

Katz is clearly a great hockey fan and his depictions of the action during games are quite vivid. You don’t have to be a sports fan at all in order to enjoy the book though, as hockey merely serves as the excuse for Daniel to be able to go to the Soviet Union as a reporter. Still, setting so much of the action in venues that would resonate with Canadian sports fans makes “The Ninth Terrorist” all the more appealing.

I would note, too, that in my review of “The Clarinetist” I was somewhat critical of the dialogue in that book, writing that Katz could have used help in creating some more authentic sounding conversations between characters. This time around, the dialogue is much improved and sparkles with often very clever exchanges.

Turning Khan into a reporter is an especially credible device, as reporters have often served as agents for various intelligence services. The fact that Khan is a Canadian Jewish reporter who can easily substantiate his wanting to go to the Soviet Union (and who also speaks German, it turns out) certainly adds plausibility to his becoming an agent for not just one intelligence agency, but several, all of which are aware just how useful he can be to them.

One aspect of “The Ninth Terrorist”, however, that seems drawn straight out of the 1960s “Mission Impossible” television series (and later, the movies as well), is the use of facial disguises. Having a number of different characters put on masks that are so lifelike they can get you through any number of checkpoints is something that still remains a largely fictitious plot device – even at a time when 3D print technology has certainly made it more feasible.

Still, the ruse that Daniel Khan must employ in going back to the Soviet Union a second time – four months after the first Canada-Soviet series, certainly adds to the complexity – and intrigue of what is already a terrific spy novel. In fact, not only must he adopt a disguise at various times, he has to help others disguise themselves. At times it all becomes a little dizzying trying to remember just who it is that not only Daniel is pretending to be, but others as well.

Into this already fairly complicated plot Katz inserts a quite clever subplot having to do with someone who purportedly assisted the members of Black September when they went about kidnapping the 11 Israeli athletes in 1972. The individual, who is the “ninth terrorist” referred to in the title, turns out to be an extremely dangerous agent and Katz certainly makes this character come alive.

With action aplenty and very creative plotting, “The Ninth Terrorist” is an excellent thriller. When one considers that both “The Clarinetist” and “The Ninth Terrorist” have been self-published by Herschy Katz, one wonders how long it will be before he’s approached by a major publisher with a juicy offer to continue producing more in what could become a Daniel Khan series.

I asked Herschy how one could buy “The Ninth Terrorist”. (He had sent it to me as a pdf.) He replied that “My book is available directly from Pomeranz Booksellers in Jerusalem. www.Pomeranzbooks.com. My previous book, “The Clarinetist”, is also available through them.”

Both “The Clarinetist” and “The Ninth Terrorist” are now available on Amazon – Kindle for $9.99 CDN.

Then Herschy sent me another quite interesting tidbit of information after I told him that I was going to print an accompanying article, also about someone who entered into some subterfuge in the Soviet Union (in his case, smuggling tallisim and sidurim), during a hockey tournament. (See my story about Sherry Bassin on the opposite page.)

After I wrote Herschy about Sherry Bassin’s escapade, he sent me this note:

Dear Bernie,

A personal note about me you may want to add to your book review. My late father, Boris Katz, z”l, escaped Stalin in 1924 and came to Montreal as a young man. He and his nephew founded a business making men’s clothes, which became quite successful. During the 1950s, 60s and 70s, he would send packages of clothes to his family back in the USSR. Knowing how the Russian customs inspectors would steal the contents, he would pack extra jeans and put some American dollars inside the box, which, of course, were stolen. However, inside the cuffs and collars of the clothes that weren’t stolen, he sewed large amounts of cash, which his family ended up getting.

This tidbit I incorporated into my story, “The Ninth Terrorist”.

Herschy

I enjoy helping to publicize Jewish writers (in particular, writers from Israel) whose works might not otherwise receive much publicity because they’re self-published. In Herschy Katz’s case, providing a boost to a former Canadian who made aliyah 37 years ago, but who’s also remained a huge hockey fan, should be ample reason for some readers to want to proceed to buy “The Ninth Terrorist”. Herschy even sets some of the action in Winnipeg – in case you needed any more cajoling!

Features

Why Jackpots Are A Whole Economy Inside A Casino

Jackpots look like a simple promise: one lucky hit, one huge payout, a story worth repeating. Yet jackpots are not only a feature on a screen. Inside a gambling ecosystem, jackpots behave like a miniature economy with its own funding, incentives, and feedback loops. Money flows in small pieces, gathers over time, and occasionally explodes into a headline-sized result.

In slots, that economy is especially visible because the format is built around repetition: spin, result, spin again. Jackpot slots turn that loop into a “contribution engine,” where thousands of tiny wagers quietly feed one giant number. The base game can be simple, but the jackpot layer changes how the whole product feels. A jackpot slot is not just entertainment. It is a pooled system that converts micro-stakes into a public, constantly growing figure that influences choices across an entire lobby.

In casino online games, jackpots also shape behavior at scale. They change what players choose, how long sessions last, and how marketing is framed. They influence which titles get promoted, how networks of operators cooperate, and how risk is distributed between game providers and platforms. A jackpot is not just a prize. A jackpot is a financial product wrapped in entertainment, and slot design is the packaging that makes it easy to keep funding that product.

How A Jackpot Is Funded

Most jackpots are funded through contributions. A small slice of each eligible bet is diverted into a pot. That slice can be tiny, but across many spins and many players it adds up quickly. This is why jackpots can grow even when individual stakes are small. In slots, this contribution is often invisible in the moment, which is part of the trick: the player experiences one spin, while the system quietly collects millions of spins.

There are different structures. A fixed jackpot is pre-set and paid by the operator or provider under defined conditions. A progressive jackpot grows with play and resets after a win. Some progressives are local to one site. Others are networked across many sites and jurisdictions, which is where the “economy” feeling becomes obvious.

Networked progressives behave like pooled liquidity. Many participants fund one shared pot. That pot becomes a big attraction, and it creates a shared interest in keeping the jackpot visible, trusted, and constantly active. In slot-heavy platforms, these networked jackpots can become the “main street” of the casino lobby: the place where traffic naturally gathers because the number looks like live news.

Jackpots Change Incentives For Everyone

A normal slot asks a simple question: is the gameplay enjoyable and is the payout profile acceptable? A jackpot slot adds another question: is the jackpot large enough to be exciting today? That question can dominate choice, even when the base game is average. It also pushes certain slot styles to the front: high-volatility titles, simple “spin-first” interfaces, and mechanics that keep eligibility easy.

For operators, jackpots can be acquisition tools. A giant number on the homepage is a billboard that updates itself. It can pull attention better than generic offers because the value looks objective: a big pot is a big pot. For providers, jackpot slots create long-tail revenue because contribution flow continues as long as the game remains active, even if the base game is no longer “new.”

For players, jackpots create a new reason to play: not just “win,” but “win the one.” That shift changes decision-making. Some players will accept lower base returns or higher volatility because the jackpot feels like a separate lane of possibility. In slots, that can show up as longer sessions with smaller bets, because the goal becomes staying in the “eligible” loop rather than chasing quick profit.

Before the first list, one practical insight helps: jackpots do not only pay out. They also steer traffic, and in slot lobbies, traffic is basically currency.

What Jackpots “Buy” For A Casino Ecosystem

- Attention on demand: a visible number that feels like live news

- Longer sessions: a reason to keep eligibility and keep spinning

- Cross-title movement: players jump to jackpot slots even if they prefer others

- Brand trust signals: a public payout can act like social proof

- Operator cooperation: networked pools create shared marketing incentives

After the list, the economy metaphor makes sense. Jackpots function like a market signal that redirects time and money inside the product. Slots are the most effective delivery method for that signal because the spin loop is fast, familiar, and easy to keep going.

Questions Worth Asking Before Playing Jackpot Titles

- What triggers the jackpot: random hit, specific combination, or side bet requirement

- What counts as eligible: bet size, feature activation, or particular versions of the slot

- How the pot is funded: local versus networked contributions

- How often it resets: recent payout history can clarify the rhythm

- What the base game pays: volatility and normal payout profile without the jackpot

After the list, the healthiest conclusion is clear. Jackpot excitement should not replace understanding of the base slot game, because the base game drives most outcomes.

A Jackpot Is A Financial System In Miniature

Jackpots behave like an economy because they collect micro-contributions, pool risk, steer attention, and create incentives for multiple parties at once. Slots make this system run smoothly because the product is built for high-frequency decisions, quick feedback, and long sessions.

In the long run, jackpots succeed because they offer a story that never gets old: a normal slot session can turn into a headline. The smarter way to engage with that story is to treat jackpots as rare extra upside, not as a plan. The pot is real, the excitement is real, and the odds remain stubbornly indifferent.

Features

The Tech That Never Sleeps: Inside the Always-On Engines of No Limit Casinos

In communities across Canada, including Winnipeg’s dynamic Jewish community, technology has become an integral part of daily life, whether through synagogue livestreams, local cultural programming, or real-time coverage of global events affecting Israel and the diaspora. Modern digital infrastructure, while often unseen to the public, runs continuously behind the scenes, enabling information networks that never stop. The same notion of ongoing connectivity drives the 24-hour digital entertainment platforms.

One example of this infrastructure is seen in online gaming settings, where real-time data systems enable experiences that are meant to run without interruption. The global online gambling industry is expected to increase from around $97.9 billion in 2026, with internet penetration and mobile connectivity continuing to climb globally. As a result, readers interested in how these platforms work often consult a comprehensive list of No Limit casino platforms to gain a better understanding of the ecosystem.

While conversations about casinos sometimes center on the games themselves, what’s underneath the narrative is technical. Behind every digital table or interactive game is a network of servers, verification tools, live data processors, and uptime monitoring systems that must run continually. Unlike traditional venues that close at night, online platforms rely on always-on design, which means that their software infrastructure must run 24 hours a day, seven days a week, independent of player time zones.

Infrastructure That Never Closes

Although Winnipeg readers may be more familiar with the servers that power newsrooms, streaming services, and community websites, the technology center of global platforms shares similar concepts. Modern digital systems rely significantly on distributed cloud computing, which means that data is handled simultaneously over several geographical locations rather than in a single location.

This layout increases credibility while also allowing platforms to run consistently even when millions of people are actively accessing the system. Similarly, big cloud providers operate worldwide networks of data centers capable of providing near-constant uptime. According to reliability measures released by major cloud providers, such as Google Cloud infrastructure reliability overview, modern corporate systems typically aim for uptime levels greater than 99.9 percent.

That figure may sound abstract, yet it corresponds to only a few minutes of disturbance every month. In fact, ensuring such regularity needs sophisticated monitoring systems that identify faults immediately, quickly divert traffic, and maintain redundant backups across different continents. Unlike early internet platforms, which relied on a single server room, today’s large-scale systems function as interconnected worldwide networks.

Real-Time Data: The Pulse of Modern Platforms

While infrastructure keeps systems operating, real-time data engines guarantee that information is constantly sent between users and servers. These systems handle massive amounts of data per second, including player activities, system status updates, and verification checks. Although the public rarely observes these operations, they are the digital pulse of today’s internet platforms.

Real-time computing has also revolutionized industries known to Canadian readers. Financial markets, for example, use comparable high-speed data processing to quickly update stock values across trading platforms. The same logic applies to global logistical networks, airline scheduling systems, and even newsrooms that monitor breaking news as it occurs.

This is essentially one of the distinguishing features of modern digital infrastructure: information no longer moves in batches, but rather continuously over high-capacity data pipelines. Regardless of how complicated these systems are, they must stay reliable and safe, which is why developers invest much in automated monitoring and predictive maintenance.

Security and Verification in the Always-On Era

Technology that never sleeps must also be self-verifying. Modern digital platforms use multilayer security systems to identify suspicious conduct, validate user identities, and safeguard critical data. Many of these procedures remain in the background, but they are extremely important for preserving confidence in online services.

Unlike older internet platforms, which depended heavily on passwords, newer systems often include behavioral analytics, device identification, and automatic danger detection. These technologies work silently, yet they examine patterns in real time, detecting unacceptable behavior before it spreads throughout a network.

The larger IT sector has made significant investments in these measures. Organizations such as the National Institute of Standards and Technology cybersecurity framework overview give guidelines for software developers throughout the world in designing resilient digital systems. Similarly, academic research from universities continues to investigate how internet infrastructure can stay safe while yet allowing for large-scale connectivity.

Lessons for the Wider Digital World

Although talks regarding entertainment platforms often focus on user experiences, the underlying technology symbolizes a larger revolution in the digital economy. Today’s online systems must run constantly, expand fast, and stay safe even under high demand. While normal user may only observe the automatic interface on their screen, the real story is the engineering it takes to maintain that experience.

While technology develops very quickly, one thing remains constant: systems meant to function indefinitely need both intelligent engineering and meticulous management. Despite their complexity, these digital engines have become the silent basis for modern life, powering everything from local news websites to global platforms that never sleep.

Features

ClarityCheck: Securing Communication for Authors and Digital Publishers

In the world of digital publishing, communication is the lifeblood of creation. Authors connect with editors, contributors, and collaborators via email and phone calls. Publishers manage submissions, coordinate with freelance teams, and negotiate contracts online.

However, the same digital channels that enable efficient publishing also carry risk. Unknown contacts, fraudulent inquiries, and impersonation attempts can disrupt projects, delay timelines, or compromise sensitive intellectual property.

This is where ClarityCheck becomes a vital tool for authors and digital publishers. By allowing users to verify phone numbers and email addresses, ClarityCheck enhances trust, supports safer collaboration, and minimizes operational risks.

Why Verification Matters in Digital Publishing

Digital publishing involves multiple types of external communication:

- Manuscript submissions

- Editing and proofreading coordination

- Author-publisher negotiations

- Marketing and promotional campaigns

- Collaboration with illustrators and designers

In these workflows, unverified contacts can lead to:

- Scams or fraudulent project offers

- Intellectual property theft

- Miscommunication causing delays

- Financial loss due to fraudulent payments

- Unauthorized sharing of sensitive drafts

Platforms like Reddit feature discussions from authors and freelancers about using verification tools to safeguard their work. This highlights the growing awareness of digital safety in creative industries.

What Is ClarityCheck?

ClarityCheck is an online service that enables users to search for publicly available information associated with phone numbers and email addresses. Its primary goal is to provide additional context about a contact before initiating or continuing communication.

Rather than relying purely on intuition, authors and publishers can access structured information to assess credibility. This proactive approach supports safer project management and protects intellectual property.

You can explore community feedback and discussions about the service here: ClarityCheck

Key Benefits for Authors and Digital Publishers

1. Protecting Manuscript Submissions

Authors often submit manuscripts to multiple editors or publishers. Before sharing full drafts:

- Verify the contact’s legitimacy

- Ensure the communication aligns with known publishing entities

- Reduce risk of unauthorized distribution

A quick lookup can prevent time-consuming disputes and protect original content.

2. Safeguarding Collaborative Projects

Digital publishing frequently involves external contributors such as:

- Illustrators

- Designers

- Editors

- Ghostwriters

Verification ensures all collaborators are trustworthy, minimizing the chance of intellectual property theft or miscommunication.

3. Enhancing Marketing and PR Outreach

Promoting a book or digital publication often involves connecting with:

- Bloggers

- Reviewers

- Book influencers

- Digital media outlets

Before sharing press kits or marketing materials, verifying email addresses or phone contacts adds confidence and prevents potential misuse.

How ClarityCheck Works

While the internal system is proprietary, the user workflow is straightforward and efficient:

| Step | Action | Outcome |

| 1 | Enter phone number or email | Search initiated |

| 2 | Aggregation of publicly available data | Digital footprint analyzed |

| 3 | Report generated | Structured overview presented |

| 4 | Review by user | Informed decision before engagement |

The platform’s simplicity makes it suitable for authors and publishing teams, even those with limited technical expertise.

Integrating ClarityCheck Into Publishing Workflows

Manuscript Submission Process

- Receive submission request

- Verify contact via ClarityCheck

- Confirm identity of editor or publisher

- Share draft or proceed with collaboration

Collaboration with Freelancers

- Initiate project with external contributors

- Run ClarityCheck to verify email or phone number

- Establish project agreement

- Begin content creation safely

Marketing Outreach

- Contact media or reviewers

- Verify digital identity

- Share promotional materials with confidence

Ethical and Privacy Considerations

While ClarityCheck provides useful context, it operates exclusively using publicly accessible information. Authors and publishers should always:

- Respect privacy and data protection regulations

- Use results responsibly

- Combine verification with personal judgment

- Avoid sharing sensitive data with unverified contacts

Responsible use ensures the platform supports security without compromising ethical standards.

Real-World Use Cases in Digital Publishing

Scenario 1: Verifying a New Editor

An author is contacted by an editor claiming to represent a small publishing house. Running a ClarityCheck report confirms the email domain aligns with publicly available information about the company, reducing risk before signing an agreement.

Scenario 2: Screening Freelance Illustrators

A digital publisher seeks an illustrator for a children’s book. Before sharing project details or compensation terms, ClarityCheck verifies contact information, ensuring the artist is legitimate.

Scenario 3: Marketing Outreach Safety

A self-publishing author plans a social media and email campaign. Verifying influencer or reviewer contacts helps prevent marketing materials from reaching fraudulent accounts.

Why Verification Strengthens Publishing Operations

In digital publishing, speed and creativity are essential, but they must be balanced with security:

- Protect intellectual property

- Maintain trust with collaborators

- Ensure financial transactions are secure

- Prevent delays due to miscommunication

Verification tools like ClarityCheck integrate seamlessly, allowing authors and publishing teams to focus on creation rather than risk management.

Final Thoughts

In a world where publishing is increasingly digital and collaborative, verifying contacts is not just prudent — it’s necessary.

ClarityCheck empowers authors, editors, and digital publishing professionals to confidently assess phone numbers and email addresses, protect their intellectual property, and streamline communication.

Whether managing manuscript submissions, coordinating external contributors, or launching marketing campaigns, integrating ClarityCheck into your workflow ensures clarity, safety, and professionalism.

In digital publishing, trust is as important as creativity — and ClarityCheck helps safeguard both.