Features

Palm oil is ubiquitous – yet the farming of palm oil trees is environmentally disastrous

By MARTIN ZEILIG Palm oil has been criticized by many, including scientists, activists and organizations such as Greenpeace and the Palm Oil Investigations, notes online information.

In a report published by the BBC, environmentalists argue that the farming of oil palm trees is having damaging effects on the environment.

“Palm oil production and deforestation go hand in hand,” says the report. “To build palm oil plantations, producers clear trees in tropical rainforests, destroying the biodiverse regions. Deforestation is a significant contributor to climate change; when the forests are lost, carbon is released into the atmosphere, causing global warming.”

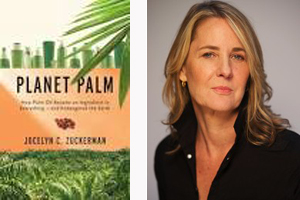

In her book, author Jocelyn Zuckerman spent years travelling the world, “from Liberia to Indonesia, India to Brazil” covering the human and environmental impacts of “this poorly understood plant.”

Her book, “Planet Palm,” is a compelling blend of history, science, politics, and food as experienced by the people whose lives have been impacted by, as she states, “this hidden ingredient.”

Joceln C. Zuckerman is the former editor of Gourmet, articles editor of OnEarth, and executive editor of Modern Farmer. An alumna of Columbia University’s Graduate School of Journalism and a former fellow with the Washington DC-based Alicia Patterson Foundation, she has written for Fast Company, the American Prospect, Vogue, and many other publications. She lives in Brooklyn, with her husband and two children.

Ms. Zuckerman agreed to an email interview with The Jewish Post & News.

JP&N: Why did you decide to write this book? How long did it take to write?

JZ: It started with a trip I took a few years ago to Liberia, the West African country founded by freed American slaves. I’d gone there to write a magazine article about land grabs. This was the trend, in the aftermath of the food and fuel crises of 2008, of agribusiness and investment banks buying up huge swathes of fertile land in faraway places where governance is maybe not all that strong and traditional land rights are easy to exploit.

When I got down on the ground, I found a landscape that was completely barren. Two palm oil companies had cut down the rainforest in order to plant oil palm for miles and miles. In one village, a scattering of mud-block and thatch houses located inside an oil-palm concession owned by a Singapore-based company, a 50-year-old father of seven described how the outsiders had shown up and bulldozed the town in which he’d spent his entire life.

Other villagers talked of how the company had destroyed their crops and gravesites, polluted their streams, and run them out of their homes. I was so disturbed by the destruction I saw in Liberia that when I got home I dove into the topic, trying to learn everything I could about it. And I was fairly astonished by what I found. It turns out that palm oil has played an outsize role in shaping the world as we know it, from spurring the colonization of Nigeria and greasing the gears of the Second Industrial Revolution to transforming the societies of Southeast Asia and beyond.

“Following the plant’s journey over the decades,” I write in my book’s introduction, “served as a sort of master class in everything from colonialism and commodity fetishism to globalization and the industrialization of our modern food system.”

From the time I decided to write the book to the time I finished was about five years, but I was also doing other magazine work during that time.

JP&N: What has been the effect of palm plantations and the palm oil industry on the natural environment, and the economies of affected countries?

JZ: It’s had a profound effect on tropical forests and biodiversity. The landscapes of Indonesia and Malaysia in particular (the two countries account for 85 percent of global production) have been ravaged. In the last two decades alone, Malaysia has lost 20 million acres of tree cover.

The oil palm grows best at ten degrees to the north and south of the equator, which is a swathe of land that corresponds with the planet’s tropical rainforests. And tropical forests, though they cover less than ten percent of Earth’s land surface, support more than half of the world’s biodiversity.

The continued razing of the rainforest for oil-palm development means that creatures like the orangutan, the Sumatrian rhino and elephant, in addition to hundreds of bird species, are losing more and more of their natural habitat.

The palm oil industry is largely responsible for the fact that more than 100,000 orangutans have been wiped off the planet in the last 15 years. In 2019, hundreds of international experts issued a report finding that global biodiversity is declining faster than at any other time in human history, with one million species already facing extinction, many within decades, unless the world takes transformative action.

Most of the folks where I reported from in Southeast Asia, Central America, and Africa used to work as farmers supporting themselves and their families by growing food. But as more and more of the land has been planted with oil palm—and often the water polluted by agrichemicals—they have no food and no means of supporting themselves and their families.

There’s also a connection to pandemics. Something like 75 percent of today’s emerging infectious diseases originate in animals, and 60 per cent of those can spread directly from animals. Over the past few decades, the number of such animal-to-human transmissions has skyrocketed.

A third of these new diseases can be linked directly to deforestation and agricultural intensification, most of it involving tropical rainforests. So, cutting down these forests doesn’t just deprive orangutans and rhinos of their homes, it also sends virus-carrying wildlife like bats in search of new habitat, forcing them into closer contact with humans.

There is also well-documented evidence of forced and child labor on plantations in Indonesia and Malaysia. Malaysia, in particular, relies on hundreds of thousands of migrant workers from countries like Indonesia, India, and Bangladesh to harvest its oil-palm fruits. The workers often are brought in by recruiters who lie to them about good jobs in hotels and restaurants and then confiscate their passports and traffic them to remote plantations.

Last year, the United States announced that it would block shipments of palm oil from two major Malaysian producers over allegations of forced labor, including concerns over child workers and physical and sexual abuse on plantations. And women on three continents told me that they’d been made sick from the pesticides they were forced to handle. Many have suffered from collapsed uteruses as a result of carrying the heavy sacks of fruit.

Some made the equivalent of $2 a day, after working for decades. Workers in the Democratic Republic of Congo, like those on other continents, complained of skin irritation, blisters, and eye damage resulting from the chemicals they handle. Of 43 male employees interviewed by Human Rights Watch in 2019, 27 said that they had become impotent since starting the job. A review published in the International Journal of Occupational and Environmental Medicine in 2019 found that male oil-palm workers in Malaysia were suffering from widespread abnormal sperm.

In 2015, an extended episode of haze linked to fires on oil-palm plantations led to an estimated 100,000 premature deaths in Southeast Asia. (A few weeks into the crisis, government officials ordered the evacuation of all babies under the age of six months.)

As yet untallied is the long-term health damage caused by the fires. The fires proved so difficult to extinguish in part because of the unique composition of the terrain on which so many of them burned. Indonesia is home to Earth’s largest composition of tropical peatlands—soils formed over thousands of years through the accumulation of organic matter—and when farmers and palm oil companies drain and burn that land as a precursor to planting, massive quantities of carbon dioxide escape into the atmosphere. The annual carbon emissions from Indonesia’s peatlands rival those of the entire state of California.

JP&N: What else would you like our readers to know?

JZ: Trade liberalization and economic growth in middle-income countries over the last two decades has led to a surge of oil flowing across international borders, where it’s enabled the production of ever-greater amounts of deep-fried snacks and ultra-processed foods, benefiting multinational companies like Unilever, PepsiCo, Grupo Bimbo, Nestle, Cargill, and others. Rates of obesity, diabetes, and heart disease are soaring in India and in the poorer countries where the multinational corporations that peddle such junk are focused on growing their markets.

Though most of us tend to blame sugar for the world’s weight woes, refined vegetable oils have added far more calories to the global diet in the last half-century than any other food group. A few months ago, a new study headed by researchers at the Institute for Research in Biomedicine found that palmitic acid, a fatty acid found in palm oil, alters the cancer genome increasing the likelihood that cancer will spread.

The industry is also impacting health and nutrition at its source. Studies have shown that diets among indigenous peoples in Indonesia are healthier than those of people working and living on the fringes of plantations, rather than in the forests as they’ve traditionally done.

In my book, I trace the political forces and dark money at work behind the scenes of the $65 billion business—from permits issued from inside jail cells and owners hidden behind offshore shell companies to long-dead villagers signing away their rights and elders hoodwinked by sweet-talking executives.

In 2019, the World Health Organization compared the tactics used by the palm oil industry to those employed by the tobacco and alcohol lobbies. It recently emerged that a Malaysian campaign accusing industry critics of being “neo-colonialists” was in fact the (very-highly-compensated) work of a Washington, DC–based lobbying firm, one whose previous clients include Exxon and the former Burmese military junta.

PepsiCo, the parent company of Frito-Lay, uses a lot of palm oil in its snacks. Activists have traced that oil to environmental destruction and labor abuses—what they call “conflict palm oil”. There have also been campaigns targeting Nestle, Kellogg’s, and Cargill for environmental and/or labor abuses linked to their supply chains.

They’ve definitely gotten some traction, and there have been reforms in the industry, though there is still a ways to go. Across the globe, those who have dared to speak out against the industry, whether environmental activists, laborers, peasant farmers, or investigative journalists, have often been met with violence.

Read labels. Reach out to the companies that use a lot of palm oil (PepsiCo, Dunkin Donuts, Unilever, Grupo Bimbo, etc) and ask them where they source it and how they can be sure that there wasn’t deforestation or land-grabbing or other labor or human rights abuses involved. Go to the websites of the Rainforest Action Network, Mighty Earth, Global Witness, Friends of the Earth, and Greenpeace, and get involved in their palm oil campaigns.

“Planet Palm: How Palm Oil Ended Up In Everything—And Endangered The World”

By Jocelyn C. Zuckerman

(The New Press 335 pg.$27.99 U.S.)

Features

ClarityCheck: Securing Communication for Authors and Digital Publishers

In the world of digital publishing, communication is the lifeblood of creation. Authors connect with editors, contributors, and collaborators via email and phone calls. Publishers manage submissions, coordinate with freelance teams, and negotiate contracts online.

However, the same digital channels that enable efficient publishing also carry risk. Unknown contacts, fraudulent inquiries, and impersonation attempts can disrupt projects, delay timelines, or compromise sensitive intellectual property.

This is where ClarityCheck becomes a vital tool for authors and digital publishers. By allowing users to verify phone numbers and email addresses, ClarityCheck enhances trust, supports safer collaboration, and minimizes operational risks.

Why Verification Matters in Digital Publishing

Digital publishing involves multiple types of external communication:

- Manuscript submissions

- Editing and proofreading coordination

- Author-publisher negotiations

- Marketing and promotional campaigns

- Collaboration with illustrators and designers

In these workflows, unverified contacts can lead to:

- Scams or fraudulent project offers

- Intellectual property theft

- Miscommunication causing delays

- Financial loss due to fraudulent payments

- Unauthorized sharing of sensitive drafts

Platforms like Reddit feature discussions from authors and freelancers about using verification tools to safeguard their work. This highlights the growing awareness of digital safety in creative industries.

What Is ClarityCheck?

ClarityCheck is an online service that enables users to search for publicly available information associated with phone numbers and email addresses. Its primary goal is to provide additional context about a contact before initiating or continuing communication.

Rather than relying purely on intuition, authors and publishers can access structured information to assess credibility. This proactive approach supports safer project management and protects intellectual property.

You can explore community feedback and discussions about the service here: ClarityCheck

Key Benefits for Authors and Digital Publishers

1. Protecting Manuscript Submissions

Authors often submit manuscripts to multiple editors or publishers. Before sharing full drafts:

- Verify the contact’s legitimacy

- Ensure the communication aligns with known publishing entities

- Reduce risk of unauthorized distribution

A quick lookup can prevent time-consuming disputes and protect original content.

2. Safeguarding Collaborative Projects

Digital publishing frequently involves external contributors such as:

- Illustrators

- Designers

- Editors

- Ghostwriters

Verification ensures all collaborators are trustworthy, minimizing the chance of intellectual property theft or miscommunication.

3. Enhancing Marketing and PR Outreach

Promoting a book or digital publication often involves connecting with:

- Bloggers

- Reviewers

- Book influencers

- Digital media outlets

Before sharing press kits or marketing materials, verifying email addresses or phone contacts adds confidence and prevents potential misuse.

How ClarityCheck Works

While the internal system is proprietary, the user workflow is straightforward and efficient:

| Step | Action | Outcome |

| 1 | Enter phone number or email | Search initiated |

| 2 | Aggregation of publicly available data | Digital footprint analyzed |

| 3 | Report generated | Structured overview presented |

| 4 | Review by user | Informed decision before engagement |

The platform’s simplicity makes it suitable for authors and publishing teams, even those with limited technical expertise.

Integrating ClarityCheck Into Publishing Workflows

Manuscript Submission Process

- Receive submission request

- Verify contact via ClarityCheck

- Confirm identity of editor or publisher

- Share draft or proceed with collaboration

Collaboration with Freelancers

- Initiate project with external contributors

- Run ClarityCheck to verify email or phone number

- Establish project agreement

- Begin content creation safely

Marketing Outreach

- Contact media or reviewers

- Verify digital identity

- Share promotional materials with confidence

Ethical and Privacy Considerations

While ClarityCheck provides useful context, it operates exclusively using publicly accessible information. Authors and publishers should always:

- Respect privacy and data protection regulations

- Use results responsibly

- Combine verification with personal judgment

- Avoid sharing sensitive data with unverified contacts

Responsible use ensures the platform supports security without compromising ethical standards.

Real-World Use Cases in Digital Publishing

Scenario 1: Verifying a New Editor

An author is contacted by an editor claiming to represent a small publishing house. Running a ClarityCheck report confirms the email domain aligns with publicly available information about the company, reducing risk before signing an agreement.

Scenario 2: Screening Freelance Illustrators

A digital publisher seeks an illustrator for a children’s book. Before sharing project details or compensation terms, ClarityCheck verifies contact information, ensuring the artist is legitimate.

Scenario 3: Marketing Outreach Safety

A self-publishing author plans a social media and email campaign. Verifying influencer or reviewer contacts helps prevent marketing materials from reaching fraudulent accounts.

Why Verification Strengthens Publishing Operations

In digital publishing, speed and creativity are essential, but they must be balanced with security:

- Protect intellectual property

- Maintain trust with collaborators

- Ensure financial transactions are secure

- Prevent delays due to miscommunication

Verification tools like ClarityCheck integrate seamlessly, allowing authors and publishing teams to focus on creation rather than risk management.

Final Thoughts

In a world where publishing is increasingly digital and collaborative, verifying contacts is not just prudent — it’s necessary.

ClarityCheck empowers authors, editors, and digital publishing professionals to confidently assess phone numbers and email addresses, protect their intellectual property, and streamline communication.

Whether managing manuscript submissions, coordinating external contributors, or launching marketing campaigns, integrating ClarityCheck into your workflow ensures clarity, safety, and professionalism.

In digital publishing, trust is as important as creativity — and ClarityCheck helps safeguard both.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.