Features

“Proof of Life” – New book about Syrian conflict tells spellbinding story of one man’s search for a young American who went missing in 2014

Review by BERNIE BELLAN The war in Syria which began in 2011 following upon earlier upheavals in the Arab world that were ignited by what became known as the Arab Spring has, by and large, vanished from the headlines of the world’s newspapers.

Once Russia intervened on the side of Bashar Al Assad in 2015, along with Iran and its Hezbollah acolytes, the tide was turned in favour of Assad. It is true that American troops, along with their various allies in Syria, were instrumental in ridding Syria of ISIS, but there were many more factions fighting the Assad regime than ISIS.

The complex world of what really amounted to inter-tribal warfare in Syria resulted in some of the most atrocious acts imaginable committed by all sides in the conflict, although when it came to the use of military hardware to massacre entire populations, Assad’s forces set new levels of barbarity in terms of the degree to which they were willing to gas, bomb, and murder innocent civilians throughout the conflict.

Within this nightmarish world, however, there were many individuals who not only did not suffer at all during the conflict – they actually thrived. Some were members of different militias who capitalized on capturing Western journalists and humanitarian workers in Syria, holding them for huge ransoms when they could.

We in the West were witness to the horrendous brutality that ISIS was capable of when it came to dealing with those captured Westerners – including their beheadings on a regular basis, but other groups were also willing to engage in equally savage treatment of innocent Westerners. In the cases of those other groups, however, the goal by and large was to trade Westerners for money.

Often captured journalists or humanitarian workers would be traded back and forth among groups. There were different reasons for the shuffling around of prisoners. For one, it made it almost impossible for anyone wanting to retrieve those prisoners to keep track of them. Secondly, at different times different groups placed different values on certain prisoners, depending on where they came from and with whom those groups were in a position to negotiate.

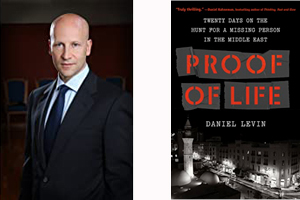

Into this hellish world stepped Daniel Levin, a Swiss-born Jew now living in the United States whose expertise is in negotiating with some of the world’s most unsavory characters. Levin is a lawyer by training and his legal negotiation skills were put to good use when he began working “with a European foundation and select individuals in Syria” in what became a project known as “Project Bistar”.

The purpose of Project Bistar, Levin explains in an incredibly fascinating new book (that is yet to be released for sale to the public) titled “Proof of Life”, was to mediate between the warring sides in the Syrian conflict, “in the hope of working quietly behind the scenes toward a negotiated settlement and, at a second stage, identifying young, next-generation individuals of the Alawite, Sunni, Druze, and Christian communities with leadership potential.”

Levin explains that, until 2015 when the Russians intervened on his side, Assad appeared amenable to a negotiated settlement, especially when rebel forces were inflicting terrible damage on his own forces.

With that as background information, in 2014 Levin found himself thrust into a situation totally unexpectedly in which his negotiating skills were put to a supreme test.

As a press release that was sent to me in January described it, “Daniel Levin was at his office one day when he got a call from an acquaintance with an urgent, cryptic request to meet in Paris. A young man had gone missing in Syria. No government, embassy, or intelligence agency would help. Could he? So begins a suspenseful, shocking, and at times brutal true story of one man’s search to find a missing person in Syria over eighteen tense days.”

Thus begins “Proof of Life: The Undercover Search for a Missing Person in Syria, where Arms, Drugs, and People Are for Sale“.

This lengthy preamble to my review of the book was necessary to provide some context for what the book is all about. Since the story that Levin tells – and the events which he describes are all true – although he has changed the names of most of the characters in order to protect the identities of individuals whose lives might be in danger, even years after the events which he describes.

Reading “Proof of Life” is like reading any well-written, fast paced thriller – except in this case, knowing that what you are reading really did happen will often leave you feeling physically ill when you realize the depths to which humans are capable of sinking to the present day. And I’m not just talking about the depravities of various armed groups around the world, many of which are Islamic it must be said (whether in the Middle East, Africa, the Philippines or any other of a number of areas in which offshoots of Al Qaeda or ISIS still hold sway).

Some of the most notorious characters in “Proof of Life” are not at all involved in actual fighting; instead they are the parasites who see opportunities in conflict situations to make vast sums of money supplying such commodities as drugs and women to the fighters.

It was within this dangerous and completely shadowy world that Levin found himself when he was asked to help obtain information about a young American by the name of Paul Blocher who had somehow entered into Syria sometime in 2014 – and disappeared.

As Levin describes it, he was contacted by an old friend who asked him for a favour, which was to use his various and very useful contacts throughout the region to do what he could to find out what happened to Blocher.

What follow sin the book is a complex series of encounters with some fascinating characters, most of whom are Arabs of varying nationalities, in locations including Ankara, Beirut, Washington, Amman, and Dubai, as Levin pursues a trail replete with scattered bits of information that bring him ever closer to the one character who he is certain can reveal what actually happened to Paul Blocher.

Throughout reading this book I couldn’t help thinking that Levin, who doesn’t at all hide his Jewish identity, was quite fearless in his willingness to seek out individuals whose reputations would leave just about anyone else terrified to even go anywhere near them, let alone try and arrange to meet them.

Given that he had been tasked with an assignment that very few individuals in the world would be capable of performing, as you read the very careful preparations he continually put in place prior to his meeting any of these dangerous individuals, although Levin doesn’t describe to any extent how he developed his unique expertise in negotiation and subterfuge, you can only marvel at the thinking he displayed at all times in planning his course of action.

At a certain point in the book though, the name of a drug known as “captagon” began to take on a prominent role in the story. I had to digress from reading “Proof of Life” to acquaint myself with just what Captagon is.

Captagon is a powerful amphetamine that is most popular in the Middle East, where it is both the recreational drug of choice in such countries as Saudi Arabia and the drug that was used by all sides during the Syrian conflict that, in the words of a BBC correspondent describing how Captagon is used in Syria,“gives people a euphoric feeling that they can take on the world and are relatively indomitable. [It] suppresses appetite and gives you a very long burst of energy, something like 18 to 24 hours.”

“Amphetamine use by fighters is commonplace, but I wondered if the specific properties of Captagon made it the perfect war drug.

“ ‘That depends on what your values are in the war,’ “ according to Max Kravits, a researcher who has spent years studying the use of Captagon in the Syrian conflict.

“ It is incredibly deteriorating and debilitating and it makes fighters take risks they otherwise wouldn’t take. But if your goal is simply to take said hill regardless of the human cost, it certainly seems to be doing the job.’ “

As Levin pursued his quest to find out what happened to Paul Blocher, he was led ever closer to the one man who, it is had become apparent from a variety of sources, would be able to tell Levin what happened to Blocher.

That man’s name was “Anas” and if you ever wanted to conjure up a more insidious villain you would be hard put to find anyone more absolutely evil than Anas. When Levin finally saw Anas for the first time – and he made sure that he was carefully hidden so that Anas did not see him, he was blown away by Anas’s physical appearance: A massive six foot five, so muscular that he said Anas’s wrist was as big as Levin’s thigh. (It turns out that Anas was a steroid junkie, which both explained his enormous physique and the almost constant bouts of rage to which he was prone.)

And, although you can’t help but fear for Levin as he entered into the proverbial lion’s den, knowing that this is a true account, the overriding question as he describes his eventual face to face encounter with Anas, was how was he going to pry information out of someone who, it turns out, was actually capable of killing his own child to exact revenge on a wife who dared to leave him.

“Proof of Life” was just recently published (in 2021, as a matter of fact) and the copy I was sent was a review copy. But, as I was reading this incredibly fascinating book (and I know I use that phrase all too often in describing books that I love), I kept thinking to myself: All right, we know that Israel is engaged in an ongoing war of sorts with Iran in Syria, as Iran uses Syria as its base for arming Hezbollah, and that threatens to turn into a major all–out war with Hezbollah, but what of the actual conflict in Syria itself between Assad and all those factions that were fighting his regime? Has it all quieted down or are we just not hearing about it any more?

Here’s the answer, as Daniel Levin writes in his postscript to “Proof of Life” (and again, it was just written in 2021):

“These days, conventional wisdom holds that the conflict in Syria has been decided. The war is over. Bashar al-Assad and his regime won with the help of Iran, Russia, and Hezbollah; the opposition, the Kurds, and ISIS were defeated. Sure, some nasty things did happen, but it’s time to move on and rebuild the country.

“Turns out, conventional wisdom is not particularly wise. This war is not over. The killings have not stopped. The chemical gassings, the cluster bombs, the executions, the torture, the human trafficking the annihilation of entire villages – they all continue. For millions of trapped Syrians, the nightmare never ends. A small group of privileged men connected to the regime through family or business have amassed unimaginable fortunes as they control the war economy, trading everything – food, medicine, fuel, heating, oil, drugs, weapons, prisoners, young girls – and looting the destroyed cities for scrap metal, copper, steel, and anything of value. Like in all war, the only ones left are a few extremely rich individuals and many extremely poor people. Everyone in between has been wiped out. Yes, the war economy is alive and well, and this war will last as long as that remains the case.”

The insights that Levin offers throughout this book – and what I just quoted is but one example of the level of knowledge that he brings forth about of what is really going on in Syria – may differ from commonly accepted wisdom about what has happened in Syria of late. Yet, Levin’s profound understanding of the Middle East left me with only one conclusion about the Arab world: It is a cruel jungle, often surrounded by a façade of material wealth that only disguises the fact that it is thoroughly tribal in nature – and an extremely dangerous world in which to set foot.

Lucky for the Israelis who are now establishing connections throughout much of the region – they know what they’re getting into. They’ve been operating in what is probably the most dangerous neighbourhood in the world for a very long time. I’m sure that Israel has a lot of Daniel Levins around who know how to negotiate their way through the metaphorical landmines into which Israel is now stepping.

“Proof of Life” is set to be released to the public in May 2021.

Features

ClarityCheck: Securing Communication for Authors and Digital Publishers

In the world of digital publishing, communication is the lifeblood of creation. Authors connect with editors, contributors, and collaborators via email and phone calls. Publishers manage submissions, coordinate with freelance teams, and negotiate contracts online.

However, the same digital channels that enable efficient publishing also carry risk. Unknown contacts, fraudulent inquiries, and impersonation attempts can disrupt projects, delay timelines, or compromise sensitive intellectual property.

This is where ClarityCheck becomes a vital tool for authors and digital publishers. By allowing users to verify phone numbers and email addresses, ClarityCheck enhances trust, supports safer collaboration, and minimizes operational risks.

Why Verification Matters in Digital Publishing

Digital publishing involves multiple types of external communication:

- Manuscript submissions

- Editing and proofreading coordination

- Author-publisher negotiations

- Marketing and promotional campaigns

- Collaboration with illustrators and designers

In these workflows, unverified contacts can lead to:

- Scams or fraudulent project offers

- Intellectual property theft

- Miscommunication causing delays

- Financial loss due to fraudulent payments

- Unauthorized sharing of sensitive drafts

Platforms like Reddit feature discussions from authors and freelancers about using verification tools to safeguard their work. This highlights the growing awareness of digital safety in creative industries.

What Is ClarityCheck?

ClarityCheck is an online service that enables users to search for publicly available information associated with phone numbers and email addresses. Its primary goal is to provide additional context about a contact before initiating or continuing communication.

Rather than relying purely on intuition, authors and publishers can access structured information to assess credibility. This proactive approach supports safer project management and protects intellectual property.

You can explore community feedback and discussions about the service here: ClarityCheck

Key Benefits for Authors and Digital Publishers

1. Protecting Manuscript Submissions

Authors often submit manuscripts to multiple editors or publishers. Before sharing full drafts:

- Verify the contact’s legitimacy

- Ensure the communication aligns with known publishing entities

- Reduce risk of unauthorized distribution

A quick lookup can prevent time-consuming disputes and protect original content.

2. Safeguarding Collaborative Projects

Digital publishing frequently involves external contributors such as:

- Illustrators

- Designers

- Editors

- Ghostwriters

Verification ensures all collaborators are trustworthy, minimizing the chance of intellectual property theft or miscommunication.

3. Enhancing Marketing and PR Outreach

Promoting a book or digital publication often involves connecting with:

- Bloggers

- Reviewers

- Book influencers

- Digital media outlets

Before sharing press kits or marketing materials, verifying email addresses or phone contacts adds confidence and prevents potential misuse.

How ClarityCheck Works

While the internal system is proprietary, the user workflow is straightforward and efficient:

| Step | Action | Outcome |

| 1 | Enter phone number or email | Search initiated |

| 2 | Aggregation of publicly available data | Digital footprint analyzed |

| 3 | Report generated | Structured overview presented |

| 4 | Review by user | Informed decision before engagement |

The platform’s simplicity makes it suitable for authors and publishing teams, even those with limited technical expertise.

Integrating ClarityCheck Into Publishing Workflows

Manuscript Submission Process

- Receive submission request

- Verify contact via ClarityCheck

- Confirm identity of editor or publisher

- Share draft or proceed with collaboration

Collaboration with Freelancers

- Initiate project with external contributors

- Run ClarityCheck to verify email or phone number

- Establish project agreement

- Begin content creation safely

Marketing Outreach

- Contact media or reviewers

- Verify digital identity

- Share promotional materials with confidence

Ethical and Privacy Considerations

While ClarityCheck provides useful context, it operates exclusively using publicly accessible information. Authors and publishers should always:

- Respect privacy and data protection regulations

- Use results responsibly

- Combine verification with personal judgment

- Avoid sharing sensitive data with unverified contacts

Responsible use ensures the platform supports security without compromising ethical standards.

Real-World Use Cases in Digital Publishing

Scenario 1: Verifying a New Editor

An author is contacted by an editor claiming to represent a small publishing house. Running a ClarityCheck report confirms the email domain aligns with publicly available information about the company, reducing risk before signing an agreement.

Scenario 2: Screening Freelance Illustrators

A digital publisher seeks an illustrator for a children’s book. Before sharing project details or compensation terms, ClarityCheck verifies contact information, ensuring the artist is legitimate.

Scenario 3: Marketing Outreach Safety

A self-publishing author plans a social media and email campaign. Verifying influencer or reviewer contacts helps prevent marketing materials from reaching fraudulent accounts.

Why Verification Strengthens Publishing Operations

In digital publishing, speed and creativity are essential, but they must be balanced with security:

- Protect intellectual property

- Maintain trust with collaborators

- Ensure financial transactions are secure

- Prevent delays due to miscommunication

Verification tools like ClarityCheck integrate seamlessly, allowing authors and publishing teams to focus on creation rather than risk management.

Final Thoughts

In a world where publishing is increasingly digital and collaborative, verifying contacts is not just prudent — it’s necessary.

ClarityCheck empowers authors, editors, and digital publishing professionals to confidently assess phone numbers and email addresses, protect their intellectual property, and streamline communication.

Whether managing manuscript submissions, coordinating external contributors, or launching marketing campaigns, integrating ClarityCheck into your workflow ensures clarity, safety, and professionalism.

In digital publishing, trust is as important as creativity — and ClarityCheck helps safeguard both.

Features

Israel’s Arab Population Finds Itself in Dire Straits

By HENRY SREBRNIK There has been an epidemic of criminal violence and state neglect in the Arab community of Israel. At least 56 Arab citizens have died since the beginning of this year. Many blame the government for neglecting its Arab population and the police for failing to curb the violence. Arabs make up about a fifth of Israel’s population of 10 million people. But criminal killings within the community have accounted for the vast majority of Israeli homicides in recent years.

Last year, in fact, stands as the deadliest on record for Israel’s Arab community. According to a year-end report by the Center for the Advancement of Security in Arab Society (Ayalef), 252 Arab citizens were murdered in 2025, an increase of roughly 10 percent over the 230 victims recorded in 2024. The report, “Another Year of Eroding Governance and Escalating Crime and Violence in Arab Society: Trends and Data for 2025,” published in December, noted that the toll on women is particularly severe, with 23 Arab women killed, the highest number recorded to date.

Violence has expanded beyond internal criminal disputes, increasingly affecting public spaces and targeting authorities, relatives of assassination targets, and uninvolved bystanders. In mixed Arab-Jewish cities such as Acre, Jaffa, Lod, and Ramla, violence has acquired a political dimension, further eroding the fragile social fabric Israel has worked to sustain.

In the Negev, crime families operate large-scale weapons-smuggling networks, using inexpensive drones to move increasingly advanced arms, including rifles, medium machine guns, and even grenades, from across the borders in Egypt and Jordan. These weapons fuel not only local criminal feuds but also end up with terrorists in the West Bank and even Jerusalem.

Getting weapons across the border used to be dangerous and complex but is now relatively easy. Drones originally used to smuggle drugs over the borders with Egypt and Jordan have evolved into a cheap and effective tool for trafficking weapons in large quantities. The region has been turning into a major infiltration route and has intensified over the past two years, as security attention shifted toward Gaza and the West Bank.

The Negev is not merely a local challenge; it serves as a gateway for crime and terrorism across Israel, including in cities. The weapons flow into mixed Jewish-Arab cities and from there penetrate the West Bank, fueling both organized crime and terrorist activity and blurring the line between them.

The smuggling of weapons into Israel is no longer a marginal criminal phenomenon but an ongoing strategic threat that traces a clear trail: from porous borders with Egypt and Jordan, through drones and increasingly sophisticated smuggling methods, into the heart of criminal networks inside Israel, and in a growing number of cases into lethal terrorist operations. A deal that begins as a profit-driven criminal transaction often ends in a terrorist attack. Israeli police warn that a population flooded with illegal weapons will act unlawfully, the only question being against whom.

The scale of the threat is vast. According to law enforcement estimates, up to 160,000 weapons are smuggled into Israel each year, about 14,000 a month. Some sources estimate that about 100,000 illegal weapons are circulating in the Negev alone.

Israeli cities are feeling this. Acre, with a population of about 50,000, more than 15,000 of them Arab, has seen a rise in violent incidents, including gunfire directed at schools, car bombings, and nationalist attacks. In August 2025, a 16-year-old boy was shot on his way to school, triggering violent protests against the police.

Home to roughly 35,000 Arab residents and 20,000 Jewish residents, Jaffa has seen rising tensions and repeated incidents of violence between Arabs and Jews. In the most recent case, on January 1, 2026, Rabbi Netanel Abitan was attacked while walking along a street, and beaten.

In Lod, a city of roughly 75,000 residents, about half of them Arab, twelve murders were recorded in 2025, a historic high. The city has become a focal point for feuds between crime families. In June 2025, a multi-victim shooting on a central street left two young men dead and five others wounded, including a 12-year-old passerby. Yet the killing of the head of a crime family in 2024 remains unsolved to this day; witnesses present at the scene refused to testify.

The violence also spilled over to Jewish residents: Jewish bystanders were struck by gunfire, state officials were targeted, and cars were bombed near synagogues. Hundreds of Jewish families have left the city amid what the mayor has described as an “atmosphere of war.”

Phenomena that were once largely confined to the Arab sector and Arab towns are spilling into mixed cities and even into predominantly Jewish cities. When violence in mixed cities threatens to undermine overall stability, it becomes a national problem. In Lod and Jaffa, extortion of Jewish-owned businesses by Arab crime families has increased by 25 per cent, according to police data.

Ramla recorded 15 murders in 2025, underscoring the persistence of lethal violence in the city. Many victims have been caught up in cycles of revenge between clans, often beginning with disputes over “honour” and ending in gunfire. Arab residents describe the city as “cursed,” while Jewish residents speak openly about being afraid to leave their homes

Reluctance to report crimes to the authorities is a central factor exacerbating the problem. Fear of retaliation by families or criminal organizations deters victims and their relatives from coming forward, contributing to a clearance rate of less than 15 per cent of all murders. The Ayalef report notes that approximately 70 per cent of witnesses refused to cooperate with police investigations, citing doubts about the state’s ability to provide protection.

Violence in Arab society is not just an Arab sector problem; it poses a direct and serious threat to Israel’s national security. The impact is twofold: on the one hand, a rise in crime that affects the entire population; on the other, the spillover of weapons and criminal activity into terrorism, threatening both internal and regional stability. This phenomenon reached a peak in 2025, with implications that could lead to a third intifada triggered by either a nationalist or criminal incident.

The report suggests that along the Egyptian and Jordanian borders, Israel should adopt a technological and security-focused response: reinforcing border fences with sensors and cameras, conducting aerial patrols to counter drones, and expanding enforcement activity.

This should be accompanied by a reassessment of the rules of engagement along the border area, enabling effective interdiction of smuggling and legal protocols that allow for the arrest and imprisonment of offenders. The report concludes by emphasizing that rising violence in cities, compounded by weapons smuggling in the Negev, is eroding Israel’s internal stability.

Henry Srebrnik is a professor of political science at the University of Prince Edward Island.

Features

The Chapel on the CWRU Campus: A Memoir

By DAVID TOPPER In 1964, I moved to Cleveland, Ohio to attend graduate school at Case Institute of Technology. About a year later, I met a girl with whom I fell in love; she was attending Western Reserve University. At that time, they were two entirely separate schools. Nonetheless, they share a common north-south border.

Since Reserve was originally a Christian college, on that border between the two schools there is a Chapel on the Reserve (east) side, with a four-sided Tower. On the top of the Tower are three angels (north, east, & south) and a gargoyle (west); the latter therefore faces the Case side. Its mouth is a waterspout – and so, when it rains, the gargoyle spits on the Case side. The reason for this, I was told, is that the founder of Case, Leonard Case Jr., was an atheist.

In 1968, that girl, Sylvia, and I got married. In the same year the two schools united, forming what is today still Case Western Reserve University (CWRU). I assume the temporal proximity of these two events entails no causality. Nevertheless, I like the symbolism, since we also remain married (although Sylvia died almost 6 years ago).

Speaking of symbolism: it turns out that the story told to me is a myth. Actually, Mr. Case was a respected member of the Presbyterian Church. Moreover, the format of the Tower is borrowed from some churches in the United Kingdom – using the gargoyle facing west, toward the setting sun, to symbolize darkness, sin, or evil. It just so happens that Case Tech is there – a fluke. Just a fluke.

We left Cleveland in 1970, with our university degrees. Harking back to those days, only once during my six years in Cleveland, was I in that Chapel. It was the last day before we left the city – moving to Winnipeg, Canada – where I still live. However, it was not for a religious ceremony – no, not at all. Sylvia and I were in the Chapel to attend a poetry reading by the famed Beat poet, Allen Ginsberg.

My final memory of that Chapel is this. After the event, as we were walking out, I turned to Sylvia and said: “I’m quite sure that this is the first and only time in the entire long history of this solemn Chapel that those four walls heard the word ‘fuck’.” Smiling, she turned to me and said, “Amen.”

This story was first published in “Down in the Dirt Magazine,”

vol, 240, Mars and Cotton Candy Clouds.